For professional services firms, cash flow isn’t just an accounting term; it’s the lifeblood of the business. It’s the rhythm of revenue coming in and expenses going out. A healthy cash flow allows you to invest in your team, take on new opportunities, and navigate economic uncertainties with confidence. But when your Quote-to-Cash process is slow, it puts a strain on everything–from operations to cash flow.

The Quote-to-Cash cycle is the end-to-end process that spans from the moment you generate a quote or proposal for a client to the moment you receive final payment for the services rendered. In professional services, this cycle often involves complex steps: estimating, proposal generation, project planning, resource allocation, time tracking, service delivery, billing, invoicing, and collections.

Manually managing these stages, especially across disconnected systems, creates bottlenecks. Estimates are slow to generate, proposals take too long to approve, time tracking is inaccurate, billing is delayed, and invoices get stuck in approval loops. This directly impacts your cash flow, delaying revenue and creating financial stress.

What if you could streamline and accelerate every stage of your Quote-to-Cash cycle? What if your systems worked together to automate handoffs, improve accuracy, and get invoices out (and paid) faster? This is the power of Professional Services Automation (PSA) software.

This article will break down the Quote-to-Cash cycle, highlight the pain points that slow it down, and show you how PSA software, like Birdview PSA, acts as a powerful engine to accelerate your revenue and improve cash flow.

What is the quote-to-cash process in professional services?

The Quote-to-Cash process is a critical business function for professional services firms. It’s the journey your services take from potential opportunity to recognized revenue. While the exact steps may vary, the core stages include:

- Quote/Estimate Generation: Creating a proposal or estimate for potential services.

- Proposal/Contract Approval: Getting the client to agree and sign off on the terms.

- Project Planning & Resource Allocation: Breaking down the work, setting timelines, and assigning resources to the project.

- Service Delivery & Time Tracking: Performing the work and accurately tracking the time and expenses incurred.

- Billing & Invoicing: Calculating the amount owed based on the contract and generated time/expenses, and creating the invoice.

- Invoice Approval (Internal & External): Getting internal finance/management approval and the client’s final approval on the invoice.

- Payment Collection: Receiving payment from the client.

- Revenue Recognition: Recognizing the revenue in your financial system.

The speed at which you can move through these stages directly impacts your cash flow. The longer the cycle, the longer it takes to get paid.

Common bottlenecks in the quote-to-cash cycle

Each stage of the revenue workflow presents potential bottlenecks, especially when managed manually or with disconnected systems:

- Slow Estimate/Proposal Generation: Manually pulling data, calculating costs, and formatting proposals takes time, delaying the start of the cycle.

- Disconnected Sales-to-Delivery Handoff: Information loss or delays between the sales team (who won the deal) and the delivery team (who does the work) can slow down project planning and resource allocation.

- Inaccurate Time & Expense Tracking: Manual time entry is prone to errors, leading to delays in billing or missed billable hours (lost revenue).

- Manual Billing & Invoice Creation: Calculating invoice amounts from timesheets and expense reports manually is time-consuming and increases the risk of errors.

- Delayed Invoice Approvals: Internal or external approval processes that rely on emails or manual sign-offs can hold up invoices from being sent out.

- Lack of Visibility into Billing Status: Not having a clear view of which invoices are outstanding or in which stage of the approval process they sit delays follow-up and payment collection.

- Siloed Systems: Using separate tools for CRM, project management, time tracking, and accounting creates data silos that slow down handoffs and reporting across the cycle.

These bottlenecks accumulate, stretching out your billing and payment workflow and negatively impacting your cash flow.

Ready to tackle these bottlenecks?

See how Birdview PSA handles them all in one platform

How PSA software speeds up the quote-to-cash cycle

Professional Services Automation (PSA) software is designed to streamline the entire Quote-to-Cash cycle by integrating these key stages into one platform. It automates handoffs, improves accuracy, and provides visibility, directly impacting your cash flow velocity.

Here’s how PSA software, and specifically Birdview PSA, helps you streamline your revenue lifecycle:

1. Accelerated Estimate & Proposal Generation:

- How PSA helps: PSA software helps you quickly generate accurate estimates and proposals by pulling data from templates, predefined rates (using Rate Cards), and historical project data.

- Birdview PSA Advantage: Birdview PSA automates proposal generation by leveraging project templates and predefined rates, ensuring consistency and speeding up this initial stage.

- Useful Tip 💡: Create standardized templates in Birdview PSA for common service packages or project types to drastically reduce estimate generation time.

📚 You may also like: Streamline Client Invoicing with Rate Cards

2. Seamless Sales-to-Delivery Handoff:

- How PSA helps: PSA software connects sales opportunities (often via CRM integration) directly to project creation. This ensures a smooth transition of information from the sales team to the delivery team.

