Your billing process doesn‘t have to be a bottleneck–it can actually be a competitive advantage. With the right system in place, invoicing, time tracking, and project management can be seamless. ▶️ That‘s where the Birdview PSA comes in. It‘s an all-in-one platform that handles everything from billing to client communications to resource management. No more switching spreadsheets or worrying about missed invoices! Birdview PSA automates the tedious stuff, cuts down on errors, and makes timely payments, giving you more time to focus on growing your business and delivering top-notch service to your clients. Sounds like a win-win, right?

What is a professional services billing solution?

A professional services billing solution helps businesses manage their billing process more easily. It automatically tracks time, expenses, and creates invoices for clients.

It also helps businesses manage cash flow better. These systems can connect with project management tools, making it easy to track hours worked, project progress, and expenses in one place.

Features to look for in a professional services billing solution

Here are some key features that can help streamline your processes, save time, and make sure accurate billing 👇.

1️⃣ Track your time accurately: Accurate time tracking is necessary for professional services billing. By keeping track of billable hours, you can make sure that no time is wasted.

2️⃣ Track your expenses: Expense tracking is just as important. With a good solution, you can easily monitor all project-related costs, including overhead and additional expenses.

3️⃣ Use project management tools: Project management tools in your billing system help you stay on top of progress, deadlines, and key deliverables. They also help you manage your project budget, so you can avoid going over budget or facing unexpected costs.

4️⃣ Client portal for transparency: A client portal lets your clients view their invoices, check payment statuses, and see project updates. This transparency builds trust and makes sure everyone is on the same page, making communication easier.

5️⃣ Customizable invoices: Customizable invoices are necessary. You can adjust the format to meet each client’s needs, include specific details, and make sure everything aligns with the project terms.

6️⃣ Recurring billing options: If you offer ongoing services, recurring billing is a must. This feature lets you automate payments, making it simpler for clients to pay regularly. It also helps your business maintain steady cash flow.

7️⃣ Integrate with other tools: Integrating your billing system with tools like accounting software streamlines your workflow. It automates data transfer, reduces errors, and saves time by cutting out manual entries.

8️⃣ Use reporting & analytics: Reporting and analytics give you key insights into your business. You can track profits, monitor cash flow, and make smart decisions to grow your business.

Top professional services billing software

Let‘s take a look at some of the best billing tools out there that can make managing your professional services a whole lot easier. 👇

1️⃣ Birdview PSA: The all-in-one billing and invoicing solution for professional services

Birdview PSA stands out as a reliable partner for professional services firms looking to streamline billing, invoicing, and project management. This all-in-one platform offers a comprehensive solution that helps businesses tackle most common pain points in the industry.

- Inefficient billing processes

- Inaccurate time tracking

- Complex billing structures

- Lack of real-time transparency

💡 Core benefits customized for professional services

1️⃣ Streamline billing and get paid faster

Birdview PSA automates your invoicing, reducing errors and speeding up approval times. It connects billing to project milestones, so you get paid as work moves forward.

By syncing with your financial tools, it cuts down on manual entry and makes billing easier.

2️⃣ Maximize billable hours and revenue

Tracking time and expenses accurately helps grow revenue. Birdview PSA‘s time tracking and expense management features help you capture every billable moment. You won‘t miss out on any revenue and can track all costs with ease, keeping your profits high.

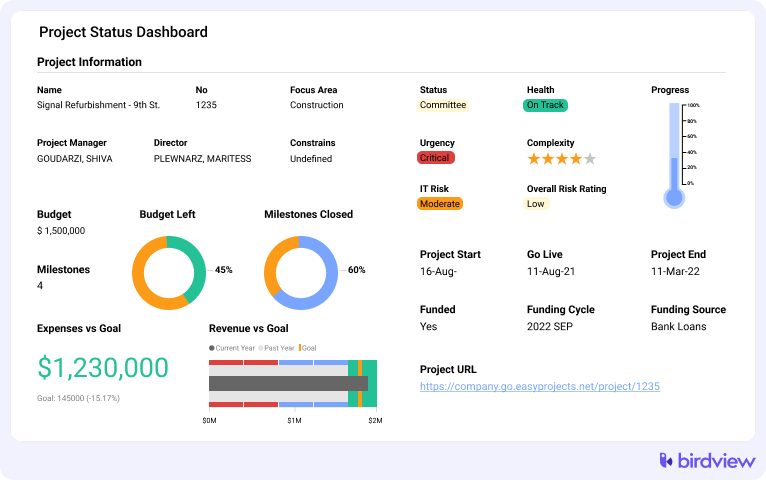

3️⃣ Enhance financial visibility and control

Birdview PSA provides real-time updates on budgets, expenses, and profits. With clear dashboards and detailed reports, you can keep projects on track and within budget. This gives you full control over your finances, preventing surprises and maintaining profitability.

