In the dynamic world of professional services, client billing isn’t a one-size-fits-all operation. You’re likely dealing with a mix of billing models – from straightforward hourly rates and fixed-fee projects to complex retainer agreements and value-based pricing. Manually navigating these varied models, ensuring accurate application of rates, and justifying costs to clients can be a significant challenge.

You understand the need for standardization (hello, Rate Cards!), but implementing these strategies effectively across diverse project types and client agreements requires more than just a simple spreadsheet. You need a sophisticated approach to manage complexity, maximize profitability, and maintain client trust.

This article will explore advanced strategies for leveraging Rate Cards in professional services, specifically tailored for varied billing models. We’ll dive into how smart application of Rate Cards can enhance your pricing, simplify complex invoicing, and improve financial oversight. We’ll also highlight how PSA software, like Birdview PSA, provides the essential tools to implement these advanced strategies, moving you beyond basic billing to truly optimized revenue management.

In this article, we will cover:

- The complexity of professional services billing models

- Rate cards: more than just hourly rates

- Advanced rate card strategies for varied billing models

- The challenge: manual rate card management is a bottleneck

- Birdview PSA: your partner in mastering advanced rate card strategies

- Implementing advanced rate card strategies with Birdview PSA

The complexity of professional services billing models

Professional services firms adopt various billing models to align with project scope, client expectations, and perceived value. While flexibility is key, managing these models manually introduces complexity:

- Hourly (Time & Materials): Billing based on hours worked and expenses incurred. Complexity arises from tracking time accurately across different team members and projects, applying varied hourly rates, and ensuring consistent time entry practices.

- Fixed Fee: Agreeing on a set price for a defined scope of work. Complexity lies in accurately estimating costs upfront, managing scope creep, and tracking internal costs relative to the fixed price to ensure profitability.

- Retainer: A fixed periodic payment (e.g., monthly) for a set amount of work or access to services. Complexity involves tracking time and services delivered against the retainer limit, managing rollovers, and billing for work exceeding the retainer.

- Value-Based: Pricing services based on the perceived value delivered to the client, rather than solely on cost or time. Complexity involves clearly defining and measuring value, communicating it to the client, and aligning pricing accordingly.

- Milestone-Based: Payments tied to the completion of specific project milestones. Complexity involves clearly defining milestones, tracking progress accurately, and triggering invoices at the right time.

Managing these models often requires applying different rates based on roles, skills, client agreements, or project types. This is where Rate Cards become fundamental.

Rate cards: more than just hourly rates

A Rate Card is a structured way to define your pricing. While often associated with simple hourly rates, Rate Cards can be far more advanced, enabling you to manage nuanced pricing rules for varied billing models.

An advanced Rate Card strategy goes beyond just a list of names and their hourly rates. It defines rules for how pricing is applied based on:

- Job Role: Different rates for a Senior Consultant vs. a Project Coordinator.

- Skill: Higher rates for specialized skills like cybersecurity analysis or complex financial modeling.

- Client: Specific negotiated rates for key clients.

- Project Type: Different rate structures for audits, implementations, strategy projects, or ongoing support.

- Billing Model: How the rate is applied within different models (e.g., hourly rate for T&M vs. internal cost rate for fixed-fee profitability tracking).

Using advanced Rate Cards is essential for managing complex billing scenarios accurately and consistently.

Advanced rate card strategies for varied billing models

Leveraging Rate Cards strategically can significantly simplify managing varied billing models and enhance profitability. Here are some advanced strategies:

1. Implementing Role-Based Rate Cards:

- Strategy: Define different rates for each distinct Job Role within your firm. Apply these rates consistently across all projects and clients.

- Value for Billing Models: Simplifies hourly billing by automatically applying the correct rate based on who logged time. For fixed-fee projects, helps accurately calculate the labor cost component to track profitability.

Example: Your firm has roles: Partner, Principal, Senior Consultant, Consultant, Analyst. Each role has a specific billable rate and internal cost rate defined in the Rate Card. When a Senior Consultant logs 8 hours on a project, the system automatically calculates $X in revenue and $Y in cost based on their role’s rates.

2. Creating Client-Specific Rate Cards:

- Strategy: Define unique Rate Cards with negotiated rates for key clients. These rates override standard rates when working on that client’s projects.

- Value for Billing Models: Supports custom client agreements for hourly or project-based work, ensuring accurate billing based on specific contract terms.

Example: Client A has a special negotiated hourly rate for all roles. The Rate Card for Client A is applied to all projects for that client, ensuring correct billing automatically.

3. Defining Project-Specific Rate Cards:

- Strategy: Apply a specific set of rates for a particular project, often used when project scope or value justifies a deviation from standard pricing.

- Value for Billing Models: Useful for unique hourly projects or when the value proposition for a fixed-fee project justifies a different internal cost rate for profitability tracking.

Example: A complex, high-profile implementation project uses a different internal cost rate for profitability calculation than standard projects, defined in the Rate Card for that specific project.

4. Managing Retainers with Rate Cards:

- Strategy: Use Rate Cards to track the cost or value of work delivered against a fixed retainer amount.

- Value for Billing Models: Helps monitor scope creep within retainers. Track billable hours using Rate Cards against the retainer limit and automatically bill for hours exceeding the limit.

Example: A client pays a fixed monthly retainer for 40 hours of support. Rate Cards define the hourly rate used to track time against that limit. If the team logs 45 hours, the system automatically identifies 5 billable hours exceeding the retainer.

