Financial management and forecasting are at the heart of any professional services firm‘s success. Yet many companies still struggle with managing finances effectively. Juggling spreadsheets, tracking billable hours manually, or working with outdated data often leads to confusion, missed revenue opportunities, and poor financial visibility.

But what if there was a smarter way to handle financial operations? That‘s where Professional Services Automation (PSA) software comes in. PSA systems simplify and centralize financial processes, improving everything from billing and forecasting to cash flow and resource profitability.

PSA Increases Profitability: 2024 Consultancy Benchmark Report.

Finding: Firms using PSA software achieve 19% higher gross margins compared to firms that rely on spreadsheets.

In this article, we‘ll explore how PSA tools–especially Birdview PSA–can help you improve financial forecasting and gain control over your bottom line.

In this article

What is PSA software and how it helps service firms

Professional Services Automation (PSA) is a category of software designed to help service-based businesses manage core operational functions. These include project planning, time tracking, resource management, expense control, and most importantly–financial forecasting and reporting.

For consulting firms, engineering companies, IT service providers, and creative agencies, PSA software offers a centralized platform to track project costs, revenue, time utilization, and profitability in real time. Instead of scattered data and disconnected tools, PSA delivers a unified view of your financial and operational health.

👉 Related: What is professional services automation (PSA)?

Key PSA features that improve financial forecasting

Forecasting in professional services requires accurate data, proactive planning, and real-time visibility. PSA software–especially Birdview PSA–provides a powerful toolkit for improving forecast accuracy and financial performance across projects.

Below are the most impactful PSA features that help professional services firms forecast more effectively, optimize resources, and maintain profitability.

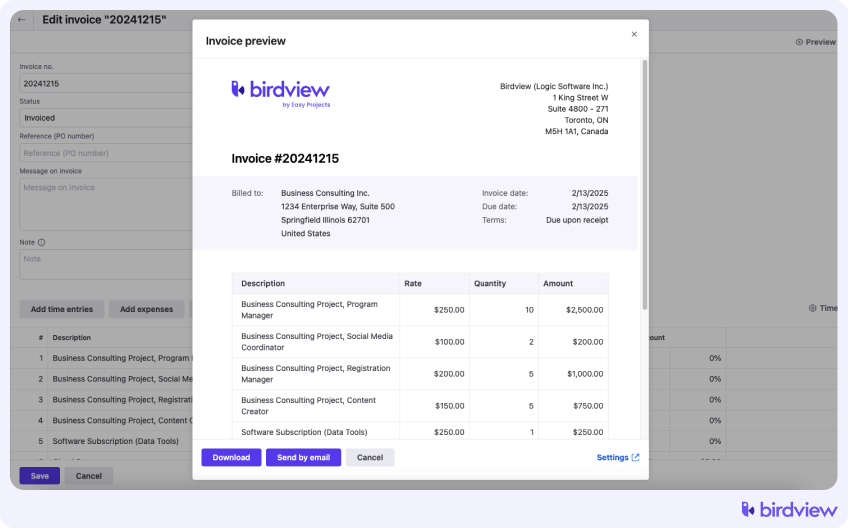

1. Automated Billing and Invoicing

Inconsistent invoicing is a common barrier to predictable cash flow. PSA software automates the entire billing cycle by linking project milestones, time logs, and rate cards to invoice generation. This ensures timely payments, reduces manual errors, and improves forecasted revenue accuracy.

Forecasting impact: Reliable invoicing data feeds directly into revenue projections and cash flow models.

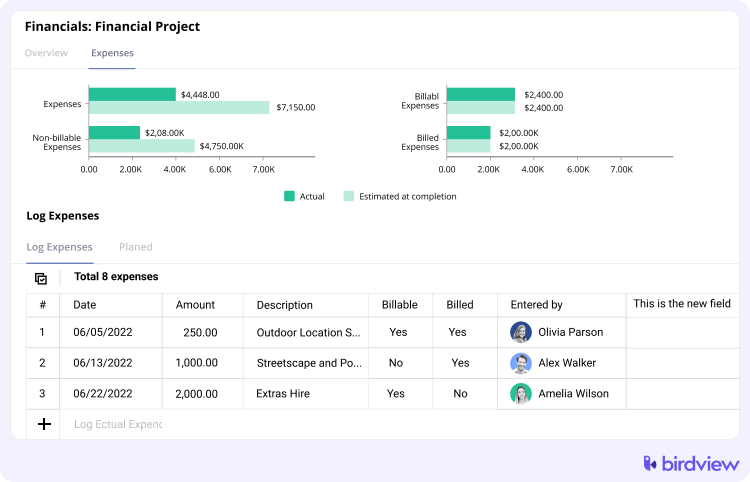

2. Real-Time Expense Tracking

Birdview PSA enables continuous monitoring of expenses by project, department, or resource. As costs are captured in real time, you can compare them against forecasted budgets and adjust future estimates based on actual spend patterns.