4️⃣ Boost client satisfaction and transparency

Birdview PSA includes a client portal where clients can view project updates, invoices, and deliverables. Real-time communication about tasks, timelines, and billing helps build trust and keeps clients informed and involved throughout the project.

💡 Flexible billing models to match every project type

Birdview PSA provides flexible billing options to fit the needs of different projects and services. It helps you easily match your billing model to how your projects work 👇

1️⃣ Flat fee billing

For projects with a clear, defined scope, flat fee billing works best. You set a fixed price based on the agreed deliverables, so both you and your client know exactly what to expect from the start.

However, if your project has multiple stages or specific tasks, milestone billing is a great choice. With this model, payments are made as each milestone is completed.

It ties costs directly to progress, helping maintain transparency and making sure that both you and your client are on the same page throughout the project.

2️⃣ Time & material billing

Time & material billing works best when the project scope isn‘t fixed. You charge based on the hours worked and the materials used. This gives you flexibility when timelines or deliverables change, while making sure the client pays for the work actually done.

3️⃣ Hybrid models

Hybrid billing combines both flat fee and time-based billing. For agreed-upon deliverables, you charge a flat fee.

For additional work or changes outside the original scope, you switch to time & material billing. This approach offers flexibility while keeping pricing clear and fair for both sides.

💡 Features designed to drive results for professional services firms

1️⃣ Unified billing and invoicing platform

Birdview PSA combines all the tools you need for billing and invoicing into one easy-to-use platform. Instead of switching between different applications, you can create projects, track progress, handle billing, and generate invoices–all in one place.

2️⃣ Advanced time and expense tracking

Tracking time and expenses with Birdview is straightforward and flexible.

Whether you prefer entering time manually, logging it on a weekly basis, or using a stopwatch timer, Birdview supports all these methods. You can also quickly mark time and expenses as billable or non-billable with a single click.

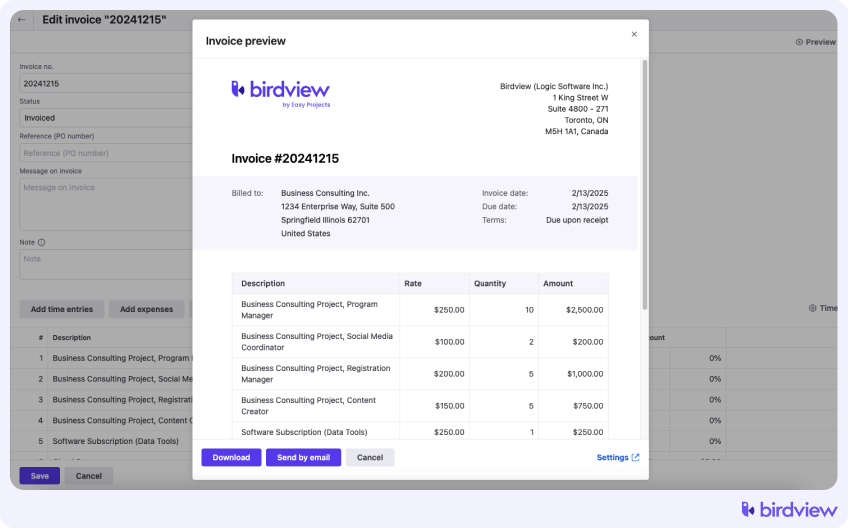

3️⃣ Customizable invoicing

With Birdview‘s invoicing capabilities, you can easily customize invoices to match your client‘s specific needs. Adjust the branding, add custom line items, and preview the invoice before sending it out.

This flexibility lets you create professional invoices that reflect your business’s unique identity, all while saving time and maintaining accuracy.

4️⃣ Real-time reporting and analytics

Birdview provides real-time reporting tools to track your project‘s financial performance.

From cost variances to projected profits and work-in-progress (WIP) metrics, everything is displayed on a user-friendly dashboard.

Need to share insights with your clients or team members? You can export detailed reports in seconds, keeping everyone on the same page with clear, up-to-date financial information.

5️⃣ Client portal for seamless collaboration

The client portal makes communication and collaboration with your clients seamless. Clients can view the progress of their projects, track milestones, and even approve invoices directly within the portal.

They can leave feedback or request changes in real time, which promotes open communication and helps strengthen the trust in your business relationship.

