In project-driven organizations, risks are inevitable. But when you manage not just one project, but an entire portfolio of projects, those risks become more complex and interrelated. That‘s where project portfolio risk management comes in.

Unlike project-level risk management, which focuses on delivery schedules and scope changes, portfolio risk management helps organizations identify threats in the big picture.

“Organizations with mature project portfolio management practices

complete 35 percent more of their programs successfully. They fail less often and

waste less money.” pmi.org

In this guide, we‘ll show you how to identify, assess, and mitigate risks across your project portfolio using practical steps, examples, and top tools.

In this article

What is project portfolio risk management?

Portfolio risk management is the process of identifying, assessing, and responding to risks that affect an entire portfolio of projects. These risks may arise from resource conflicts, financial risks, market changes, or project interdependencies, and often extend beyond the scope of a single project.

💡For example, a delay in a product launch may delay marketing campaigns, which in turn may delay customer acquisition. A budget cut in one department may impact several other projects delivered by the same technical team.

The goal of portfolio risk management is to ensure that the organization delivers the optimal mix of projects on time, within budget, and in line with strategic objectives, even as conditions change.

The difference between project risk and portfolio risk

While project risk is concerned with the success of individual initiatives, portfolio risk focuses on the health and performance of the entire project ecosystem.

Project risk: Will this project miss its deadline due to scope creep?

Portfolio risk: Are too many projects dependent on the same team or resource pool?

This difference matters because portfolio-level risks require coordination, prioritization, and sometimes difficult trade-offs across projects. It‘s about steering the ship, not just keeping it afloat.

Common types of risks in project portfolios

When you‘re running many projects at the same time, some risks can affect more than just one of them. They can come from shared teams, changing priorities, or things happening outside your company. Knowing the most common types of risks can help you spot problems early and keep your whole portfolio on track.

Here are the most common risk categories you should monitor across your portfolio:

| Risk Type | Example |

| Strategic misalignment | Projects no longer match updated business goals |

| Resource constraints | Shared team members are overbooked across multiple projects |

| Financial exposure | Unexpected cost increases hit several large projects at once |

| Market or regulatory | New laws affect project delivery in multiple regions |

| Technology risks | A shared platform delay slows down several interconnected initiatives |

| Reputation impact | One failed high-profile project affects client trust in other areas |

| Interdependencies | A delayed project causes cascading delays in related programs |

📌 Tip: Use a risk register that covers your full portfolio–not just individual projects. PPM tools like Birdview PSA can help consolidate risk data across teams and departments, so you can see the bigger picture.

Why portfolio risk management matters

In today‘s environment, organizations are juggling more projects than ever, often with limited staff, shifting priorities, and increasing stakeholder pressure. This makes portfolio-level oversight essential.

Take, for example, a professional services firm running several client projects alongside internal system upgrades. If two senior consultants are scheduled to lead three different projects each, that‘s not just a resource problem–it‘s a portfolio risk. One scheduling conflict could cascade across multiple timelines, harming both revenue and client satisfaction.

What makes these risks so challenging is that they‘re often invisible until it‘s too late. That‘s why risk visibility, scenario planning, and early signals are critical components of portfolio risk management. When you can spot the warning signs early, you can make smarter trade-offs and keep your overall strategy intact.

When portfolio risks go unmanaged, organizations face missed opportunities, wasted resources, and strategic drift. Here‘s why it‘s critical:

- Better resource allocation: Prevents overloading teams or departments

- Improved decision-making: Helps leadership prioritize high-value projects

- Faster response to change: Enables teams to adjust plans based on external events or performance trends

- Higher strategic alignment: Keeps the project mix in sync with business goals

In short, it‘s the foundation for building a more adaptive, resilient organization.

How to develop a project portfolio risk management plan step by step

Creating a project portfolio risk management plan doesn‘t need to be overwhelming, but it does require thoughtful coordination across teams, leadership, and systems. Unlike single-project risk plans, a portfolio-level plan must account for the bigger picture: how different risks interact, where they concentrate, and how they could impact strategic goals.

