In professional services, it’s easy to focus heavily on labor costs – the hours your team spends on projects. But what about everything else? Travel, software licenses, materials, third-party vendors, printing, meals… these project-related expenses can quietly add up, impacting profitability and pushing projects over budget if they aren’t tracked and managed effectively.

You understand the need to capture these costs, but manually collecting receipts, categorizing expenses, linking them to specific projects, and reconciling them for billing or financial reporting is often a disconnected, time-consuming process. This lack of streamlined expense tracking creates blind spots in your project financials and makes it hard to see the true cost of delivery.

What if you had a system that makes capturing, categorizing, and managing project expenses effortless, automatically linking them to the right project and financial reports? This is the essential value of Professional Services Automation (PSA) software for expense tracking.

According to a post in TBRC Report “PSA software market will reach $22.14 billion by 2029, driven by the need to centralize billing, time tracking, and expense management.”

This article will dive into the importance of accurate expense tracking for professional services, highlight common types of project expenses, and show you how PSA software, specifically Birdview PSA, simplifies the process, improves budget management, and provides critical financial visibility.

In this article

Why accurate expense tracking matters in professional services

Labor might be your biggest cost–but it‘s not the only one. Travel, software, materials, and vendor fees all add up fast. If you‘re not tracking them properly, it‘s hard to know what a project really costs–or if it‘s even profitable.

Missing or mislabeling expenses means lost revenue, especially when clients should be paying for those costs. And without up-to-date expense data, budgets go off track before you even realize it.

You also need accurate records for reporting, taxes, audits, and spotting spending patterns. If your expense process is still based on spreadsheets, emails, or paper receipts, you‘re wasting time and opening the door to errors.

The fix? A system that captures all expenses in one place, links them to projects automatically, and keeps your finances clear and under control.

Types of expenses you should track in professional services projects

Professional services projects can incur a variety of expenses beyond labor. Recognizing and categorizing these is the first step to effective expense tracking:

- Travel Expenses: Flights, accommodation, meals, transportation, parking, and mileage incurred while traveling for project work or client meetings.

- Software & Licensing Costs: Costs for software licenses, subscriptions, or specific tools required for a project (e.g., specialized design software, temporary access to a platform).

- Materials & Supplies: Physical materials or supplies directly used for a project’s deliverables (e.g., printing costs, specific hardware components, presentation materials).

- Third-Party Vendor/Subcontractor Costs: Payments to external consultants, freelancers, or vendors for specialized services required for the project.

- Training Costs: Specific training or certifications required for team members to complete project tasks.

- Data & Research Costs: Costs for purchasing market research reports, data access, or other information needed for the project.

- Communication Costs: Specific project-related communication expenses beyond standard overhead (e.g., dedicated conference lines, client presentation platforms).

Effectively capturing and categorizing these expenses is key to accurate project costing.

Key benefits of implementing expense tracking

When you start tracking expenses properly, the benefits show up fast–especially in a service business where every dollar counts.

1. First, you get a clear picture of what your projects are really costing. It‘s not just about salaries or hourly rates. Travel, tools, outside help, and even small purchases can eat into your margins if they‘re not accounted for. By tracking everything, you can see where money is going and make better decisions about pricing, staffing, and project scope.

2. It also helps you bill clients more accurately. When expenses are logged in real time and linked to the right project, there‘s no guesswork. You can include all billable costs on the invoice with full confidence, which reduces back-and-forth with clients and helps you get paid faster.

3. From a budgeting perspective, expense tracking gives you control. You can compare what you‘ve spent so far with what you planned. If spending is going off track, you‘ll see it early–before it becomes a problem.

4. It‘s also a big help for reporting. With all your data in one place, you can run reports on how much you‘ve spent, what types of expenses are most common, and which projects are eating up the budget. That insight helps you spot patterns and improve your financial planning over time.

5. Finally, there‘s peace of mind. If you‘re ever audited or need to justify project costs internally, everything is organized, documented, and easy to pull up. No more chasing receipts or trying to remember who bought what.

In short, implementing proper expense tracking makes your projects more profitable, your billing more accurate, and your team more efficient–all while giving you better control over your bottom line.

Effective strategies to improve expense tracking

![]()

Implementing PSA software is a great step, but adopting smart strategies maximizes the effectiveness of expense tracking:

- Set Clear Expense Policies: Define what types of expenses are reimbursable and which are billable to clients. Communicate these policies clearly to your team.

- Require Timely Submission: Encourage team members to submit expenses promptly (e.g., daily or weekly) to avoid delays in billing and cost tracking.