6️⃣ Seamless integrations with financial tools

Birdview PSA integrates smoothly with popular financial tools like QuickBooks, NetSuite, Deltek, and Microsoft Dynamics. These integrations give you a complete view of your financial data, eliminating the need for manual data entry.

7️⃣ Enhanced collaboration for teams

Birdview supports team collaboration by offering shared project timelines, task tracking, and instant notifications. Everyone stays aligned with the same goals and deadlines, which helps keep projects organized and on track.

By centralizing communication and project details in one platform, Birdview minimizes confusion and helps your team stay focused on delivering great results.

💡 Industry applications: How Birdview PSA transforms billing for professional services

Birdview PSA shines when it comes to billing and invoicing for professional services. It’s not a one-size-fits-all solution; it‘s built to cater to the specific needs of different industries.

Birdview makes the whole billing process easier and more seamless, so you can focus on what matters most–serving your clients.

✅ Consulting

Birdview PSA simplifies billing for consultants by tracking time spent on client projects with precision.

You can easily set different hourly rates based on client or project type, making sure your invoices match exactly what‘s been worked.

Moreover, as project scopes shift, the system automatically updates to reflect these changes, so you can send accurate invoices without hassle.

✅ Marketing agencies

For marketing agencies, Birdview PSA adapts to various billing models–whether you‘re billing by milestones, retainers, or project value. It tracks every task and deliverable tied to each client‘s project, making it easier to stay on top of billing.

And with real-time project visibility for clients, you can promote trust while minimizing billing disputes.

✅ Engineering firms

Engineering firms can count on Birdview PSA to handle both project budgets and customized billing. The platform tracks billable and non-billable hours across multiple projects, linking them to milestones to make sure accurate invoicing.

Whether it‘s large or small, Birdview keeps things in check, helping avoid overbilling or underbilling, while offering clients transparent and precise invoices.

Actionable steps to get started with Birdview PSA

Getting started with Birdview PSA is simple and fast. Here‘s how you can take immediate action:

▶️ Book a personalized demo

Want to see how Birdview PSA can solve your billing problems? Book a demo! Just visit this link to schedule a session. During the demo, you‘ll see how Birdview PSA can simplify your billing and invoicing.

We‘ll walk you through real examples and show how it fits into your workflow. You‘ll discover how the software can work for you, making everything smoother and faster.

Why choose Birdview PSA for your professional services firm?

| Feature | Why Birdview PSA? |

| Proven results for industry leaders | Trusted by leading firms, Birdview PSA delivers strong ROI and consistent results. With over 396 reviews on Capterra, it has a great average rating. |

| Comprehensive solution built for professionals | Birdview PSA consolidates your tools into one platform, saving time and reducing costs by eliminating the need for multiple systems. |

| Scalable for growing businesses | As your firm expands, Birdview PSA grows with you. With flexible billing and scalable features, you can continue providing excellent service. |

| Unmatched support and community | Birdview PSA offers 24/7 support and a wealth of resources to help you make the most of the platform. Their team makes sure smooth operations. |

| Seamless onboarding | Birdview PSA is easy to set up with quick data imports, pre-built templates, and a simple guide, so you can start using it right away. |

Pricing

Click here to check the pricing plans!

2️⃣ Zoho Invoice

Zoho Invoice is a billing tool designed for professional services. It helps businesses handle client billing, track payments, and generate invoices without the hassle.

It’s user-friendly and works well for small to medium-sized businesses, but it’s also flexible enough for larger companies that need more advanced features.

Key features

- Customizable invoice templates

- Multi-currency support

- Time tracking and billing

- Recurring invoicing

- Automated payment reminders

- Integration with other Zoho products

- Tax management tools

- Client portal for easy communication

- Expense tracking

- Mobile app for invoicing on-the-go

Budget considerations for different company sizes👉 If you‘re running a small business, Zoho Invoice offers a free plan with necessary features.

👉 For medium-sized businesses, a paid plan provides a good balance of advanced tools without breaking the bank.

👉 Larger businesses may find value in a higher-tier plan, which supports more complex billing needs and integrates seamlessly with other enterprise software.

As of the writing date, Zoho Invoice has 4.7 stars on Capterra.

Pricing

Click here to check the pricing plans!

3️⃣ Xero

Xero is a cloud-based accounting software that makes managing finances easy, especially for professional service providers.

It helps you stay on top of invoicing, track payments, and manage expenses–all in one place. Its simple interface and automation save time, so you can focus on what matters most–your clients.