3. Seamless Integration with Accounting Systems

Forecasting is only as accurate as your data. Birdview PSA integrates with accounting tools like QuickBooks and Xero, syncing billing, expense, and time data automatically. This ensures clean, up-to-date financial records that support trustworthy forecasts.

4. Scenario Planning and What-If Analysis

Birdview PSA allows you to model potential project changes–such as scope increases, deadline shifts, or staffing changes–and see how they affect financial forecasts. This makes it easier to prepare contingency plans and keep forecasts realistic.

Use case: An IT firm models a 20% delay in project delivery to anticipate revenue shifts and reschedule contractor hours.

5. Advanced Financial Reporting and Analytics

Birdview‘s built-in reporting tools let you drill down into project costs, utilization rates, and revenue recognition in real time. You can create custom dashboards tailored to your forecasting needs–by role, service line, or client.

Forecasting benefit: Real-time insights into key financial metrics help you adjust projections monthly or even weekly, instead of waiting for quarterly closes.

Streamlining financial management with PSA

Financial operations in service firms involve a complex web of moving parts: billable hours, resource costs, project budgets, client contracts, and invoicing cycles. PSA software brings these elements into a single, automated workflow.

Birdview PSA eliminates manual errors by connecting time tracking, billing, and resource planning in one platform. You no longer have to reconcile data across disconnected systems–Birdview keeps everything accurate, consistent, and up to date.

Key benefits of PSA for financial accuracy & cash flow

Enhanced Billing Accuracy

One of the most common pain points in financial management is inaccurate billing. PSA links your time tracking and project management directly to invoicing, ensuring that your clients are billed correctly for the work completed. This improves billing accuracy and ensures timely payments, reducing cash flow problems.

Accurate Time Tracking for Revenue Reporting

Without an accurate way to track time, it’s easy to undercharge clients or lose track of billable hours. Birdview PSA offers robust time-tracking tools that integrate with your billing system, so every minute of work is captured and accounted for. This ensures you’re not leaving money on the table and helps with accurate revenue reporting.

Effective Cost Management and Resource Allocation

PSA makes it easier to track project expenses and allocate resources efficiently. This transparency helps you manage project budgets more effectively, ensuring that costs are kept in check and resources are used optimally.

👉 Related: Project Cost Management: Definition and Best Practices

Improve financial forecasting accuracy with PSA tools

Financial forecasting is one of the most challenging aspects of managing a service-based business–but it doesn‘t have to be. PSA software can significantly enhance forecast accuracy while reducing the time and manual effort involved. By leveraging historical data, real-time inputs, and automation, PSA systems provide a dynamic, data-driven foundation for smarter financial forecasting.

Whether you’re estimating revenue for next quarter, planning budgets for new projects, or managing long-term cash flow, PSA‘s forecasting tools help you move from reactive guesswork to proactive decision-making.

Leverage Historical Data for Future Predictions

PSA doesn‘t just automate your current financial operations–it becomes a living database of your financial history. By analyzing past project performance, resource utilization, labor costs, billable hours, and client payment behavior, PSA helps uncover meaningful patterns that inform future projections.

For example, if a consulting firm consistently underestimates design time in fixed-price projects, Birdview PSA can highlight this trend, enabling more accurate scoping and budgeting in future engagements. Over time, your forecasting becomes not only more informed–but also more precise and realistic.

Tip: Group historical data by project type, client, or team to identify trends in profitability and duration. Use this to build forecasting models tailored to each project category.

Automate Forecasting Workflows

Manual forecasting often relies on outdated spreadsheets, fragmented systems, and gut feelings. This opens the door to errors, duplication, and incomplete insights. PSA platforms automate the entire forecasting process–from data collection to reporting–pulling real-time figures directly from live projects, resource plans, and financial records.

Birdview PSA, for example, automatically updates your forecast when timelines shift, costs increase, or billable hours rise.

Additional Forecasting Techniques Enabled by PSA

- Scenario Modeling: Use what-if analysis to test different budget and staffing scenarios. How would a delayed launch affect cash flow? What if a key client pauses their retainer? PSA lets you simulate outcomes and adjust your plans accordingly.

- Forecast by Role or Team: Plan headcount and workload based on upcoming project needs. Birdview PSA lets you forecast resource demand down to the individual or department level, avoiding over-hiring or last-minute scrambling.

- Rolling Forecasts: Instead of static annual projections, PSA enables continuous rolling forecasts. As new data flows in, your financial outlook adapts–giving you an agile, real-time planning capability.

Example: A digital agency uses rolling forecasts in Birdview PSA to adjust campaign budgets monthly based on client scope changes and internal resourcing. This flexibility improves profitability and prevents over commitment.