- Birdview PSA Advantage: Birdview PSA offers seamless integration with popular CRMs (like Salesforce and HubSpot). When a deal is closed, it can automatically trigger project creation in Birdview PSA, pulling relevant details and assigning initial resources.

- Useful Tip 💡: Define clear criteria in Birdview PSA for when a project is automatically created from a CRM opportunity to ensure information is captured accurately at the right time.

3. Accurate and Real-Time Time & Expense Tracking:

- How PSA helps: PSA software provides intuitive tools for tracking billable hours and project expenses in real-time, eliminating manual spreadsheets and reducing errors.

- Birdview PSA Advantage: Birdview PSA offers flexible time tracking options (timer, manual entry, weekly timesheets). Team members can log time directly against tasks and projects, and expenses can be easily recorded and categorized. This accurate, real-time data is essential for billing.

- Useful Tip 💡: Encourage your team to log time and expenses daily in Birdview PSA to maintain the highest level of accuracy.

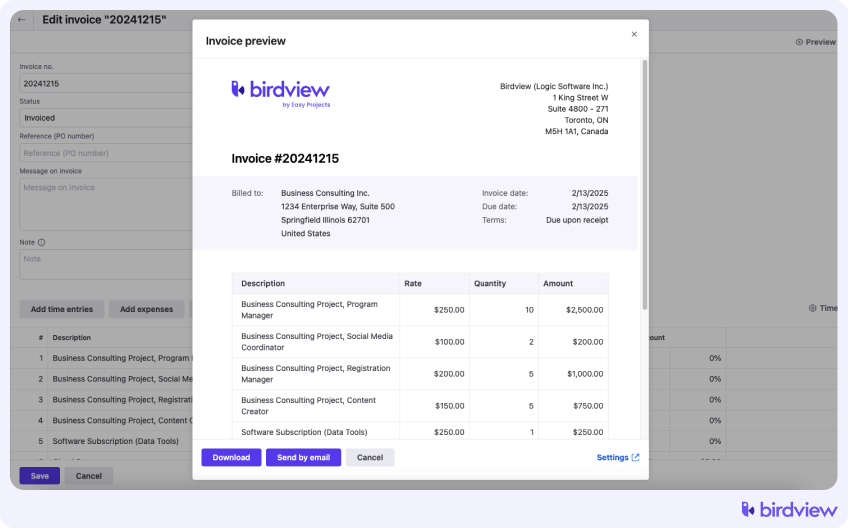

4. Automated Billing & Invoice Creation:

- How PSA helps: PSA software automates the calculation of invoice amounts based on recorded time, expenses, and applied rates (Rate Cards). It simplifies generating invoices for various billing models.

- Birdview PSA Advantage: Birdview PSA streamlines billing and invoicing. You can generate detailed, accurate invoices directly from your project data within the system. Rate Cards are automatically applied to ensure correct pricing.

- Useful Tip 💡: Configure different billing rules and Rate Cards in Birdview PSA for different clients or project types to automate calculations for complex scenarios.

5. Streamlined Invoice Approval Workflows:

- How PSA helps: PSA software facilitates digital approval workflows for invoices, allowing finance or management to review and approve invoices quickly within the system.

- Birdview PSA Advantage: Birdview PSA includes automated approval workflows for invoices. Configure who needs to approve an invoice (internally) and allow clients to review and approve directly via the client portal. This digital process reduces delays compared to manual sign-offs.

- Useful Tip 💡: Utilize Birdview PSA’s notifications to alert approvers when an invoice is ready for review to speed up the process.

6. Improved Billing Status Visibility:

- How PSA helps: PSA software provides a centralized view of all invoices, their status (draft, sent, approved, paid, overdue), and payment tracking.

- Birdview PSA Advantage: Birdview PSA offers dashboards and reports that provide clear visibility into your invoice pipeline. Track outstanding invoices, monitor payment aging, and see payment history all within the platform.

- Useful Tip 💡: Configure automated reminders in Birdview PSA for upcoming or overdue invoice payments.

7. Integration with Accounting Systems:

- How PSA helps: PSA software integrates with accounting software (like QuickBooks, NetSuite) to ensure seamless data transfer of invoices and payments, reducing manual entry and reconciliation.

- Birdview PSA Advantage: Birdview PSA provides robust integrations with popular accounting platforms. This allows for efficient transfer of invoice data, streamlining the accounts receivable process and improving financial reporting. Birdview PSA’s QuickBooks integration is a prime example.