Key features

- Customizable invoices

- Automated bank feeds

- Real-time expense tracking

- Mobile access on-the-go

- Multi-currency support

- Collaborative features

- Secure cloud storage

- Customized reports

- Easy app integrations

- 24/7 customer support

Budget considerations for different company sizes

👉 For small businesses, the basic plan covers all the essentials without breaking the bank.

👉 Medium-sized companies will get more value from the growing plan, which offers extra features.

👉 Larger businesses should go for the established plan, making sure they have all the tools needed as they scale.

Currently, Xero has 4.4 stars on Capterra.

Pricing

Click here to check the pricing plans!

4️⃣ FreshBooks

FreshBooks is a handy all-in-one billing, payroll, and accounting tool for professional service providers. Whether you’re a freelancer or running a small to mid-sized business, it helps you manage invoices, track time, and generate financial reports with ease.

It’s especially helpful when tax season rolls around, as it saves you hours of work. FreshBooks is perfect for professionals in fields like consulting, marketing, legal, and IT. Furthermore, you can collaborate with clients, your team, and your accountant from just about anywhere.

Key features

- Easy invoice creation

- Time tracking

- Project management

- Expense management

- Client collaboration tools

- Tax support

- Recurring billing

- Mobile app access

- Customizable reports

- Integrates with 100+ apps

Budget considerations for different company sizes

👉 If you’re a small business, the basic plan works great to get started without breaking the bank.

👉 For medium-sized businesses, the more advanced options offer better support as your needs grow.

👉 Larger businesses can take advantage of customizable plans that scale with them.

As of now, FreshBooks has 4.5 stars on Capterra.

Pricing

Click here to check the pricing plans!

5️⃣ Harvest

Harvest is a billing solution that makes life easier for professional service teams, agencies, and consultants.

It helps you track billable hours, generate invoices, and manage projects without the usual headaches.

Key features

- Time tracking

- Automated invoicing

- Expense tracking

- Easy tool integrations

- Project management

- Team collaboration

- Customizable billing rates

- Detailed reporting

- Payment tracking

- Mobile app access

Budget considerations for different company sizes

👉 For smaller teams, Harvest‘s basic plan gives you everything you need at an affordable price.

👉 If you‘re part of a medium-sized business, you‘ll appreciate the added features and flexibility at a reasonable cost.

👉 Larger teams can opt for the premium plan, which offers advanced reporting and premium support to handle more complex needs.

As of the writing date, Harvest has 4.6 stars on Capterra.

Pricing

Click here to check the pricing plans!

6️⃣ QuickBooks Online

QuickBooks makes billing and accounting a breeze for professional service businesses. Whether you’re a freelancer or running a growing service firm, QuickBooks helps you stay on top of your finances.

It’s simple design with powerful features allows you to manage invoices, track expenses, and generate reports without the hassle.

Key features

- Customizable invoices

- Automated payment reminders

- Multi-currency support

- Syncs transactions in real-time

- Tracks expenses seamlessly

- Recurring billing options

- Access via mobile app

- Project profitability tracking

- Time tracking built-in

- Detailed reporting tools

Budget considerations for different company sizes

👉 If you’re just starting out, the “Simple Start” plan is perfect for managing your basics on a budget.

👉 Growing businesses might want to step up to the “Plus” plan for extra features.

👉 For larger teams, the “Essentials” plan offers multi-user access and more advanced reporting options, giving you everything you need to scale.

QuickBooks has 4.3 stars on Capterra.

Pricing

Click here to check the pricing plans!

Practical tips for implementing professional services billing tools

Let‘s take a look at some key steps to make your billing system more seamless and easy to use.

Focus on simplicity and fast onboarding

When selecting a billing tool, go for one that‘s simple to understand and quick to get started with. The quicker your team can learn how to use it, the faster you can see positive results.

Look for a solution that has a clean, user-friendly interface and doesn‘t require a lot of setup.

A tool with an easy setup and straightforward features will help your team feel comfortable using it, reducing frustration and increasing adoption rates.

Conduct team training and ensure smooth integration with existing tools

Before rolling out the new billing system to everyone, make sure your team is well-prepared. Take time to train them so they fully understand how the tool works.

When everyone knows how to use the system properly, you‘ll avoid mistakes and your processes will run more smoothly.

It‘s also important to make sure the new system integrates well with the tools your business already uses.

Migrate data carefully to avoid discrepancies

Data migration is a critical step that should never be rushed. It‘s important to move your billing data over slowly, making sure each record is accurate.

If there are mistakes during the transfer process, it could lead to billing errors, which could damage your relationship with clients and cause confusion.

Take the time to double-check everything as you move the data.