- Utilize Mobile Capture: Encourage the use of mobile apps to capture expense details and receipts immediately, rather than saving them up.

- Streamline Approval: Implement digital approval workflows in your PSA software to expedite the review and approval process for expenses.

- Regularly Review Expense Reports: Analyze project expenses regularly to identify trends, potential cost savings, or areas where policies need to be adjusted.

- Integrate with Time Tracking: Ensure your expense tracking is linked to your time tracking process within your PSA software for a consolidated view of project costs (labor + expenses).

- Educate Your Team: Provide training on how to use the expense tracking features in your PSA software and why accurate and timely submission is important for both them and the firm.

Effective expense tracking is vital for accurate project costing, profitable billing, and sound financial management in professional services. Manually managing expenses is inefficient and prone to errors.

Real-world examples of PSA expense tracking in professional services

Expense tracking in PSA software isn‘t just about receipts–it‘s about getting full financial visibility across all types of projects. Here‘s how different professional services companies benefit from it in day-to-day scenarios:

A consulting firm sends a team member to a client meeting out of town. They log their travel meal right from their phone–snapping the receipt, tagging the expense as billable, and linking it to the client project. It‘s automatically sent to their manager for approval.

An engineering firm hires an external contractor for a specific task. The vendor‘s invoice is recorded as a project expense, connected to the relevant project phase, and marked as non-billable. The cost is still tracked internally to keep the project‘s total budget on point.

An IT services provider buys a hardware component for a client system upgrade. The technician enters the cost into the PSA system, tags it as billable, and associates it with the upgrade project–so it shows up correctly on the client invoice without extra effort.

These examples show how PSA software helps teams stay organized, reduces manual steps, and ensures no expenses slip through the cracks–whether they‘re client-facing or internal.

You may also like:

8 Major Challenges Faced by Professional Services Industry 2025

Professional Services Automation Software: A Practical Guide

Expense tracking in PSA Software: 8 key features

Professional Services Automation (PSA) software integrates expense tracking directly into its platform, linking it to projects, resources, and financials. This streamlines the entire process, making it easier to capture, categorize, approve, and report on project expenses.

Here’s how PSA software, and specifically Birdview PSA, simplifies expense tracking:

1. Centralized expense capture

One of the biggest advantages of using PSA software is having a single, centralized place where all project-related expenses are submitted. Instead of chasing down receipts or digging through emails, team members can log their expenses directly in the system–right when they happen.

Everything is instantly linked to the correct project or task, so nothing slips through the cracks. Whether they’re at their desk or out in the field, the process is simple and fast–especially when using the mobile app.

To make the most of this, ensure your team knows how to enter expenses on the go, so accurate data comes in without delays.

2. Expense categorization

Effective expense tracking isn‘t just about collecting receipts–it‘s about organizing them in a way that makes sense. PSA software lets you create custom categories that reflect the types of expenses your business actually deals with, like travel, software licenses, or third-party services.

When team members submit an expense, they simply choose the right category, which keeps everything neatly organized and easy to report on. This structure helps you analyze spending trends, control budgets, and ensure every cost is correctly classified from the start.

3. Linking expenses to projects and tasks

To get a true picture of project costs, every expense needs to be connected to the right place. PSA software makes this easy by ensuring that each expense is linked directly to the project it was incurred for.

Some platforms go even further, allowing you to assign expenses to specific tasks within a project, giving you granular visibility into where your money is going. This level of detail helps project managers make smarter decisions and spot budget issues early.

To get the full benefit, train your team to always associate expenses with the correct project and task as soon as they enter them–accuracy starts at the point of submission.

4. Managing billable vs. non-billable expenses

Not every project expense is created equal–some costs are passed on to the client, while others stay on your books. PSA software helps by letting you mark each expense as billable or non-billable at the time of entry.

This ensures that billable expenses make it onto the client‘s invoice–no more missed reimbursements. At the same time, non-billable costs are still tracked as part of the total project spend, giving you a complete view of profitability.

To keep things running smoothly, define clear rules for which expenses are billable, and make sure your team understands and applies them consistently. Accurate tagging at the start means fewer billing issues later.

Not every project expense is created equal–some costs are passed on to the client, while others stay on your books. PSA software helps by letting you mark each expense as billable or non-billable at the time of entry.

This ensures that billable expenses make it onto the client‘s invoice–no more missed reimbursements. At the same time, non-billable costs are still tracked as part of the total project spend, giving you a complete view of profitability. Combined with tracking billable and non-billable hours, this gives you a fuller picture of true project costs and margins.

