Effective revenue recognition is paramount for professional services organizations to maintain financial accuracy and make informed decisions. In this article, we’ll explore the complexities of professional services revenue recognition and how Birdview PSA simplifies and enhances this process, ensuring accurate and agile revenue recognition.

What is the revenue recognition principle?

The revenue recognition principle is the cornerstone of accurate financial reporting. It outlines when a company should record and recognize revenue. To meet this principle, four criteria must be satisfied:

- Persuasive evidence of an arrangement: Clear evidence must exist that an agreement or contract is in place. This evidence can take the form of written contracts, purchase orders, or other documented agreements.

- Delivery of services or goods: The organization must have delivered the promised services or goods to the customer. This delivery signifies that the organization has fulfilled its obligations under the agreement.

- Fixed or determinable price: The price of the services or goods should be ascertainable with reasonable certainty. This means that the organization should be able to determine the amount it expects to receive from the customer.

- Collectability is reasonably assured: There should be a high likelihood of receiving payment from the customer. In other words, the organization should have a reasonable expectation that it will collect the revenue associated with the delivered services or goods.

Failure to adhere to these criteria can lead to inaccurate financial statements, hindering informed decision-making across the organization.

Complexities in professional services revenue recognition

Professional services firms often grapple with the complexities of revenue recognition due to a variety of commercial structures and billing methods. These structures include:

- Time and Materials: Billing clients based on the hours worked and materials used.

- Cost-Percent Complete: Recognizing revenue based on the percentage of project completion and incurred costs.

- Effort-Percent Complete: Recognizing revenue based on the percentage of effort expended on a project.

Each of these structures requires distinct recognition methodologies, adding layers of complexity to the revenue recognition process. For instance, the cost-percent complete model considers cost variances across resources, offering a more accurate representation of revenue.

Project Revenue and Project-Based Billing Methods

Rate Cards: Advanced Strategies for Complex Billing

The consequences of inaccurate revenue recognition

Inaccurate revenue recognition can have far-reaching implications for professional services organizations, extending well beyond the confines of the finance department:

- Misleading Financial Statements: Inaccurate revenue recognition can distort financial statements, presenting a skewed picture of a company’s financial health. Overstating revenue can make the organization appear more profitable than it actually is, which can mislead investors, stakeholders, and potential partners. Conversely, understating revenue can lead to unwarranted concerns about the company’s financial stability. Both scenarios erode trust in financial reporting and can harm the organization’s reputation.

- Impaired Decision-Making: Revenue is a critical metric used by executives and decision-makers to assess the company’s performance and plan for the future. Inaccurate revenue recognition disrupts this process. When decision-makers lack confidence in the accuracy of revenue data, they may make suboptimal choices regarding investments, resource allocation, and strategic initiatives. These decisions can have lasting repercussions on the organization’s growth and profitability.

- Delayed and Reactive Decision-Making: Inaccurate revenue recognition often leads to delayed decision-making. Instead of making proactive choices based on accurate, real-time data, organizations are forced to react to events that have already transpired. This reactive approach can hinder agility and competitiveness, as it prevents organizations from seizing opportunities or mitigating risks promptly.

- Regulatory Compliance Concerns: Professional services organizations are subject to regulatory frameworks and accounting standards, such as Generally Accepted Accounting Principles (GAAP) and the ASC 606 revenue recognition standard. Failing to adhere to these guidelines can result in legal and regulatory consequences. Inaccurate revenue recognition may lead to compliance issues, investigations, fines, and even legal actions, jeopardizing the organization’s legal standing and reputation.

- Erosion of Investor Confidence: Investors and shareholders rely on accurate financial reporting to assess the value and potential of an organization. When revenue recognition discrepancies arise, investor confidence can be shaken. A loss of trust may lead to reduced investment interest, declining stock prices, and a diminished ability to secure funding for growth and expansion initiatives.

- Impact on Employee Morale: The consequences of revenue recognition inaccuracies are not limited to external stakeholders. Internally, employees may become demoralized and frustrated when financial goals are consistently missed due to unreliable revenue data. This can lead to reduced motivation, decreased productivity, and higher employee turnover rates.

