While almost every project has a cost and budget, Project Billing only comes to life when you have a paying Customer. So what is project revenue? At Birdview PSA, we use the following definition: Project Revenue (Billing) is the total amount of money a Customer pays for a project.

Similar to Cost, Revenue can be represented as multiple financial metrics, such as:

- Target Revenue

The expected total amount of money your Customer will pay for this project. If your project Billing Type is Flat (Fixed) Fee, your Target Revenue is equal to Project Fixed Fee. Otherwise, if your project Billing Type is Time & Material, you should set your Target Revenue at the amount you plan to collect from the Customer and still make a profit (more on it later). - Actual Billing

The amount of money matching the work you are ready to bill your customer for. Actual Billing is the sum of all Actual Time spent on the project multiplied by the Billing Rates plus all Actual Billable Expenses and Flat Fees of all completed activities. Ideally, in the end, Actual Billing should equal or be greater than Target Revenue. - Estimate at Completion (EAC) Project Billing (Revenue)

Summary of the Actual Billing and all remaining Labor Billing, remaining Planned Billable Expenses plus Flat Fees of all unfinished activities. Ideally, the difference (Revenue Variance) between Target Revenue and EAC Project Revenue should equal or be greater than zero.

What is project profit?

This one is easy. At Birdview PSA, we use the following description:

Naturally, you want to collect more money from the Customer than it costs to complete your project.

Below are the different types of Profit metrics throughout the project lifecycle:

- Target Project Profit

The expected delta between Project Revenue and Project Cost at the end of the project. This target can be tracked as an absolute number in your project‘s currency or as a percentage, often referred to as Profit Margin. - Actual Project Profit

The real-time difference at any given moment between Actual Project Revenue and Actual Project Cost. - Estimate at Completion (EAC) Project Profit

The real-time difference between EAC Project Revenue and EAC Project Cost.

Project billing types

If you are charging Customers for your services, essentially there are two types of agreement on how you will charge them:

- Flat Fee – no matter how much time you spend on the project and what kind of expenses you have, you agree with a customer on a fixed amount that you will charge. For example, a client is charged $50K for a project. Clients are not charged for time or expenses. Instead, these are tracked for internal cost calculations and references.

- Time and Material – with this approach, the customer agrees to pay for the actual billable hours spent and cover certain billable expenses or fixed costs.

In the case of Time and Material billing, there are multiple ways to charge for your team and contractors‘ time spent on the project.

Resource Hourly Rate – the billing amount will be calculated based on the Hourly Billing rate specified for each employee, regardless of what project they are working on.

Project Hourly Rate – the billing amount will be calculated based on the Hourly Billing rate specified for the entire project, regardless of who is doing the work.

Customer Hourly Rate – all projects done for this Customer will be billed based on one specific rate, regardless of who is doing the work.

Activity Hours Rate – billing will be based on the rate’s set for the project‘s individual activities (tasks), regardless of who is doing the work. With this option, it is possible to use a combination of hourly and fixed-cost tasks.

Rate Cards – this is the most flexible option, suitable for complex billing situations. With rate cards, different people might have different rates in various projects, depending on their role.For example, Linda can be a designer with a billing rate of $150/hr in Project A and can act as a Senior Design Lead in Project B with a billing rate of $200/hr.

If you want to maximize your billable hours and bill your clients for the time your team spent on each task, your organization requires a time-tracking solution. It allows tracking your team’s billable hours accurately and automatically, as well as analyzing the project’s total time spent in real-time. You can also manage your employees’ schedules to assign the right people for the right task to keep up with the deadlines and avoid project budget overruns.

Note that before your client chooses the most suitable billing type, you need to determine your Expected Income. Expected Income is the amount of money you need to:

- Pay bills and taxes

- Cover the costs

- Pay staff salary

- Make a profit

Payments

Once you have agreed with the customer on the billing type, you also probably want to decide on the payment schedule (when and how much the customer will pay you). Such arrangements vary by customer and project; however, it is common to have a fixed installment schedule for the Flat Fee projects.

For example, 25% of the project cost will be billed upfront, 50% when the working prototype is delivered, and another 25% when user acceptance testing is completed. Additionally, you can have some type of recurring payments (monthly or bi-weekly) for the Time & Material billing.

It is useful for a Manager to be able to track Schedule (or Planned) Payments against the Actual Payments always to know what is outstanding and when to expect the next tranche.