To keep things running smoothly, define clear rules for which expenses are billable, and make sure your team understands and applies them consistently. Accurate tagging at the start means fewer billing issues later.

5. Expense approval workflows

Approving expenses manually–via email chains or spreadsheets–can slow everything down and lead to errors. PSA software solves this by providing automated approval workflows that route each submitted expense to the right person for review.

You can set rules and thresholds, such as requiring manager approval for expenses over a certain amount, to maintain control without creating bottlenecks. This not only speeds up the process but also ensures that only verified expenses make it into financial reports and client invoices.

Useful Tip: Configure approval thresholds in Birdview PSA (e.g., expenses over $X require manager approval) for efficient processing.

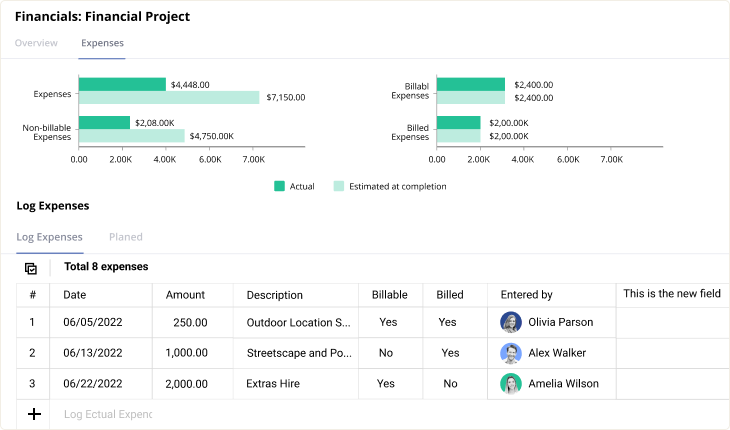

6. Real-time expense tracking vs. budget

One of the most valuable features of PSA software is the ability to track actual expenses in real time against your project budget. You don‘t need to wait until the end of the month to find out if you’re over budget–everything is updated as expenses come in.

Dashboards and alerts let you monitor spending as it happens, so you can spot issues early and take corrective action before they affect profitability.

Example: If travel expenses for a project are exceeding the estimated budget for that category, Birdview PSA will highlight this deviation, prompting investigation.

7. Integrated reporting and analytics

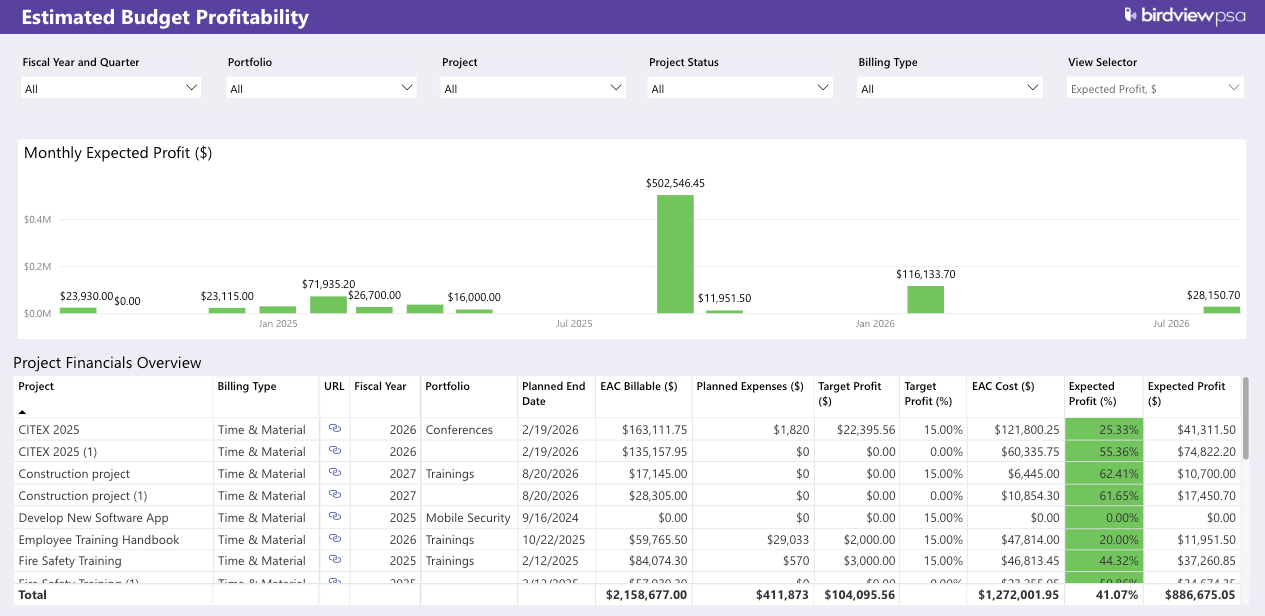

PSA software brings all your expense data together and turns it into clear, actionable reports. You can break down expenses by category, project, resource, or time period to understand exactly where money is going.