- Difficulty in Financial Forecasting: Revenue recognition is integral to financial forecasting. When revenue recognition is inconsistent or unreliable, forecasting becomes challenging. Unpredictable revenue can disrupt cash flow management, budgeting, and resource planning. Accurate revenue recognition, on the other hand, enables organizations to make more precise forecasts and allocate resources effectively.

Five steps of the revenue recognition model

Professional services organizations must adhere to a structured approach to revenue recognition as outlined in the joint standards ASC 606 and IFRS 15. This comprehensive five-step revenue recognition model serves as a foundational framework for accurate and transparent financial reporting and helps organizations maintain consistency, and clarity in their financial reporting practices, ultimately benefiting both internal decision-making and external stakeholder trust.

- Identify the Customer Contract:

The first step in revenue recognition involves identifying the customer contract. While not all contracts need to be formal written agreements, they must represent a clear commercial understanding between two parties, with well-defined payment terms, rights, and obligations. These contracts can take various forms, ranging from formal written agreements in service-based businesses to online terms of service embedded within invoices or subscription details.

- Identify the Contract‘s Specific Performance Obligations:

Before revenue can be recognized, professional services organizations must define the specific performance obligations within the contract. A performance obligation refers to distinct goods or services that the organization has committed to delivering to the customer. These must be identifiable as separate line items on invoices or receipts. For example, a bakery may have a specific performance obligation to provide one pastry in exchange for a fixed price, while an insurance broker may have a performance obligation for a single-house insurance policy.

It’s important to note that these performance obligations must be capable of benefiting the customer independently from other items in the contract. If a product or service cannot be purchased separately, it may not qualify as a distinct performance obligation.

- Determine the Transaction Price:

The transaction price represents more than just the exchange of money; it encompasses all elements contributing to the economic exchange between the organization and the customer. This includes considerations such as the right to return goods or potential discounts. Clarity and transparency are essential, especially when there are changes from past practices.

For example, if a professional services organization offers discounts during a semi-annual sale or specifies return policies for its services, these terms must be incorporated into the transaction price. Similarly, service-based businesses should consider the terms and conditions of their offerings, particularly in situations where customer satisfaction or service quality might lead to refund requests.

- Allocate the Transaction Price to Distinct Performance Obligations:

Once the transaction price is determined, it must be allocated to each distinct performance obligation within the contract. This step involves assigning specific selling prices to individual performance obligations. When stand-alone selling prices exist for each product or service, allocation is straightforward. However, in cases involving variable considerations like discounts, incentives, or rebates, organizations may need to estimate the prices based on expected values.

- Recognize Revenue When Performance Obligations Are Fulfilled:

The final step in the revenue recognition process is the actual recognition of revenue. Revenue should only be recognized when the organization has fulfilled each performance obligation. Until this point, revenue remains deferred.

In cases where customers have pre-paid for services not yet rendered or goods not yet delivered, this prepayment is categorized as “deferred revenue” until the control of the good or service is transferred to the customer. For subscription-based businesses, where performance obligations are satisfied over a period of time, revenue recognition occurs evenly throughout the service period. Similarly, in projects or services completed over time, recognition may be tied to external milestones, percentage of completion, incurred costs, or labor hours.

Six revenue recognition methods

Accurate revenue recognition is crucial for financial reporting and decision-making, as it impacts a company’s profitability and financial health. Various revenue recognition methods exist, each designed to suit different business models and situations.

1. Sales-basis: This method recognizes revenue at the time of sale or transaction. It is commonly employed in industries like retail, where customers make immediate purchases and leave with the goods. For subscription-based services, revenue is recognized as the service is provided, aligning with the delivery of goods or services rather than the timing of payment.

Example: A retail store sells a computer for $1,000 in cash. Revenue of $1,000 is recognized immediately upon the sale.