Advanced project billing arrangements

Advanced billing arrangements adapt to the unique needs of both the client and the service provider.

For example, in performance-based billing, the service provider earns more when they surpass predefined performance goals. This model motivates excellence and efficiency, aligning the provider’s objectives with the client’s expectations.

Milestone billing breaks the project into phases, with payments tied to the completion of specific stages. This method offers transparency, allowing clients to see progress before making payments. It’s beneficial for managing cash flow and building trust, as clients pay for visible results.

Retainers are another flexible option, especially suited for long-term relationships. They involve a set payment for a defined bundle of services over a period, offering stability for the provider and predictable costs for the client.

To make these arrangements work, both parties need to have a clear understanding of the terms. This includes detailed criteria for performance metrics, milestones, and retainer services. Open discussion and agreement on these terms are vital before commencing work, ensuring there are no surprises. Trust is the cornerstone of these arrangements, with both sides relying on the other to uphold their part of the deal. Establishing these terms clearly and concisely can lead to a more satisfying and productive partnership.

Client communication and agreements

Effective communication with clients regarding billing sets the stage for a successful project from the beginning. It’s crucial to establish mutual agreement on project billing practices as the project kicks off. This involves a detailed conversation about the terms of billing, including rates, schedules, and payment methods, ensuring clarity and transparency. Commit these details to a written agreement using language that is easy to understand, reducing the risk of confusion or disputes later on.

Should there be any adjustments needed as the project progresses, promptly inform your client and seek their agreement to the changes. Documenting these updates is vital for maintaining an accurate record of the agreed terms. Approach any disagreements with patience and a focus on finding a resolution that satisfies both parties, preserving the integrity of the client relationship.

By making sure that both you and your client have a shared understanding of the billing arrangements, you lay a strong foundation for a project that runs smoothly and efficiently, with fewer surprises or conflicts about payments. This proactive approach to client communication and agreements not only fosters trust but also contributes to building lasting partnerships with your clients.