This insight helps you spot trends, control spending, and identify areas for optimization across your portfolio.

Useful Tip: Generate reports in Birdview PSA showing project expenses vs. profitability to understand the financial impact of different expense types.

8. Seamless integration with billing and financials

With PSA software, there‘s no need to re-enter data into different systems. Approved expenses flow directly into your billing and financial reporting, ensuring accuracy and saving time.

Billable costs are automatically added to client invoices, while all expenses–billable or not–are included in project cost calculations and real-time financial dashboards.

The result? No missed charges, fewer billing errors, and a complete picture of project profitability–all in one place.

Birdview PSA Advantage: Approved billable expenses in Birdview PSA can be automatically included in client invoices. Expense data also flows into project cost calculations and financial reports, providing a consolidated view of project financials.

“Birdview helped the C-P Systems team to manage project budgets proactively rather than reactively, resulting in a significant improvement in resource management and tracking project spending.

With Birdview PSA, C-P Systems can monitor project expenses in real-time and take action when needed to ensure that the project stays on budget.” – Jeff Baltz, Vice President at C-P SYSTEMS

Professional Services Automation (PSA) software, like Birdview PSA, provides the integrated solution needed to simplify expense tracking. By centralizing capture, automating approvals, linking expenses to projects and financials, and providing detailed reporting, Birdview PSA empowers you to uncover project costs, improve profitability, and gain critical financial oversight.

Discover how Birdview PSA can transform your financial management

- Project Cost Estimation Guide: Methods and Examples

- Boost Project Profitability with PSA: Examples & Tips

- Project Cost Management: Definition and Best Practices

- How to Improve Budget Planning in Professional Services

Frequently Asked Questions

Why is accurate expense tracking important for professional services?

Accurate expense tracking is important for professional services because it allows for true project cost calculation, accurate client billing (for billable expenses), effective budget management, comprehensive financial reporting, profitability analysis, and compliance with regulations.

What are the common types of project expenses in professional services?

Common project expenses include travel expenses, software/licensing costs, materials/supplies, third-party vendor/subcontractor costs, training costs, data/research costs, and communication costs.

How does PSA software simplify expense tracking?

PSA software streamlines expense tracking by providing a centralized platform for capturing, categorizing, linking expenses to specific projects or tasks, marking expenses as billable or non-billable, automating approval workflows, and integrating with billing and financial systems.

Can PSA software help track billable and non-billable expenses?

Yes, PSA software allows users to mark expenses as either billable (to be charged to the client) or non-billable (part of the project’s internal cost) during submission, which is crucial for accurate billing and profitability tracking.

Does PSA software support expense approval workflows?

Yes, most PSA software includes features for automating expense approval workflows. Submitted expenses are routed digitally to the appropriate manager for review and approval before they are included in project costs or client invoices.

How does expense tracking in PSA software help with budget management?

Expense tracking in PSA software helps with budget management by capturing actual expenses in real-time and automatically tracking them against the project’s planned expense budget. This provides visibility into spending and highlights variances, allowing for proactive management.

Can project expenses be linked to specific tasks within a project in PSA software?

Yes, many PSA software solutions allow expenses to be linked not just to the overall project, but also to specific tasks within that project for more granular cost tracking and analysis.

How does PSA software integrate expense tracking with billing?

PSA software integrates expense tracking with billing by automatically pulling approved billable expenses into client invoices. This streamlines the billing process and ensures all billable costs are captured and included in the invoice.

What types of reports can be generated from expense tracking data in PSA software?

Expense tracking data in PSA software can be used to generate reports on project expenses by category, resource, or time. These reports can show billable vs. non-billable expenses, total project costs, and contribute to profitability analysis.

Why is using a mobile app for expense capture useful for professional services?

Using a mobile app for expense capture is useful because it allows team members to quickly capture expense details and receipts immediately as they are incurred (e.g., during travel or at a client site), rather than having to remember and submit them later.