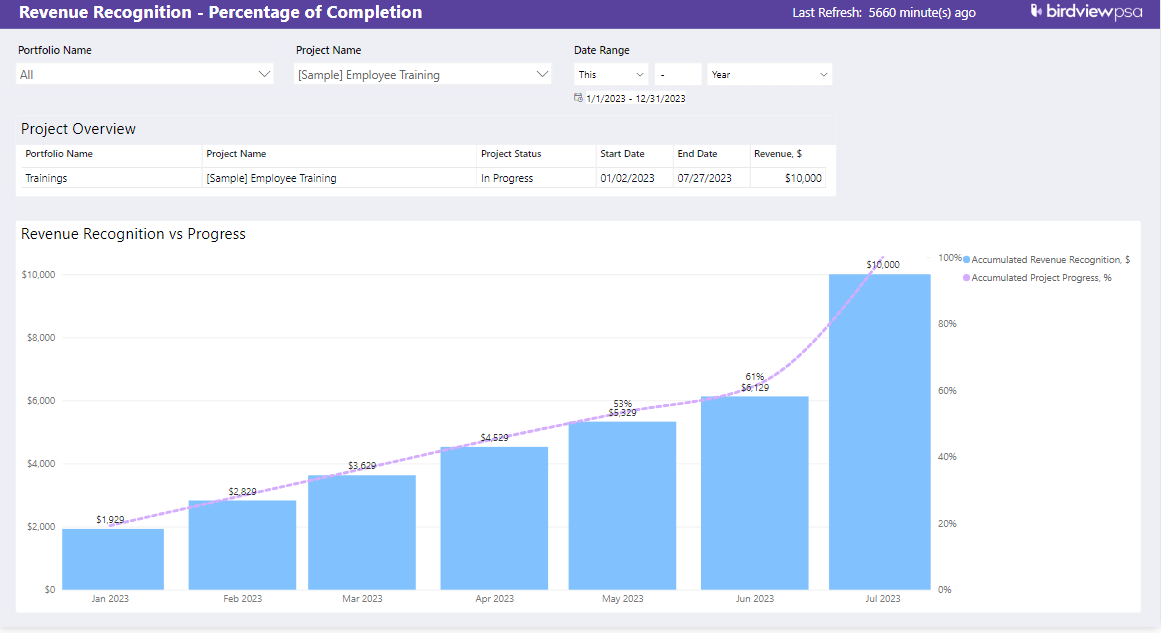

2. Percentage of Completion: Used in long-term projects, this method allocates revenue to specific milestones or costs incurred during the project’s progression. It provides real-time recognition, ensuring financial statements reflect consistent revenue flow, especially in industries like construction.

Example: An engineering company is contracted to oversee a construction project valued at $1 million. As they complete 60% of the project’s engineering work, they recognize revenue of $600,000 ($1,000,000 x 60%).

3. Completed Contract: Unlike the percentage of completion method, this approach recognizes revenue only when the entire contract is fulfilled and all obligations are met. It is suitable for shorter-term projects or those without clear progress indicators, ensuring revenue is recognized in the appropriate accounting period.

Example: A graphic design agency signs a contract to create marketing materials for a client. The project takes three months to complete, and revenue of $10,000 is recognized at the end of the third month when all deliverables are provided.

4. Cost Recovery (or Recoverability): A conservative method, revenue is recognized only after all costs associated with delivering a product or service have been fully recovered. This method is often chosen by businesses facing payment delays or uncertainty about expenses.

Example: An IT consulting company undertakes a project with uncertain costs. After incurring $30,000 in expenses, they recognize revenue only when these costs are fully recovered from the client.

5. Installment: Ideal for businesses with customers making payments over an extended period, revenue is recognized as payments are received. This method aligns revenue recognition with cash receipts, offering flexibility for uncertain payment schedules.