Align Forecasting with Project Milestones

One of the most overlooked aspects of forecasting is timing. PSA tools like Birdview allow you to align financial forecasts with project milestones, giving you greater clarity into when revenue is expected to be recognized and when major expenses will occur. By mapping forecasts to specific phases–such as kickoff, delivery, or go-live–you gain a more granular and accurate picture of your cash flow.

Improve Forecast Accuracy with Real-Time Collaboration

Forecasting is not just a finance function–it requires inputs from project managers, department leads, and resource planners. PSA systems enable cross-functional collaboration by centralizing data and providing shared visibility. When teams input updates in real time (e.g., delayed timelines, scope changes, unplanned resource shifts), the forecasting engine can adjust instantly, keeping your projections accurate.

You may also like:

Improve Cash Flow with PSA: Speed Up Quote-to-Cash Cycle

Professional Services Revenue Recognition: Examples & Methods

Increase project profitability through financial forecasting with PSA

Profitability is the key driver for any project-based business, and tracking it accurately can be a challenge. Many businesses struggle with understanding whether their projects are truly profitable due to inefficient processes and a lack of real-time visibility into costs and revenues. This is where professional services automation (PSA) comes into play.

Optimizing payments and receivables

By automating invoicing and tracking payments, PSA helps ensure that you are paid promptly for your work. This reduces the risk of late payments and improves your overall cash flow. Additionally, PSA can automate payment reminders, making sure nothing slips through the cracks.

Tracking project profitability with real-time data

PSA gives you real-time data on project costs and revenues, allowing you to monitor profitability throughout the project lifecycle. This helps you make informed decisions about resource allocation and project pricing.

Real-time monitoring of costs and revenues

One of the main advantages of using PSA is its ability to track project costs and revenues in real time. With traditional methods, you might only get insights at the end of a project, when it‘s too late to make adjustments. PSA allows you to monitor expenses such as labor, materials, and other resources, while also tracking incoming revenues from client payments. This enables you to see a live snapshot of how profitable a project is at any given moment.

Better resource allocation

Effective resource allocation plays a critical role in keeping project costs down and maximizing profitability. PSA helps you allocate the right resources to the right tasks based on their availability and skill sets. By optimizing resource use, PSA reduces instances of overstaffing or underutilizing employees, both of which can impact project profitability. This ensures that you‘re getting the most out of your team while staying within budget.

Identifying profitable vs. unprofitable projects

With PSA, businesses gain clear insights into which projects are driving profitability and which are not. PSA systems provide detailed reports on the costs and revenues of each project, helping you identify patterns of success or areas where margins are tight. This data empowers you to make informed decisions about where to focus your efforts, allowing you to prioritize projects that bring in the most value to your business.

Real-world PSA use cases in financial forecasting for professional services

Professional services firms across industries–engineering, IT, marketing, and more–face common challenges when it comes to accurate financial forecasting. Whether it‘s managing multi-phase projects, juggling client campaigns, or optimizing resource costs, the ability to predict future financial outcomes is key to long-term success. PSA software brings clarity to this process by automating billing, tracking expenses in real time, and aligning forecasts with operational data.

Here are real-world examples of how PSA tools like Birdview PSA are used to improve financial forecasting in different professional service sectors.

Engineering Teams

IT Services

Business Consulting Firms

How to use Birdview PSA for financial forecasting and planning

Birdview PSA makes financial forecasting easier by centralizing your project, resource, and financial data in one place. With automated workflows and real-time visibility, you can shift from reactive reporting to proactive planning.

Here‘s how to use Birdview PSA to strengthen your financial forecasting and decision-making:

1. Monitor Real-Time Financial Health

Track expenses, revenue, and profit margins across all active projects using Birdview‘s live dashboards. This immediate visibility helps you spot risks early, make budget adjustments, and prioritize the most profitable work.

2. Automate Invoicing with Time & Expense Data

Use Birdview‘s built-in time tracking and expense management tools to generate accurate, timely invoices. This reduces manual effort, improves cash flow, and ensures clients are billed correctly for every billable hour or reimbursable cost.

3. Allocate Resources Based on Forecasted Demand

Forecast future costs by analyzing current project progress, historical trends, and upcoming demand. Birdview allows you to match resources to projects based on availability, skills, and forecasted workload–helping you stay efficient and profitable.

Pro Tip: Use Birdview‘s workload view to plan team utilization three months ahead and avoid costly last-minute resourcing.

4. Access Detailed Financial Reports for Strategic Planning

Birdview PSA provides customizable financial reports that break down project costs, resource spend, billing status, and margin trends. Use these insights to improve pricing models, evaluate project profitability, and inform executive planning.

Advice: Schedule monthly report exports for leadership to review forecast accuracy versus actual results.

It has also contributed to a 10-20% increase in the completion of projects on-budget and on-schedule. The flexibility around core project planning and time recording is what BoomData appreciates most about Birdview PSA.

Stuart Barnard Executive Director

.

You may also like:

You may also like: