For professional services firms, the quote-to-cash cycle is the lifeblood of the business. Yet, this critical process is often hampered by manual invoicing, disconnected spreadsheets, and rigid billing structures. You‘ve likely seen the consequences: revenue leakage from unbilled hours, client disputes over confusing invoices, and countless administrative hours wasted chasing data instead of driving growth. The core challenge lies in aligning how you deliver services with how you bill for them–and doing it efficiently.

Choosing the wrong billing model for a project can erode profit margins, while manual invoicing invites errors that delay payments and damage client trust. This is where a Professional Services Automation (PSA) platform becomes essential. A robust PSA solution provides the flexibility to support multiple billing models and the power to automate invoicing, transforming a complex, error-prone process into a streamlined, reliable workflow.

This guide will walk you through the three primary billing models–fixed fee, time and materials (T&M), and retainer–and explain when to use each. We will also provide a clear, step-by-step recipe for setting up automated invoicing within a PSA system to help your organization improve cash flow, enhance accuracy, and scale with confidence.

Why flexible billing and automated invoicing matter for service firms

Flexible billing and automated invoicing are core components of operational excellence for service firms. Supporting multiple billing models allows you to tailor your pricing to the nature of the project and the needs of your client, while automation eliminates the manual effort that drains productivity and introduces risk. By integrating these functions, you can directly address common pain points like revenue leakage and delayed payments.

When your billing process is disconnected from project execution, you lose money. Billable hours get lost in spreadsheets, expenses are forgotten, and milestone payments are missed. Automating invoicing with a PSA closes these gaps by creating a single source of truth. Every time entry and expense is logged directly against a project, ensuring all billable work is captured and invoiced accurately. This not only protects your revenue but also accelerates your cash flow by generating and sending invoices faster.

The key benefits of adopting a flexible and automated billing system include:

- Improved Cash Flow: Automation shortens the time between work completion and payment. Invoices are generated on schedule without manual intervention, reducing delays and improving financial predictability.

- Reduced Administrative Overhead: Manual invoicing is a time-consuming task. Automation frees up your project and finance teams to focus on strategic, high-value activities instead of data entry and reconciliation.

- Increased Accuracy and Fewer Errors: Automated invoicing pulls data directly from timesheets and expense reports, eliminating the human errors that lead to client disputes, credit memos, and payment delays.

- Enhanced Client Trust: Professional, accurate, and timely invoices build client confidence. When clients receive clear, detailed bills that reflect the work delivered, it strengthens the relationship and reduces friction.

- Greater Profitability: By plugging revenue leaks and reducing administrative costs, a streamlined billing process directly contributes to healthier project margins and overall business profitability.

📚 Read more: Accelerate the quote-to-cash process in professional services with PSA software

Choosing the right billing model: Retainer vs. time and materials vs. fixed fee

The ability to offer different billing models is a competitive advantage. It shows you understand your clients’ needs for predictability, flexibility, or ongoing support. A modern Professional Services Automation (PSA) software should seamlessly support each of the main billing types, as each is suited for different project scenarios.

Fixed fee billing: Predictability and risk management

Fixed fee billing is a model where you agree to deliver a specific project or set of deliverables for a single, predetermined price. This approach is best suited for projects with a clearly defined scope, repeatable processes, and predictable timelines, such as a standard website build, a system audit, or a fixed-scope consulting engagement.

- Pros: The primary advantage of a fixed fee model is predictability for both you and your client. The client knows the total cost upfront, which simplifies their budgeting, and your firm has a clear revenue target for the project. It also simplifies invoicing, which can be tied to milestones or a payment schedule.

- Cons: The biggest risk lies with your firm. If you underestimate the effort required or if the project suffers from scope creep, your profit margins can quickly disappear. This model requires a mature project estimation process and disciplined scope management to remain profitable. A fixed fee billing PSA helps by allowing you to build detailed project plans and track progress against the budget in real time, alerting you to potential overruns before they happen.

Time and materials (T&M): Flexibility for evolving projects

A time and materials (T&M) model bills clients for the actual hours worked by your team, plus the cost of any materials or expenses incurred. This model is ideal for projects where the scope is not well-defined, requirements are likely to change, or the work is exploratory, such as agile software development, R&D projects, or ongoing support and maintenance.

