Accurate billing is critical for consultants. Whether you work independently or run a growing consulting firm, your billing software should make it easy to track time, invoice clients, and manage project costs without the headache. The right tool helps you get paid faster, stay compliant, and keep your clients happy.

Consultants who aim to work smarter and deliver consistently high-quality service often struggle with time-consuming billing tasks and scattered financial processes. Manual invoicing, tracking hours, and managing payments across multiple systems can lead to delays, errors, and lost revenue.

The good news? Specialized billing and invoicing software for professional services can automate these processes, reduce administrative workload, and improve accuracy.

In this article, we‘ll explore nine top billing solutions tailored to consultants–so you can simplify invoicing, get paid faster, and stay focused on serving your clients.

In this article, we‘ll look at 10 of the best billing software solutions for consultants in 2025–including Birdview PSA, a powerful platform designed specifically for professional services teams.

📚 Best professional services billing solutions – Top picks for 2025

Top tools for consultant invoicing and billing

1. Birdview PSA – End-to-end PSA Software

2. FreshBooks

3. QuickBooks Online

4. Xero

5. Zoho Invoice

6. Bonsai

7. Harvest

8. Wave

9. Bill.com

10. Paymo

What service businesses need billing software?

Service-based businesses that bill clients for time, projects, or recurring services–such as Business consulting, Software development, Engineering, and IT providers–rely on billing software to streamline invoicing, track billable hours, and ensure timely payments. The right tool helps reduce manual work, prevent revenue leakage, and improve financial visibility.

Key criteria for selecting the best billing software for consultants

For consultants, choosing the right billing software is about more than just generating invoices–it‘s about building a reliable, professional, and scalable process for getting paid. The right tool helps you track billable hours, manage client expenses, automate invoicing, and ensure timely payments with minimal manual effort.

With so many platforms available, it‘s important to focus on features that support the way consulting businesses operate–whether you bill hourly, by project, or on a retainer basis. Your billing software should not only look professional but also save time, reduce errors, and improve your cash flow.

Here are the most important features to consider when selecting billing software for your consulting business:

![✅]() Easy invoice creation

Easy invoice creation

You need an invoicing tool that lets you create professional, branded invoices in minutes–not something that forces you to fight with formatting. Look for software that offers customizable templates so your invoices reflect your brand while keeping things simple.

![✅]() Time tracking and billable hours integration

Time tracking and billable hours integration

For consultants, agencies, and service providers who charge by the hour, invoicing and time tracking should go hand in hand. The best invoicing software connects directly with your time-tracking tools, so every billable hour is accounted for–no more guessing or undercharging.

![✅]() Expense tracking and reimbursement

Expense tracking and reimbursement

Projects come with expenses–whether it‘s software subscriptions, travel costs, or client-related purchases. Your invoicing software should allow you to add reimbursable expenses to your invoices effortlessly, so you‘re not leaving money on the table.

![✅]() Multiple billable models support

Multiple billable models support

Every professional services business has its own way of charging clients, so your invoicing software should be flexible enough to handle different billing models. Whether you bill based on time and materials, charge a fixed project fee, or use a hybrid approach that combines both, your software should make it easy to generate accurate invoices without manual adjustments.

![✅]() Integration with accounting software

Integration with accounting software

Your invoices should sync seamlessly with your accounting software (like QuickBooks, Xero, or FreshBooks). This saves time on bookkeeping and ensures your financial records stay accurate.

![✅]() Detailed reporting and analytics

Detailed reporting and analytics

How much are you billing each month? Which clients take the longest to pay? Invoicing software with built-in reporting tools gives you insights into your cash flow, helping you make smarter business decisions.

Choosing billing software based on these criteria ensures you have the right foundation to streamline invoicing, reduce admin overhead, and stay focused on delivering value to your clients.

Top 10 billing platforms for consultants and service firms

Here are ten top billing software solutions for professional services teams, designed to simplify your invoicing process so you can concentrate on providing outstanding services to your clients.