The challenge: manual rate card management is a bottleneck

While these advanced strategies leveraging Rate Cards are powerful, managing them manually with spreadsheets introduces significant challenges:

- Complexity and Errors: Spreadsheets become unwieldy with multiple dimensions (role, skill, client, project). Applying the correct rate for every time entry and expense manually is highly prone to errors.

- Lack of Real-Time Calculation: Spreadsheet calculations are static. You don’t see the real-time financial impact (cost/revenue) as time is logged or expenses are incurred.

- Version Control Issues: Ensuring everyone is using the latest version of the complex Rate Card spreadsheet is difficult, leading to inconsistent billing.

- Difficulty Integrating Data: Manually pulling time entries, expenses, and project progress data from different systems into a spreadsheet for billing calculations is time-consuming and increases the risk of errors.

- Limited Reporting: Analyzing project profitability or resource cost contribution from spreadsheet data requires significant manual aggregation and analysis.

You need a system that can manage Rate Cards dynamically and automatically apply rates throughout the project lifecycle.

Birdview PSA: your partner in mastering advanced rate card strategies

Birdview PSA is designed to manage Rate Cards with the sophistication required for varied billing models in professional services. It integrates Rate Card functionality directly into its PSA software platform, automating calculations and providing real-time financial visibility across your project portfolio – all without the need for manual spreadsheets.

Here‘s how Birdview PSA helps you implement advanced Rate Card strategies:

- Dynamic Rate Card Configuration: Birdview PSA allows you to define and manage Rate Cards based on multiple dimensions (Role, Skill, Client, Project) within the system. You can set up complex pricing rules that automatically apply based on who logs time or which project they are working on.

- Automated Rate Application to Time and Expenses: As your team logs time and expenses against projects in Birdview PSA, the system automatically applies the correct rate from the relevant Rate Card. This eliminates manual lookups and calculations, ensuring accuracy and saving time.

- Real-Time Financial Metrics: Birdview PSA calculates project costs and revenue in real-time based on applied Rate Cards and time/expense entries. You can see the financial impact of work as it’s being done.

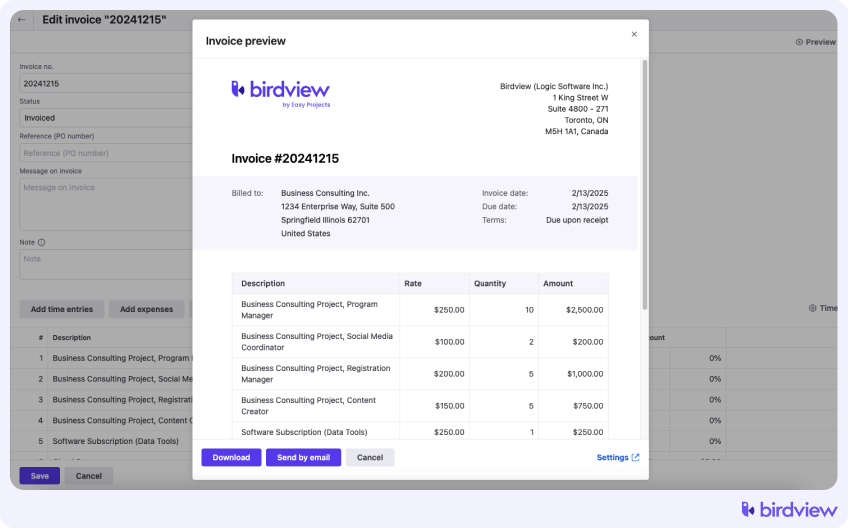

- Accurate Invoice Generation: Generate detailed, accurate invoices directly from project data, including billable time, expenses, and applied rates from Rate Cards. Customize invoice templates and ensure consistency.

- Integrated Financial Reporting: Birdview PSA provides dashboards and reports that leverage Rate Card data to show project profitability, resource costs, and revenue trends. Analyze performance across your portfolio based on accurate, system-calculated data.

- Manage Different User Types and Rates: Birdview PSA supports different user types with varying rates, all manageable with Rate Cards.

Implementing advanced rate card strategies with Birdview PSA

Ready to move beyond spreadsheet struggles and leverage Rate Cards for smarter billing in Birdview PSA?

- Define Your Rate Structures: Map out your required Rate Cards based on roles, skills, clients, or projects.

- Configure Rate Cards in Birdview PSA: Set up these Rate Cards directly within the Birdview PSA system.

- Ensure Accurate Data Entry: Train your team on accurate time and expense tracking within Birdview PSA.

- Assign Resources and Projects with Rate Cards: Link relevant Rate Cards to projects, clients, or resources in Birdview PSA.

- Monitor Financial Performance: Use Birdview PSA dashboards and reports to track project profitability and resource costs in real-time.

- Automate Invoice Generation: Generate invoices directly from Birdview PSA based on collected data and applied rates.

Managing varied billing models in professional services is complex, but advanced Rate Card strategies offer a path to simplification and increased profitability. While manual management with spreadsheets is prone to errors and inefficiency, integrating Rate Cards into a PSA software platform transforms the process.

Birdview PSA provides the comprehensive solution to manage Rate Cards dynamically, automating rate application, providing real-time financial visibility, and simplifying invoicing for varied billing models. Stop wrestling with manual processes and empower your firm with accurate, efficient billing.

Ready to master advanced Rate Card strategies and simplify client billing?

Discover how Birdview PSA can transform your financial operations.

or

📚 You may also like:

Time-and-material vs fixed-fee contracts | Profit margins

Billing Workflow: From Time and Expense Tracking to Invoicing

Project Revenue and Project-Based Billing Methods

Best professional services billing solutions – Top picks for 2025