Let‘s walk through how to build a practical, scalable plan step by step.

Step 1: Understand your portfolio context

Start by defining the scope and structure of your portfolio. What kinds of projects does it include–client-facing, internal, R&D? Are you balancing high-risk innovation with low-risk maintenance work? Is your portfolio aligned with long-term strategic goals?

Understanding your portfolio‘s purpose will shape how you assess risk.

💡For example, a consulting firm focused on fast client delivery might prioritize resource and reputational risks, while a product-based company may focus more on financial and market risks.

📌 Tip: Document your portfolio‘s objectives and risk tolerance levels before getting into the details.

Step 2: Identify risks at the portfolio level

This is more than just collecting project-level risk logs.

Engage project managers, PMO leads, and business stakeholders to identify risks that may not be immediately apparent. Use past project data, capacity forecasts, and upcoming demand to look for patterns.

Examples of portfolio-level risks:

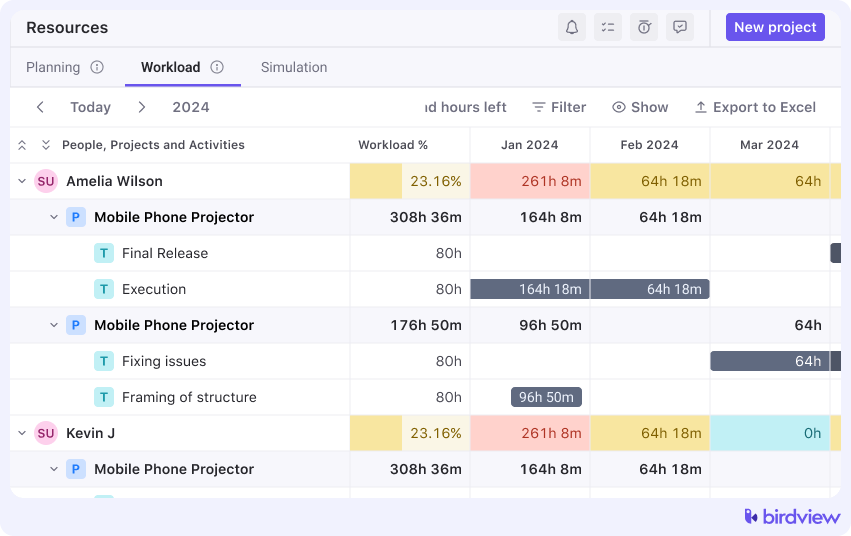

💡 For example, in Birdview PSA, you can use workload reports, dashboard flags to track resource load and risks in active and planned projects.

Step 3: Analyze and prioritize

Assess each risk for likelihood and impact. Pay special attention to risks that could affect multiple projects or strategic priorities. Document who owns each risk and how it will be monitored.

Consider how risks could affect funding cycles, department capacity, client relationships, or business continuity.

📌 Tip: Categorize risks into controllable (e.g., resource conflicts) and uncontrollable (e.g., market downturns). This helps focus mitigation efforts where they can make a difference.

Step 4: Define response strategies

Now it‘s time to decide what to do about the top risks. Your responses may include:

- Re-sequence project timelines to spread workload

- Adding buffer capacity for high-risk delivery periods

- Diversifying your project mix to avoid over-reliance on one business unit

- Scaling back or putting high-risk, low-value initiatives on hold

Some risks may be accepted as part of your strategy, while others need mitigation or contingency plans. The key is making decisions based on portfolio value, not just individual project outcomes.

💡 Example: If two large projects are competing for the same design team in Q4, you might move one to Q1 and bring in a contractor short-term, rather than risk delays on both.

Step 5: Establish monitoring and review mechanisms

A good plan isn‘t static–it evolves. Set up regular portfolio risk reviews with the PMO, finance, and key delivery leads. Define who will monitor what, how often, and using which tools.

You‘ll want to track:

- Changes in risk levels (increased severity, new dependencies)

- Whether mitigation plans are working

- Any new risks arising from changes in business priorities or the environment

Birdview PSA helps streamline this process with real-time dashboards and resource planning tools, making it easier to adapt to change without having to start from scratch..

Step 6: Communicate and integrate

Make sure your portfolio risk plan is visible, actionable, and part of everyday workflows–not buried in a spreadsheet. Discuss risks regularly, share key insights across teams, and include risk updates in meetings and reports.

A risk plan only adds value if people use it. Keep it simple, relevant, and easy to apply within your organization‘s existing processes.

Project portfolio risk management best practices

Managing risk across a portfolio of projects is as much about mindset as it is about process. The goal isn‘t to eliminate risk–that‘s impossible–but to spot threats early, respond strategically, and keep your portfolio aligned with what matters most: delivering business value.

Here are some best practices to make your project portfolio risk management more effective, resilient, and repeatable.

1. Shift from project-level to portfolio-level thinking

It‘s easy to get caught up in individual project risks, like a missed milestone or scope change.

Don‘t just react to project issues–step back and ask what they mean for the broader portfolio. One late project might be manageable. Five late projects all pulling from the same team? That‘s a portfolio issue.

Train yourself and your team to recognize when isolated project issues signal broader portfolio threats. This shift in mindset allows you to rebalance proactively, not reactively.

💡 Example: If three projects are all scheduled to use your data analytics team in Q4, it‘s not just a resource issue–it‘s a portfolio-level risk that may affect delivery across the board.

2. Make risk identification a continuous habit

Risk management isn‘t a one-time workshop–it‘s a living process. Risks change constantly. Make it a habit to check in regularly and update your plans. Set triggers (like team capacity thresholds) that signal when something needs review.

Encourage your teams to report risks early and often. The sooner you know about a potential issue, the more options you have to address it.

Birdview PSA can support this by surfacing real-time indicators–like delayed tasks, overallocated resources, or budget overruns–that often signal bigger portfolio risks in the making.

3. Prioritizing Project Portfolio Management (PPM) risks

Not all risks are equal. Some threaten minor schedule slips; others put major investments or client relationships at risk. Focus on risks that could derail strategic outcomes, not just tactical timelines.

You can‘t manage everything. That‘s why it‘s important to assess each risk‘s potential impact across the portfolio–and act accordingly. A delayed internal admin project might be fine. A blocked client-facing initiative tied to Q4 revenue? Not so much.

📌 Tip: Keep a short list of high-priority risks visible to the executive team. Use it to drive discussions, not just document them.

4. Balance risk with opportunity

Too much caution can be just as dangerous as too little. Some of the most innovative, high-reward projects carry a degree of risk, but that doesn‘t mean they should be avoided.

The best portfolio leaders know how to balance low-risk, stable work with bolder, high-impact initiatives. Think of it like a financial portfolio: you need a healthy mix to grow.

Use risk-adjusted value scoring when prioritizing your portfolio. That way, a project with high potential but known risks can still be considered, just with proper planning, buffers, or contingencies.

5. Use tools that support visibility and agility

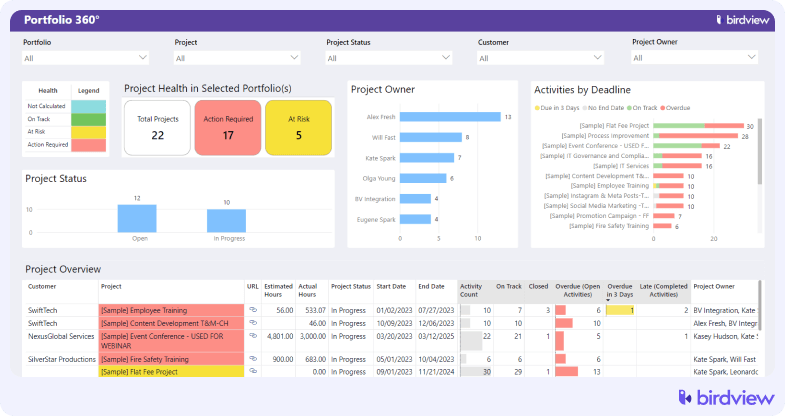

One of the biggest challenges in managing portfolio risk is a lack of centralized, real-time data. Adopt tools that bring everything together in one place–projects, resources, budgets, timelines, and risk indicators. Birdview PSA, for example, helps portfolio managers see risk signals early through, progress dashboards, and portfolio-level workload views.

Even more important than visibility is agility. When risks materialize, you need to be able to model trade-offs, reallocate resources, and adjust timelines quickly. Static Gantt charts won‘t cut it at the portfolio level.

6. Involve the right stakeholders early

Portfolio risk doesn‘t live in a vacuum. It intersects with finance (budget exposure), HR (capacity and turnover), legal (compliance), and client services (delivery and trust). Bring these perspectives into the conversation from the start.

Too often, portfolio risks are discussed only within the PMO or project teams. But cross-functional involvement–especially at the planning and prioritization stages–leads to stronger mitigation plans and fewer surprises.

7. Build in buffers and scenarios, not just plans

No matter how detailed your plan, things will change. So instead of aiming for perfection, aim for flexibility.

Build in buffers–both time and capacity–for high-risk areas of your portfolio. Run “what-if” scenarios to test how changes in budget, staffing, or delivery order would impact your overall portfolio performance.

This kind of risk resilience separates reactive teams from mature, adaptive ones. It‘s not about knowing exactly what will go wrong–it‘s about being ready for when something does.

Also read: Best Project Portfolio Management Software 2025

Looking for a way to streamline your risk management process?

Birdview PSA, an end-to-end project management platform, offers powerful features to help you implement and manage your project portfolio more effectively.

“One of the biggest benefits we‘ve seen is the consolidated view of all our project work – internal, client, and product development. Birdview has given us the outcome we were looking for in terms of having one place to see utilization, resource planning, and time tracking across the organization. The out-of-box functionality from Birdview PSA meets 85-90% of the requirements of a professional services organization.”

Nick Choo-Hum, Director of Professional Services of of HEALWELL AI Inc

Solving project portfolio risk challenges with Birdview PSA

Managing risks across a portfolio isn‘t just about tracking issues–it‘s about seeing the big picture and acting fast. Here are the top challenges portfolio teams face, and how Birdview PSA helps solve them.

1. Limited visibility across projects

The challenge: When project data is scattered across spreadsheets, emails, and disconnected tools, it‘s hard to spot risks that impact multiple projects. Leaders may see individual project issues–but miss cross-project patterns, like resource overload or repeated delays in one department.

How Birdview PSA helps: Birdview gives you a centralized view of all active and planned projects. Portfolio dashboards highlight which projects are at risk, while workload views show where specific teams or roles are overbooked. You can see dependencies, flag overdue tasks, and drill into project health in real time–without chasing updates.

2. Siloed risk tracking

The challenge: Different teams often manage risks in isolation. Each project might track its own risks, but there‘s no shared process to escalate issues to the portfolio level. As a result, broader patterns–like growing technical debt or repeated scope creep–get lost.

How Birdview PSA helps: With Birdview, you can standardize risk intake across all projects using shared forms and fields. Risks can be tagged, categorized, and escalated to the PMO or executive team for portfolio-level review. This ensures that no critical issue stays hidden in someone‘s private task list.

3. Resource conflicts and overload

The challenge: A common portfolio risk is when too many projects depend on the same people. Overbooking key specialists leads to bottlenecks, quality issues, and project delays–but it‘s often not obvious until someone flags it manually.

How Birdview PSA helps: Birdview‘s resource planning tools make it easy to see who‘s assigned to what, and when. The Workload view shows availability by person, team, or role, so you can spot overload before it happens. You can even run “what-if” scenarios to see how shifting timelines would affect resource demand.

4. Difficulty adjusting plans when risks emerge

The challenge: Even if teams identify risks, they may struggle to adapt quickly. Without the right tools, rebalancing the portfolio, reallocating resources, or delaying projects can take days–or weeks. That delay can cost the business time, money, and trust.

How Birdview PSA helps: Birdview makes portfolio adjustments easier with flexible project scheduling, drag-and-drop timelines, and real-time updates. PMOs can shift deadlines, adjust resource assignments, or pause projects–while instantly seeing how changes impact the rest of the portfolio.

5. Lack of executive insight into risks

The challenge: Executives need to understand which risks could affect business outcomes–but detailed risk logs are often too technical or buried in project-level updates. This disconnect makes it harder for leadership to make informed decisions.

How Birdview PSA helps: Birdview‘s executive dashboards turn portfolio risk data into clear visuals. You can highlight top risks, monitor key KPIs like budget variance or milestone delays, and provide high-level summaries to decision-makers. Everyone sees what matters most–without getting lost in the details.

6. Inflexible planning tools

The challenge: Traditional project management tools don‘t always support the kind of flexibility portfolio teams need. Static Gantt charts and rigid schedules make it hard to respond when new risks appear or priorities shift.

How Birdview PSA helps: Birdview was designed with change in mind. From scenario planning to portfolio-level filters and drag-and-drop rescheduling, it gives PMOs and risk managers the agility they need to respond in real time–without losing control of the bigger picture.

Risks are part of every project portfolio–but how you manage them determines whether they become obstacles or opportunities.

With the right structure, tools, and habits, even complex portfolios can become more predictable and resilient. And if you‘re looking for a platform to support that process, solutions like Birdview PSA provide the real-time visibility and coordination needed to keep risks under control.

Start streamlining your risk management today–explore how Birdview PSA can help your team stay ahead of uncertainty and deliver smarter, safer portfolios.

0r

Read more about Project Portfolio Management:

Project Portfolio Management: The Ultimate Guide

Top PPM benefits for service businesses. Tips & examples

Project Portfolio Management Software | Birdview PSA

Common project portfolio mistakes to avoid: Examples & Tips

Frequently asked questions: Project portfolio risk management

1. How often should I review risks in a project portfolio?

Monthly or quarterly reviews are a good starting point. However, frequency should reflect your organization’s project volume, pace of change, and resource volatility. Use dashboards and risk thresholds to trigger ad-hoc reviews when needed.

2. Who should be responsible for managing portfolio-level risks?

The PMO typically owns the portfolio risk framework, but responsibility is shared. Project managers flag local risks, while department leads and executives contribute strategic oversight. A cross-functional approach ensures risks are not siloed or overlooked.

3. What tools support effective portfolio risk management?

Tools like Birdview PSA, Planview, or Smartsheet offer portfolio-level dashboards, resource capacity views, and scenario planning–all critical for visibility and agility. Look for platforms that integrate resource, budget, and risk data in one place.

4. Is it acceptable to “accept” portfolio risks?

Yes. Risk acceptance is a valid strategy–especially when the cost of mitigation outweighs the potential impact. The key is documenting your rationale and monitoring those risks closely. Some risks are worth taking to enable innovation or speed.

5. How do I build executive awareness of portfolio risks?

Use high-level dashboards, clear visuals (like heatmaps), and simple summaries that tie risks to strategic outcomes. Avoid technical jargon. Focus on how risks affect revenue, delivery, reputation, or compliance–and what can be done about them.

6. Can portfolio risk management improve ROI?

Absolutely. By avoiding duplicated effort, reallocating resources proactively, and killing low-value projects early, you free up capacity for initiatives that matter. A risk-informed portfolio is not just safer–it‘s more efficient and aligned with business value.