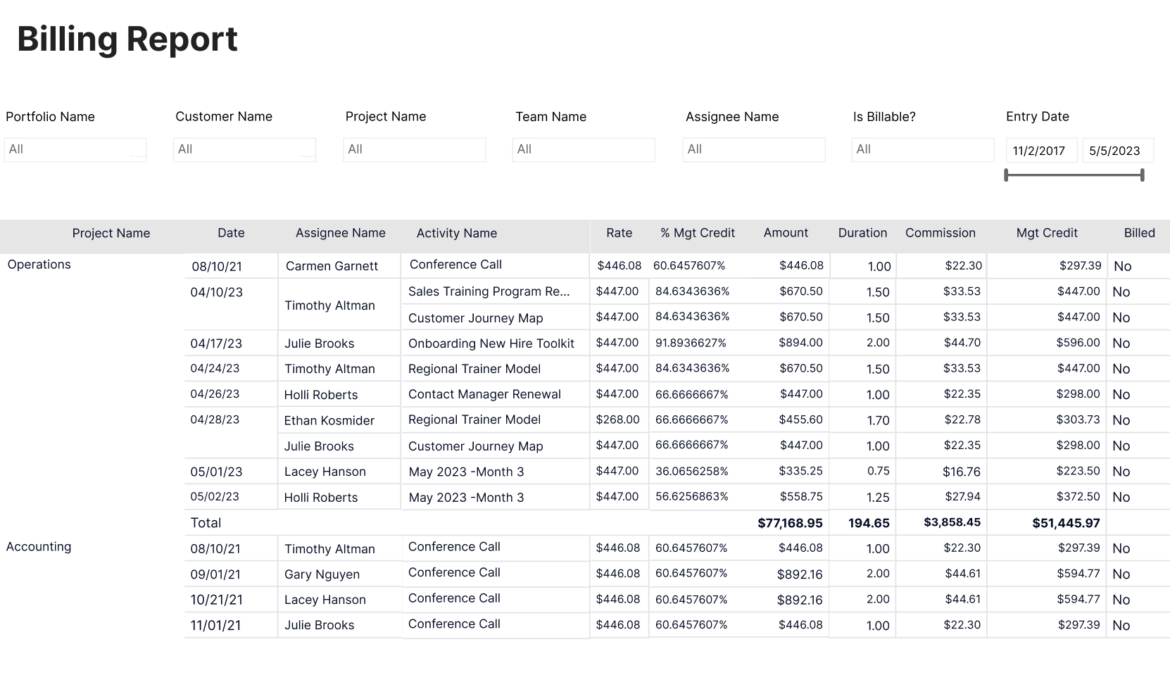

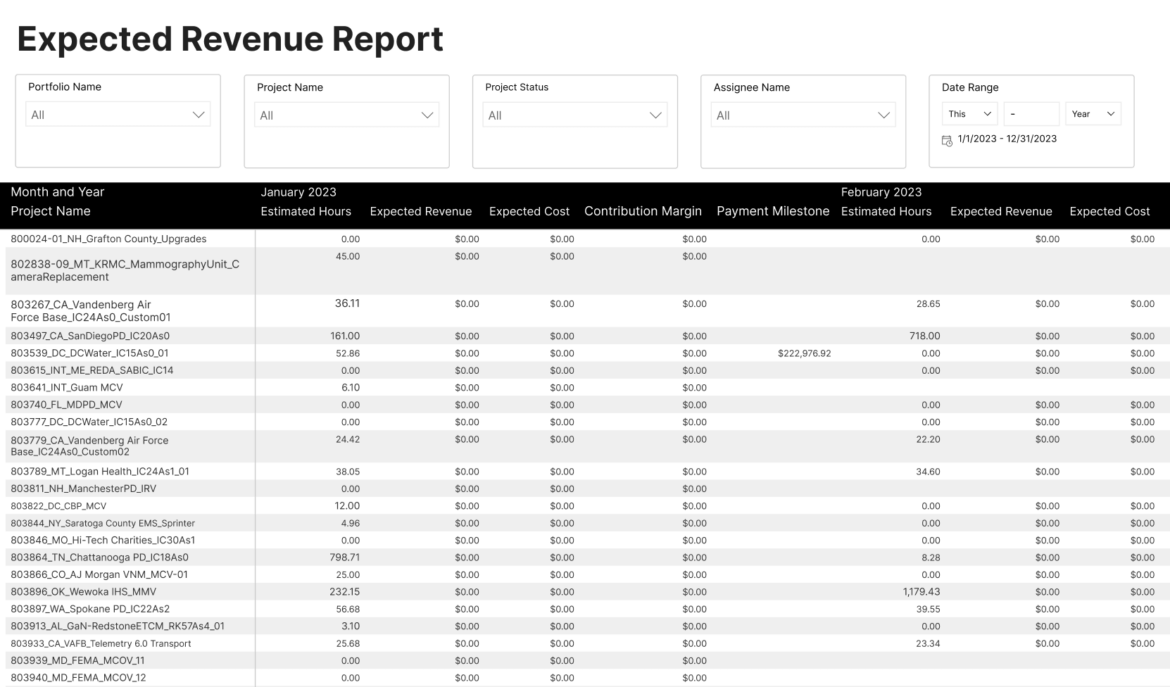

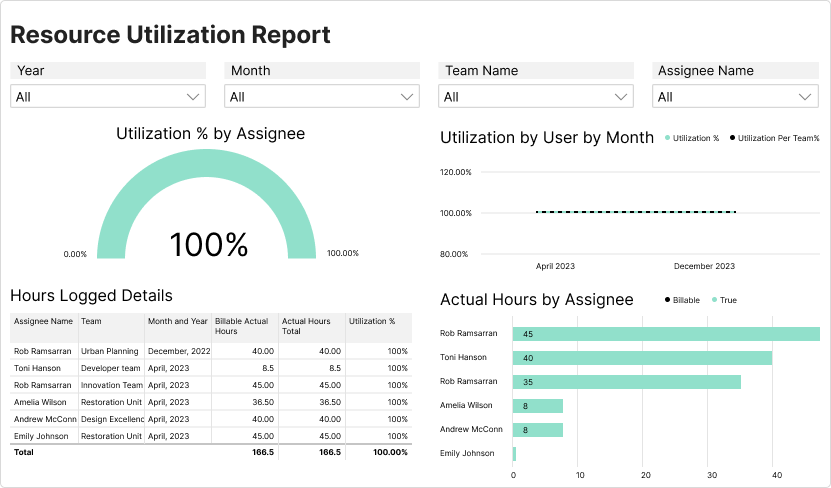

Billing reporting and analytics

Reporting and analytics significantly enhance project billing management. These tools allow you to monitor outstanding invoices, analyze client payment patterns, and project future cash flows. Insights gleaned from these reports are pivotal for assessing the financial health of your projects and making strategic decisions. Regularly examining these reports enables you to spot trends, identify potential issues early, and inform your project management strategies with data-driven insights.