Get paid faster: the cash flow impact of PSA software

Speeding up your Quote-to-Cash cycle directly impacts your cash flow velocity. When you reduce the time it takes to move from winning a deal to receiving payment, you improve your firm’s financial health.

With Birdview PSA, you can:

- Reduce Days Sales Outstanding (DSO): By automating billing and speeding up invoice approvals, you get invoices out faster, leading to quicker payments.

- Improve Working Capital: Faster cash inflow provides more capital available for operations, investment, and growth.

- Increase Predictability: Streamlined processes make revenue collection more predictable, aiding in financial planning and budgeting.

- Reduce Administrative Costs: Save time and resources previously spent on manual billing and follow-up.

Final thoughts: why PSA software is essential for cash flow

A slow Quote-to-Cash cycle is a major drain on cash flow for professional services firms. Manual processes, disconnected systems, and bottlenecks at various stages delay revenue and create financial stress.

Professional Services Automation (PSA) software, like Birdview PSA, offers a powerful solution to accelerate your Quote-to-Cash cycle. By integrating and automating key stages – from estimate generation and project planning to time tracking, billing, invoicing, and payment tracking – Birdview PSA eliminates bottlenecks, improves accuracy, and speeds up the entire process.

Equip your team with the tools they need to manage the Quote-to-Cash cycle efficiently, improve cash flow, and drive sustainable growth.

Ready to accelerate your Quote-to-Cash process?

Discover how Birdview PSA can transform your financial operations.

or

📚 You may also like:

Project revenue and project-based billing methods

Best professional services billing solutions – Top picks for 2025

10 best billing software for consultants in 2025

How PSA improves financial management and financial forecasting

![❓]() Frequently Asked Questions

Frequently Asked Questions

What is the Quote-to-Cash cycle?

The Quote-to-Cash cycle is the complete process from generating a proposal for a client to receiving final payment for the services delivered. It includes steps like quoting, proposal approval, project planning, service delivery, time tracking, billing, invoicing, and payment collection.

How can PSA software improve cash flow?

PSA software improves cash flow by accelerating the Quote-to-Cash cycle. It automates tasks like estimate generation, time tracking, billing, and invoicing, reducing manual effort and errors. This leads to faster invoice generation, quicker approvals, and ultimately, receiving payments sooner.

What are common bottlenecks in the Quote-to-Cash cycle?

Common bottlenecks include slow estimate/proposal generation, disconnected sales-to-delivery handoffs, inaccurate manual time and expense tracking, manual billing and invoice creation, delayed invoice approvals (internal and external), lack of visibility into billing status, and using siloed systems for different stages.

How does automation speed up the Quote-to-Cash process?

Automation speeds up the Quote-to-Cash process by eliminating manual tasks, reducing errors, and streamlining handoffs between stages. Automated actions like project creation from CRM deals, automatic calculation of invoice amounts, and digital approval workflows significantly reduce the time needed to move through the cycle.

Can PSA software integrate with CRM and accounting systems?

Yes, most modern PSA software is designed to integrate seamlessly with popular CRM systems (like Salesforce, HubSpot) and accounting software (like QuickBooks, NetSuite). These integrations ensure data consistency and automate the flow of information across the Quote-to-Cash cycle.

How to reduce Days Sales Outstanding (DSO)?

Reduce Days Sales Outstanding (DSO) by accelerating the Quote-to-Cash cycle. This involves speeding up estimate/proposal generation, improving sales-to-delivery handoffs, ensuring accurate and timely time tracking and billing, automating invoice approvals, and proactively following up on outstanding invoices.

What role does accurate time tracking play in cash flow?

Accurate time tracking is crucial for cash flow in professional services. It ensures that all billable hours are captured and included in invoices, preventing lost revenue. It also provides the data needed for accurate billing, which reduces disputes and speeds up the invoicing process.

How can PSA software help with invoice approvals?

PSA software streamlines invoice approvals by facilitating digital approval workflows. It allows invoices to be routed automatically to the necessary reviewers (internal managers, finance) and provides clients with a dedicated portal to review and approve invoices online, reducing delays associated with manual processes.

What features in PSA software support the Quote-to-Cash cycle?

Features in PSA software supporting the Quote-to-Cash cycle include estimate/proposal generation, CRM integration, project planning, resource allocation, time and expense tracking, billing rules and rate cards, automated invoicing, approval workflows, payment tracking, and accounting system integrations.

How to streamline the billing process for professional services?

Streamline the billing process by using PSA software to automate time tracking, expense tracking, and invoice creation. Implement digital approval workflows for invoices, use customizable templates, integrate with accounting systems, and provide clients with clear, transparent invoices.

Try Birdview‘s billing automation in action

or

Frequently Asked Questions

Frequently Asked Questions