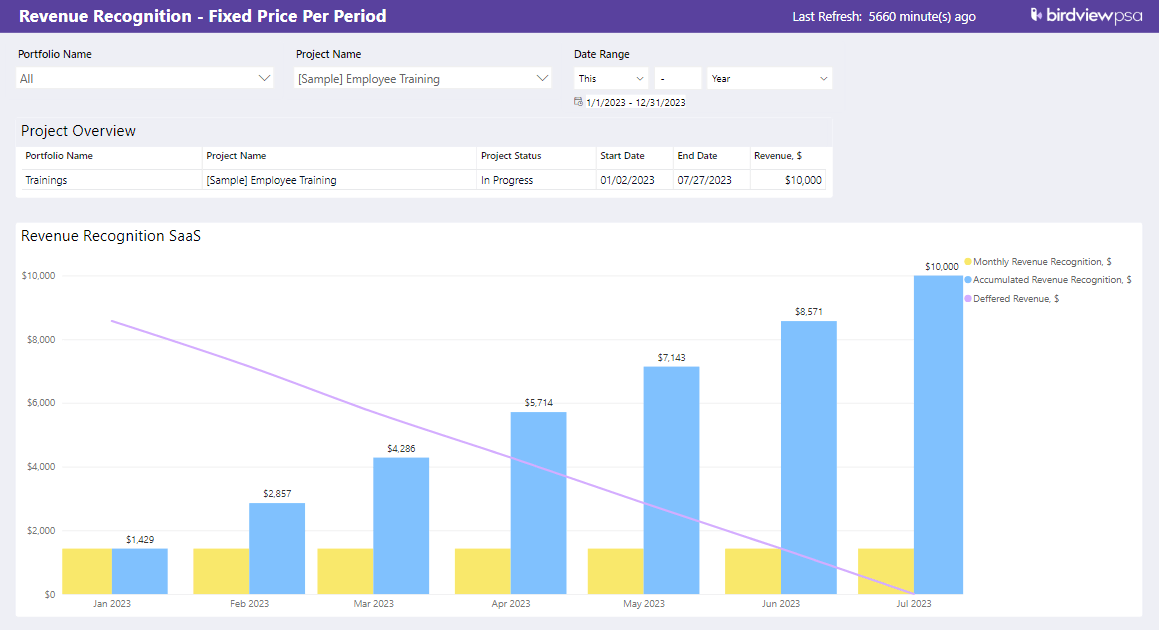

Example: A SaaS company offers a subscription plan at $50 per month. Revenue of $50 is recognized monthly as customers continue to use the software.

6. Accrual: In this method, prepayments are initially recorded as prepaid assets and later as expenses once goods or services are delivered, ensuring accurate matching of revenue and expenses.

Example: An accounting firm signs a contract with a client for annual services at $12,000. The firm recognizes revenue monthly, so at the end of each month, $1,000 ($12,000 / 12 months) is recognized as revenue.

Seven benefits of streamlining revenue recognition with Birdview

Birdview, with its comprehensive suite of purpose-built software tools, plays a pivotal role in simplifying and enhancing the revenue recognition process for professional services organizations. Let’s explore the specific ways Birdview can transform revenue recognition:

- Efficient Collaboration and Accuracy through Streamlined Data Centralization

Birdview centralizes data across project management, resource allocation, and financial reporting teams. This streamlines data collection, ensuring accuracy and promoting collaboration. With a single source of truth, teams work together seamlessly for precise revenue recognition.