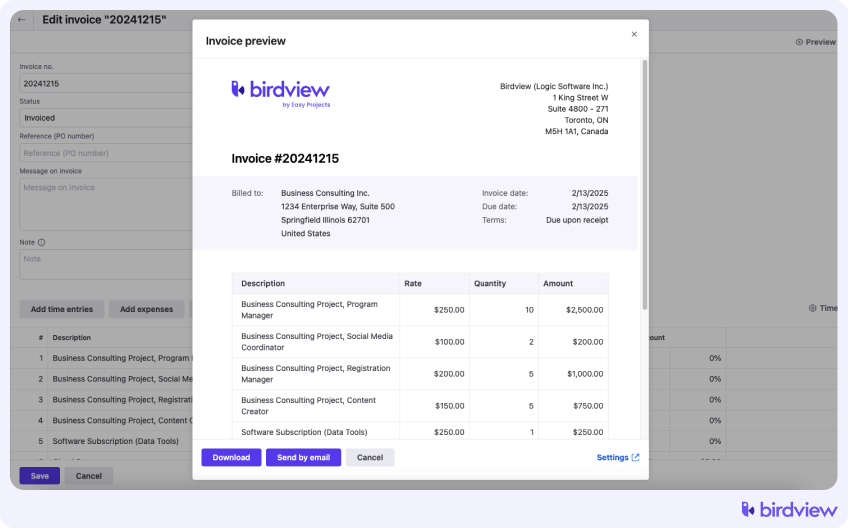

1. Birdview PSA – end-to-end PSA software

Birdview PSA is an all-in-one professional services automation (PSA) platform designed to help consulting teams manage the entire project lifecycle–from planning and resource allocation to time tracking, billing, and financial reporting. With built-in billing capabilities and real-time visibility into project performance, Birdview PSA eliminates disconnected tools and manual workflows.

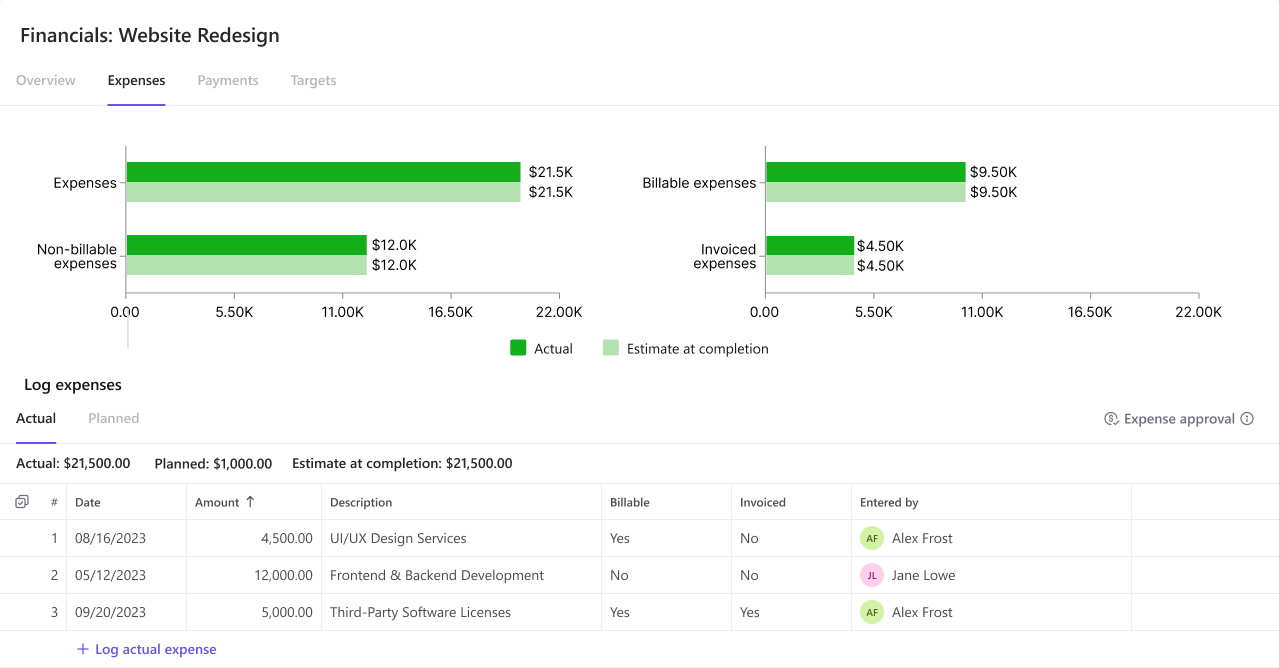

With comprehensive resource management, you can allocate your team effectively, set custom rates, and create rate cards that fit different clients or projects. The platform also lets you track both billable and non-billable hours, ensuring accurate invoicing while giving you insights into overall team productivity. Expense tracking is built in, so reimbursable costs are never missed, and every dollar spent is accounted for.

Key features:

-

Flexible Billing Models: Supports hourly, fixed-fee, milestone-based, and retainer billing, with customizable rate cards per role, project, or client.