- Pros: The T&M model shifts the budget risk from your firm to the client, ensuring you are compensated for all the work you perform. It offers maximum flexibility to adapt to changing project needs without requiring constant contract renegotiations. For clients, it provides transparency, as invoices detail exactly how time and resources were spent.

- Cons: The main drawback is the lack of budget predictability for the client, which can cause anxiety and require more frequent communication. This model also demands meticulous and consistent time tracking from your team. You must have a system in place to accurately capture every billable hour and differentiate it from non-billable work.

When considering PSA billing retainer vs time and materials, the T&M model is fundamentally about billing for active work performed, whereas a retainer is about securing access to services over a period.

📚 Read more: Profit margins in time-and-material vs fixed-fee contracts

Retainer agreements: Building long-term partnerships

A retainer agreement is a contract where the client pays a recurring fee–typically monthly–in exchange for access to a predetermined amount of your team‘s time, services, or expertise. Retainers are perfect for long-term, ongoing relationships where the client needs continuous support, such as managed IT services, SEO and marketing campaigns, or strategic advisory services.

- Pros: For your firm, retainers provide a predictable, recurring revenue stream that smooths out cash flow and makes financial forecasting easier. For the client, it guarantees access to your services and often comes at a more favorable rate than standard hourly billing.

- Cons: The challenge with retainers is managing scope and demonstrating ongoing value. Clients may try to fit extra work into the retainer period, leading to “scope seep.” It is crucial to clearly define what is included in the retainer and have a process for handling out-of-scope requests. You also need to provide regular reports that show the value you are delivering to justify the recurring fee.

A quick comparison of billing models

| Factor | Fixed Fee | Time & Materials (T&M) | Retainer |

| Best For | Projects with a well-defined scope | Projects with an evolving or unclear scope | Ongoing, long-term service relationships |

| Client Risk | Low (cost is known) | High (budget can fluctuate) | Medium (fixed cost, but value must be proven) |

| Firm Risk | High (scope creep erodes profit) | Low (all work is billable) | Medium (risk of over-servicing) |

| Revenue Flow | Milestone-based or scheduled | Variable, based on work performed | Predictable and recurring |

| Key to Success | Accurate estimation & scope control | Meticulous time tracking & communication | Clear agreement & value reporting |

How to automate invoicing with a PSA platform

Once you’ve chosen the right billing model, the next step is to automate invoicing to ensure efficiency and accuracy. A PSA platform connects project data directly to your financial workflows, making it possible to generate invoices automatically based on rules you define. Here‘s a four-step recipe for setting it up.