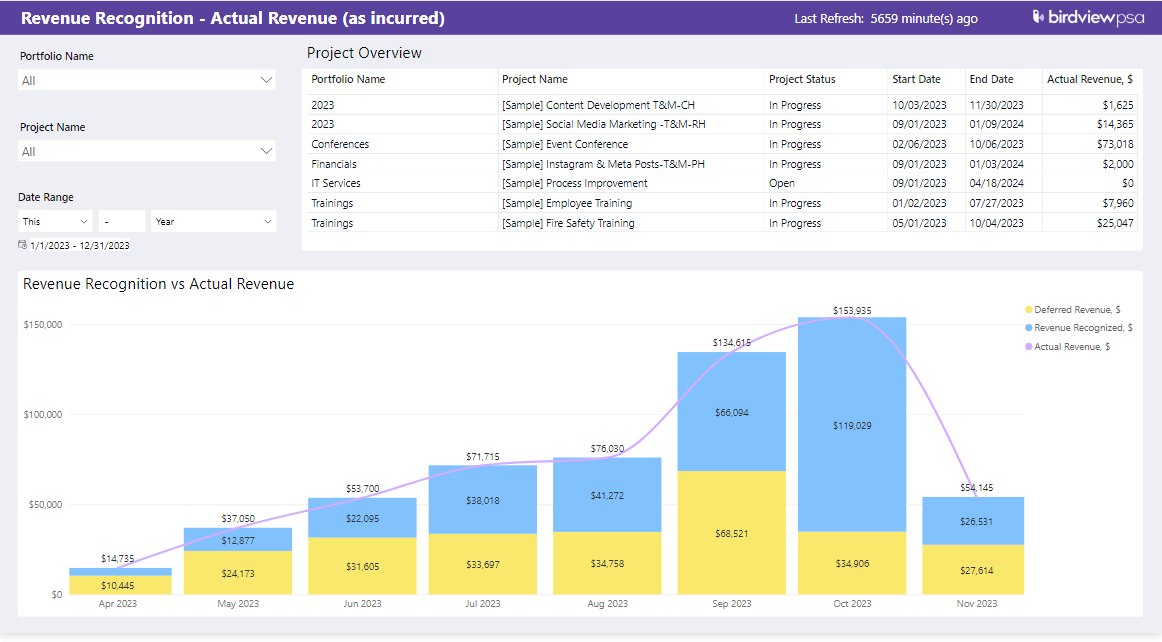

- Enhanced Efficiency and Accuracy through Automated Calculation Precision

Birdview’s standout feature lies in its ability to automate revenue recognition calculations. This automation reduces the need for manual data manipulation, significantly enhancing efficiency. Professionals can rely on Birdview to perform complex calculations in real time, ensuring precise and timely revenue figures.

- Real-time Financial Insights with Instantaneous Recalibration

Birdview adapts effortlessly to the dynamic professional services landscape. When inputs change, whether in resource costs, project progress, or billing terms, Birdview automatically recalibrates revenue recognition. This instant adjustment provides real-time insights into financial impacts, enabling quick decision-making.

- Accurate Financial Forecasts with Accelerated Period Closings

Birdview expedites the period-closing process, preventing delays that could result in inaccuracies in future financial forecasts. It ensures prompt revenue recognition, eliminating the risk of unaccounted revenue. Birdview offers a comprehensive view of all unrealized revenue, facilitating swift corrective actions.

- Seamless Teamwork and Strong Collaboration

Collaboration is essential in professional services organizations. Birdview serves as a central repository for project, resource, and financial data. Teams access up-to-date information, promoting seamless communication and informed decision-making. Enhanced collaboration is a key benefit.

- Data-Driven Decision-Making through In-depth Reporting and Analysis

Birdview provides advanced reporting and analysis capabilities, empowering professionals to gain deeper insights into revenue trends, project profitability, and resource allocation. These insights facilitate data-driven decisions, enabling organizations to refine their strategies for sustainable growth.

- Scalability for Future Growth

Birdview is designed to scale alongside professional services firms as their needs evolve. Whether managing a few projects or a diverse portfolio, Birdview adapts to evolving requirements, ensuring consistent and reliable revenue recognition practices. Its scalability provides peace of mind for future growth.

Final thoughts

In the intricate landscape of professional services, revenue recognition is not merely an accounting task but a strategic imperative. Birdview’s solutions for professional services revenue recognition offer a myriad of benefits that range from increased efficiency and accuracy to real-time insights and enhanced collaboration. Moreover, its adaptability ensures that it can evolve with your organization, supporting your growth and evolving needs seamlessly.

Contact us today to discover how Birdview PSA can transform your revenue recognition practices, optimize your financial outlook, and drive success in an ever-evolving industry.

or

Project Financial KPIs to Track in Professional Services

Learn about key performance indicators essential for financial tracking in professional services.

Project Cost Estimation Guide

Understand various methods for estimating project costs accurately.

How PSA Improves Financial Management and Forecasting

Discover how PSA software enhances financial oversight and forecasting accuracy.

Professional Services Automation (PSA) Software: A Practical Guide

Gain insights into how PSA software streamlines operations in professional services firms.

❓ Frequently Asked Questions (FAQ)

Q1: What is revenue recognition in professional services?

Revenue recognition in professional services refers to the process of recording revenue when it is earned, regardless of when payment is received. This ensures that financial statements accurately reflect a company’s financial performance.

Q2: Why is revenue recognition important for professional services firms?

Accurate revenue recognition is crucial for compliance with accounting standards, ensuring transparency in financial reporting, and providing insights into a firm’s profitability and financial health.

Q3: How does Birdview PSA assist with revenue recognition?

Birdview PSA automates the revenue recognition process by integrating project management with financial tracking. It supports various recognition methods, ensuring compliance and providing real-time financial insights.

Q4: What are common revenue recognition methods used in professional services?

Common methods include:

-

Percentage of Completion: Recognizing revenue based on project progress.

-

Completed Contract: Recognizing revenue upon project completion.

-

Milestone Billing: Recognizing revenue at predefined project stages.

-

Time and Materials: Recognizing revenue based on hours worked and materials