-

Time & Expense Tracking: Log billable hours and expenses directly in the platform; mark them as billable/non-billable and link them to invoices.

-

Automated Invoicing: Generate invoices based on approved time entries, cost data, or project milestones–streamlining your quote-to-cash process.

-

Financial Insights: Track budgets, cost variance, and profit margins in real time with dashboards and advanced financial reports.

-

Approval Workflows: Ensure billing accuracy through configurable time, expense, and invoice approval processes.

-

Seamless Integrations: Connect with accounting platforms like QuickBooks, NetSuite, Microsoft Dynamics, and more.

Why it‘s great for consultants: Birdview PSA brings together billing, project management, and financial control in one place. It‘s built for teams that need to stay on top of client engagements, control budgets, and get paid on time–with less manual effort.

Trial: A free 14-day trial is available, possibly extending the trial period to 28 days. Sign up for a trial today to learn more about Birdview PSA.

👍 Pros:

- All-in-one platform for project and financial management

- Flexible billing models with rate customization

- Detailed resource and expense tracking

👎 Cons:

- Can take time to fully set up

2. FreshBooks

FreshBooks simplifies accounting and billing for consultants, freelancers, and small businesses. Its clean, user-friendly interface makes financial management approachable–even for those without an accounting background. From creating polished invoices to tracking time and managing expenses, FreshBooks offers everything a consultant needs to stay organized and get paid on time.

Key features: Invoicing, expense tracking, time tracking, project management, reporting

Trial: A free 30-day trial is available.

👍 Pros:

- User-friendly interface

- Strong invoicing capabilities

- Responsive customer support

👎 Cons:

- Higher pricing tiers

- Limited advanced accounting features

3. QuickBooks Online

QuickBooks Online is a leading cloud-based accounting solution trusted by millions of small and mid-sized businesses–including many consulting firms. It goes beyond invoicing to offer a full suite of financial tools, making it ideal for consultants who want to combine billing, bookkeeping, and tax preparation in one platform.

Key features: Expense tracking, invoicing, payroll management, inventory tracking, financial reporting

Trial: A free 30-day trial is available.

👍 Pros:

- Comprehensive feature set

- Extensive third-party integrations

- Robust reporting tools

👎 Cons:

- Steeper learning curve

- Higher cost for advanced features

4. Xero

Xero is a modern, cloud-based accounting and billing platform tailored for small to medium-sized businesses, including consultants who operate globally. Known for its clean interface and strong financial reporting, Xero offers multi-currency support, seamless bank reconciliation, and robust integrations–making it a solid choice for consultants managing international projects or clients.

Key features: Bank reconciliation, invoicing, expense claims, inventory management, financial reporting

Trial: A free 30-day trial is available.

👍 Pros:

- Unlimited users

- Strong integration capabilities

- User-friendly interface

👎 Cons:

- Customer support response times

- Some features require additional fees

5. Zoho Invoice

Zoho Invoice is a completely free, feature-rich invoicing solution designed for freelancers, independent consultants, and small service-based businesses. Despite being free, it offers a professional and polished billing experience with capabilities that rival many paid platforms.

Key features: Customizable invoicing, expense tracking, time tracking, client portal, reporting

Trial: A free plan is available with limited features.

👍 Pros:

- Cost-effective solution

- Easy to use

- Integration with other Zoho products

👎 Cons:

- Limited advanced features

- Customization options could be expanded

6. Bonsai

Bonsai is an all-in-one business management platform designed specifically for freelancers and independent consultants. It combines billing, proposals, contracts, time tracking, and project management into one easy-to-use solution–eliminating the need to juggle multiple tools.

Key features: Proposal and contract creation, time tracking, invoicing, expense tracking, task management

Trial: A free 7-day trial is available.

👍 Pros:

- All-in-one solution for freelancers

- Professional templates for contracts and proposals

- Integrated time tracking

👎 Cons:

- Higher cost compared to some competitors

- Occasional app performance issues

7. Harvest

Harvest is a popular time tracking and billing tool designed for consultants, agencies, and small project-based teams. It helps you accurately track time, manage billable hours, and turn timesheets into professional invoices with minimal effort. With a clean interface and powerful reporting, Harvest is a trusted solution for consultants who charge by the hour or by project milestones.

Key features: Time tracking, invoicing, expense tracking, project management, reporting

Trial: A free 30-day trial is available.