Step 1: Centralize time and expense tracking

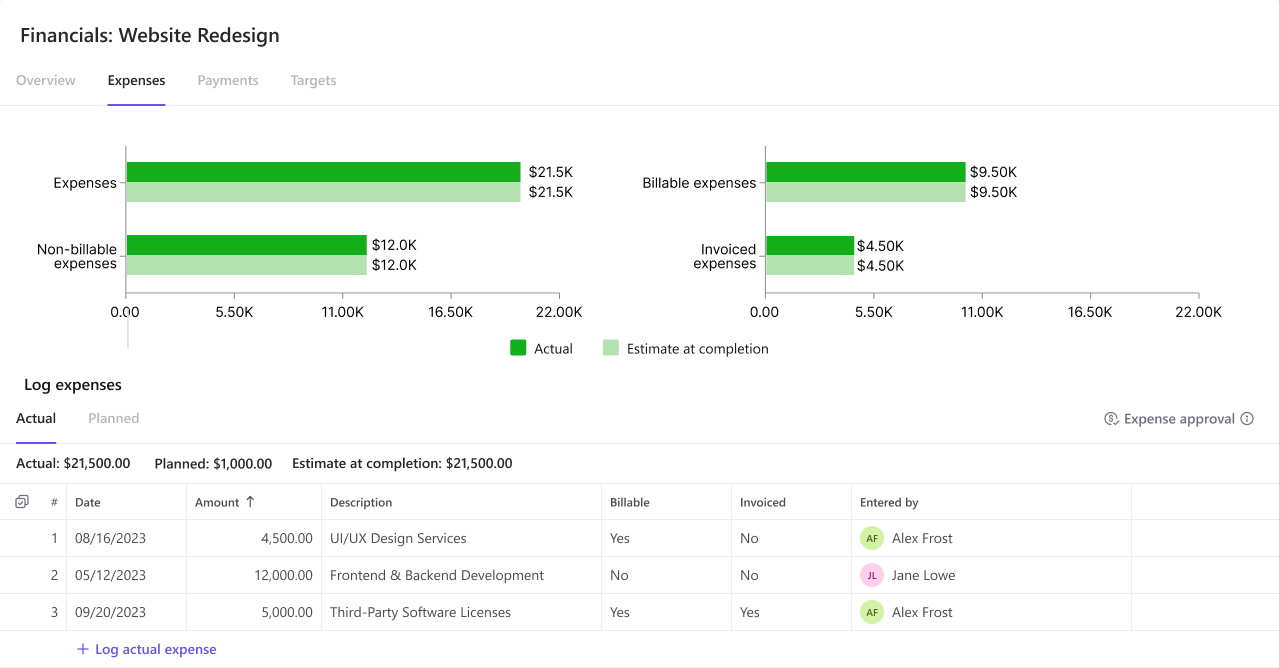

The foundation of accurate billing is reliable data. Your PSA software should serve as the central hub where all team members track their time and log expenses against specific projects and tasks. This creates a detailed, auditable record of all billable activities. Within the PSA, you can easily distinguish billable vs. non-billable hours, ensuring that internal meetings or administrative tasks don’t accidentally end up on a client’s invoice. This unified tracking is the first step to eliminating revenue leakage.

Step 2: Configure your billing rules and rates

A flexible PSA platform allows you to set up custom billing rates for different projects, clients, roles, or even individual team members. You can establish standard rates across your organization but override them as needed for specific contracts. For each project, you will assign a billing model–T&M, Fixed Fee, or Retainer. This tells the system how to calculate the invoice amount when it’s time to bill the client.

📍 Example: In Birdview PSA, you can create multiple rate cards and assign them at the project or client level. This ensures that when a team member logs time, the system automatically applies the correct billable rate, whether it’s a senior consultant’s rate for a T&M project or a standard rate for retainer-based work.

Step 3: Set up automated invoice generation

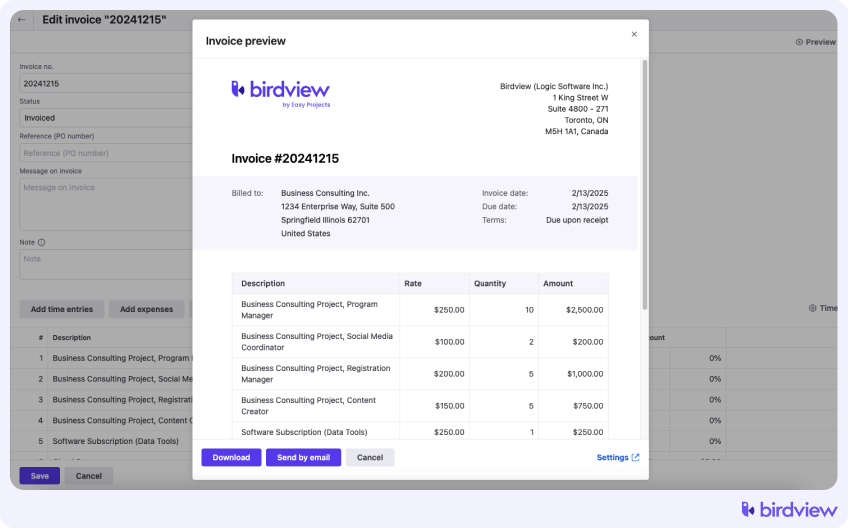

This is where the magic happens. Instead of manually creating invoices each month, you can configure your PSA to generate them automatically. For a T&M project, you might set the system to create an invoice every two weeks, pulling in all approved time and expenses from that period. For a retainer, you can schedule a recurring invoice to be generated on the first of every month. For fixed fee billing in a PSA, you can trigger invoices based on the completion of project milestones.