For example, consider the following types of reports that could be invaluable:

Invoice Aging Report: This report shows the age of your invoices, helping you identify which invoices are due, overdue, or paid. Tracking how long invoices have been outstanding can signal when to follow up with clients on late payments.

Cash Flow Forecast: A forecast report predicts your future cash flow based on current invoices and expected expenses. It can help you plan for periods of high expenditure or identify when you might need to tighten spending.

Project Budget vs. Actuals Report: This crucial report compares the estimated budget of your projects against the actual costs incurred. It highlights where you’re over or under budget, allowing you to adjust project plans or billing accordingly.

Client Payment Behavior Report: Analyzing how quickly clients make payments after receiving invoices can help you identify trends in payment behaviors. You may discover that certain clients consistently pay late, prompting a discussion about payment terms.

Profitability Report: This report breaks down the profitability of each project by comparing the revenue earned to the costs incurred. It helps in identifying which types of projects are most profitable for your business.

Resource Utilization Report: Though not directly related to billing, understanding how effectively your team’s time is utilized on billable vs. non-billable work can impact project pricing and staffing decisions.

Incorporating examples like these into your analytics strategy can illuminate various aspects of billing in project management. They not only aid in day-to-day operations but also support long-term planning and strategic decision-making. By leveraging detailed reports, you can ensure your projects remain financially viable while also identifying opportunities for improvement and growth.

Project billing and client retention

Good billing practices are key to maintaining positive relationships with your clients. Being clear and open about how you bill, ensuring invoices are sent promptly, and showing willingness to adapt can significantly influence client perceptions of your service. Here’s how you can enhance your billing practices for better client relationships:

Clarity and Transparency: Clearly explain your billing process to clients from the start. Break down the costs in your invoices so clients can easily understand what they are being charged for. This openness builds trust and reduces confusion or disputes.

Timely Invoicing: Send out invoices as soon as the work is completed or according to the agreed schedule. Delayed invoicing can lead to cash flow issues for you and surprises for your clients, which can be frustrating.

Flexible Payment Options: Offering various payment methods and terms can accommodate your clients’ preferences and make it easier for them to pay. Flexibility in payment schedules, when possible, can also be appreciated by clients who might need it.

Prompt Response to Queries: Be ready to answer any questions your clients might have about their invoices quickly and accurately. Prompt responses show that you value their business and are attentive to their needs.

Consistent Invoice Format: Use a consistent format for all your invoices. Consistency helps clients quickly find the information they need, making the payment process smoother for them.

Follow Up Politely: When payments are late, follow up with a polite reminder. Sometimes, invoices get overlooked, and a gentle nudge is all that’s needed. Maintaining a courteous approach preserves a positive relationship.

Feedback Loop: Ask for feedback on your billing process. Client suggestions can help you refine your practices to better meet their needs and expectations.

Implementing these practices not only enhances client satisfaction but also supports the financial health of your business. By investing in client-friendly billing practices, you’re not just ensuring prompt payments; you’re building a foundation for lasting business relationships.

Software and tools integration

Integrating project billing software with other tools enhances efficiency across your operations. When your billing system talks seamlessly with project management, accounting, and CRM platforms, it creates a unified workflow. This means information flows freely and accurately between systems, eliminating the need to manually input data more than once. As a result, you’re less likely to encounter mistakes that can arise from manual data entry, ensuring your records are always up to date and reliable.

Seek out billing solutions designed for easy integration. Many modern software options offer plug-and-play connectivity with popular project management, accounting, and CRM platforms. This compatibility ensures that your team can keep track of project timelines, budget status, and customer details without switching between different applications.

Having a centralized system saves valuable time and resources, allowing your team to focus more on delivering quality work rather than on administrative tasks.

Moreover, it gives you a 360-degree view of your business operations, from project progress and financial health to customer satisfaction, all within a single dashboard. This holistic approach to managing your business data not only simplifies administrative processes but also empowers you to make informed decisions based on comprehensive insights.