👍 Pros:

- Intuitive time tracking

- Detailed reporting

- Integrates with various tools

👎 Cons:

- Limited invoice customization

- Pricing can add up with multiple users

8. Wave

Wave is a free, user-friendly financial management platform ideal for freelancers, solo consultants, and small consulting businesses. Despite being free, Wave provides professional-level invoicing, accounting, and payment features that help consultants keep their finances organized without extra overhead costs.

Key features: Invoicing, expense tracking, accounting reports, receipt scanning, payroll (paid feature)

Trial: No free trial is available.

👍 Pros:

- Simple and intuitive interface

- No transaction or billing limits

👎 Cons:

- Limited advanced features

- Customer support is limited for free users

9. Bill.com

Bill.com is a cloud-based financial operations platform designed to streamline accounts payable (AP), accounts receivable (AR), and expense management. It’s particularly beneficial for consulting firms looking to automate their billing processes, enhance cash flow visibility, and reduce manual administrative tasks.

Key features: Automated invoicing, ACH payments, accounts payable and receivable, approval workflows, document storage, integration with accounting software

Trial: A free trial is available.

👍 Pros:

- Centralizes payment processes

- Automates financial workflows

- Integrates with major accounting platforms

👎 Cons:

- Customer support responsiveness

- Complexity for smaller businesses

- Pricing considerations

10. Paymo

Paymo is an integrated work management platform designed for consultants and small teams that need to manage projects, track time, and handle invoicing within a single system. It‘s particularly well-suited for consultants juggling multiple clients and projects, offering a seamless workflow from task management to payment collection.

Key features: Project management, time tracking, invoicing, task management, expense tracking, team collaboration

Trial: A free 15-day trial is available.

👍 Pros:

- User-friendly interface

- Comprehensive-time tracking

- Integrated invoicing features

👎 Cons:

- Limited mobile app functionality

- Some advanced features behind paywalls

- The learning curve for new users

Optimize your billing efficiency using Birdview PSA

Birdview PSA helps consultants streamline their entire billing process–saving time, reducing manual work, and improving revenue accuracy. With its built-in billing and invoicing features, you can move from project planning to payment without switching tools or duplicating data.

Birdview PSA eliminates billing bottlenecks by bringing your entire consulting workflow–from quote to cash–into one centralized platform. Whether you’re a solo consultant or part of a growing firm, Birdview helps you get paid faster with less effort by simplifying billing, optimizing resource allocation, and keeping your financials on track. With tools to track billable and non-billable hours, manage expenses, and customize rate cards, it ensures accuracy and profitability without the hassle.

Sign up for a free trial to explore all the features Birdview PSA has to offer, or schedule a demo with our team to get a personalized walkthrough.

or

You may be interested in…

FAQ: Billing software for consultants

💡 What makes Birdview PSA a good billing solution for consultants?

Birdview PSA is built specifically for professional services like consulting. It combines project management, time tracking, budgeting, and billing in one platform–so you can manage your entire workflow from quote to invoice without switching tools.

💰 Can I bill clients using different pricing models in Birdview PSA?

Yes. Birdview PSA supports flexible billing models, including hourly rates, fixed-fee projects, retainers, and milestone-based billing. You can also apply role-based rate cards and customize billing rules for each client or project.

⏱️ Does Birdview PSA include time and expense tracking?

Absolutely. Consultants can track billable hours and log expenses directly within Birdview PSA. These records can be reviewed, approved, and automatically pulled into invoices, saving time and improving billing accuracy.

🔁 Can I automate invoicing with Birdview PSA?

Yes. Birdview PSA lets you automate recurring invoices, send billing reminders, and generate invoices based on tracked time and approved expenses. This helps ensure timely payments with minimal manual effort.

🧾 Does Birdview PSA support invoice customization?

Birdview PSA allows you to create branded invoices with your company logo, terms, tax rates, and itemized billing details. You can tailor invoices to each client while maintaining a consistent, professional look.

🔗 Can Birdview PSA integrate with accounting software?

Yes. Birdview PSA integrates with popular accounting tools like QuickBooks, NetSuite, Deltek, and Microsoft Dynamics, allowing for seamless financial data sync and reducing the need for manual data entry.

🎯 How does Birdview PSA help improve billing accuracy?

Birdview connects time tracking, project progress, and financial data in real time. This means invoices reflect actual work done–no guesswork or disconnected spreadsheets–ensuring transparency and minimizing billing disputes.

📈 Is Birdview PSA suitable for growing consulting teams?

Definitely. Birdview PSA is built to scale with your business. It offers multi-user access, role-based permissions, detailed reporting, and automation features that support teams of all sizes–from solo consultants to large firms.

Easy invoice creation

Easy invoice creation