Step 4: Streamline approvals and integration

Before an invoice is sent to a client, it often needs internal review. Good PSA software includes approval workflows, allowing a project manager or finance lead to review and approve a draft invoice before it’s finalized. Once approved, the invoice can be sent directly to the client from the platform. To complete the quote-to-cash cycle, top PSA tools offer integrations with accounting software like QuickBooks or NetSuite, automatically syncing invoice data and eliminating double data entry.

How Birdview PSA delivers billing flexibility and automation

Many service organizations ask, “Which PSA tool supports different billing types like retainer, T&M, and fixed fee?” The answer is a platform designed with financial management at its core. Birdview PSA provides a unified system for managing projects, resources, and finances, giving you the flexibility and automation needed to streamline your entire billing process.

Unify your projects, resources, and finances

Birdview PSA serves as your organization‘s single source of truth. By connecting every project task and resource assignment to its financial impact, Birdview ensures that your billing is always accurate and aligned with the work being delivered. This integrated approach provides real-time visibility into project budgets and costs, empowering you to make data-driven decisions that protect your profitability.

Support for T&M, fixed fee, and retainer models

Birdview PSA is built to handle the diverse needs of modern service firms. Our platform offers robust support for all major billing models:

- Time & Materials: Automatically pull approved time logs and expenses into an invoice with just a few clicks. The system applies the correct rates, calculates totals, and generates a detailed invoice ready for client review.

- Fixed Fee: Set up billing schedules based on project milestones, specific dates, or completion percentages. As your team makes progress, you can generate invoices that reflect the value delivered.

- Retainers: Easily create recurring invoice templates for your retainer clients, ensuring consistent and timely billing every month with minimal manual effort.

Automate the entire quote-to-cash cycle

With Birdview‘s recently released invoicing and billing feature, you can manage the entire invoicing process without leaving the platform. Create, customize, and preview invoices, then send them to clients directly or export them to your accounting system. This end-to-end automation reduces administrative burdens, minimizes errors, and helps you get paid faster.

Frequently asked questions

What is the main difference between T&M and fixed fee billing in a PSA?

The main difference is how the invoice total is calculated. For Time & Materials (T&M), a PSA platform automatically aggregates all billable hours and expenses logged during a billing period and multiplies them by the pre-set rates. For Fixed Fee, the invoice amount is a predetermined installment of the total project price, often tied to a milestone or date rather than actual hours worked.

How does automated invoicing reduce revenue leakage?

Automated invoicing reduces revenue leakage by creating a direct link between work performed and billing. When all billable hours and expenses are captured in a central PSA system as they occur, there is no chance for them to be forgotten or lost in spreadsheets. The system ensures every billable item is automatically included in the next invoice, capturing all earned revenue.

Can a PSA tool handle non-billable hours for internal projects?

Yes, a comprehensive PSA platform like Birdview PSA allows teams to track both billable and non-billable hours. This is crucial for getting a complete picture of resource utilization and project costs. Tracking non-billable time spent on internal projects, training, or sales activities helps in capacity planning and understanding the true cost of running your business.

How does a PSA platform integrate with accounting software?

Most modern PSA platforms, including Birdview PSA, offer integrations with popular accounting systems like QuickBooks, Xero, and NetSuite. This integration allows approved invoices generated in the PSA to be automatically synced to your accounting software, eliminating manual data entry and ensuring financial records are always up-to-date.

Gain control and confidence in your billing process

Manual invoicing and rigid billing structures are holding your services firm back. They create administrative drag, cause revenue leakage, and introduce unnecessary friction into your client relationships. By leveraging a unified PSA platform, you can adopt flexible billing models that fit your projects and automate invoicing to drive efficiency, accuracy, and profitability.

Birdview PSA provides the end-to-end visibility and control you need to master your quote-to-cash cycle. By unifying your projects, resources, and financials in one place, you can eliminate guesswork and make confident, data-driven decisions that fuel sustainable growth.

Ready to streamline your invoicing and protect your profits?