Test the tool with a pilot project before full-scale implementation

Before fully committing to the new billing system, test it on a smaller scale first. You can do this by using it with a single project or a limited number of clients.

This way, you can identify any hidden issues early, before they affect your entire operation.

Running a test will give you a chance to see how the tool works in practice and determine if it meets your business needs.

You can also fine-tune any areas that need improvement, making sure a smoother rollout when you go live with the full system.

Leverage customer support for troubleshooting and customization

If you run into any problems, don‘t hesitate to reach out to the customer support team. A responsive support team can help solve issues quickly and guide you through any needed customizations.

Whether you need help troubleshooting a problem or adjusting settings to fit your business, they are there to assist you.

What to consider when choosing a professional services billing solution?

When picking a billing solution for your business, keep these four important factors in mind: 👇

Business needs: Make sure the billing solution matches your agency’s unique needs. Whether you’re handling complex projects, managing many transactions, or tracking expenses, the system should fit your workflow and make your processes easier. Look for a solution that helps you stay organized and on track.

You might also consider exploring how PSA improves financial management and forecasting for deeper insights.

Integrations with your tools: Find a solution that works well with the tools you already use, like QuickBooks, SharePoint, or ServiceNow. This will save you time by cutting down on manual data entry, reducing mistakes, and keeping everything in sync.

The right integration makes sure that your billing system works smoothly with your other operations.

Flexible pricing: Choose a billing solution with pricing that fits your budget and needs. Some solutions charge a flat fee, while others charge based on usage. Make sure the pricing structure offers a good balance between cost and the features you need to manage your billing.

Ease of use: Your team should be able to use the billing solution easily. Look for a system with a simple, clear interface that‘s easy to navigate. The easier it is for your team to learn and use the solution, the quicker they can get up to speed and be productive.

How to choose the right billing solution for your professional services industry?

Let‘s break down how you can find the best billing solution for your business.👇

For agencies with retainers

If your agency works with retainers, you‘ll want a billing solution that makes recurring payments simple.

Automated invoicing helps you process payments on time without extra effort. Look for tools with strong reporting features so you can track project expenses, budgets, and time spent on each retainer.

Trust accounting features are also important to keep client funds secure and comply with regulations, building trust with your clients.

For small business owners

As a small business owner, you need a billing system that grows with your business. Choose one that integrates easily with your current tools, like accounting or CRM software.

This helps reduce errors and keeps everything organized. Look for a system with recurring billing options to create a steady cash flow.

This way, you can focus on growing your business instead of managing invoices and payment cycles.

For consultants

Consultants often deal with both hourly rates and project-based billing. This requires a flexible tool that works for both.

You‘ll want a way to track time accurately while also managing fixed-price projects. A good solution lets you set milestones, track hours, and create invoices based on the details of each project.

For freelancers

Freelancers value simplicity and ease. Choose a tool that‘s easy to navigate and understand. Time tracking should be smooth so you can stay focused on your work.

Automated invoicing makes getting paid less stressful, letting you spend more time providing great services and less time on paperwork.

The right tool should make billing feel like a simple task.

Understanding the billing challenges specific to your service-based business

| Audience Segment | Challenges |

| Freelancers | – Managing multiple clients and projects at the same time.

– Accurately tracking hours for each client to avoid billing errors. – Making sure timely payments without having to micromanage clients. |

| Small businesses | – Handling recurring invoices seamlessly to maintain steady cash flow.

– Managing administrative tasks while focusing on client deliverables. – Balancing invoice consistency with fluctuating project demands. |

| Consultants | – Struggling to balance project work with accurate time tracking.

– Managing invoicing while staying on top of project timelines. |

| Firms with retainers | – Making sure transparency in long-term billing relationships.

– Maintaining consistent invoicing practices that align with client expectations. |

Frequently asked questions (FAQs)

How to invoice for professional services?

To invoice, gather details about the services provided, hours worked, and any expenses. Use billing software to create clear, accurate invoices that include: 👇

- Service descriptions

- Payment terms and due dates

Send invoices promptly and set up automatic reminders for late payments to maintain cash flow.

How customized and detailed invoices reflect your brand and professionalism?

Customized invoices with your logo and branding show attention to detail and professionalism. Clear service descriptions help build trust and show your commitment to quality.

How improved billing practices free up time to focus on growing the business?

Improved billing practices save time by reducing errors and automating processes. This gives you more time to focus on:👇

- Acquiring clients

- Delivering projects

- Growing your business

Conclusion: Take control of your billing today!

Choosing the right billing solution brings more than just convenience–it saves you time, builds client trust, and improves your bottom line.

If you‘re still struggling with manual processes or outdated systems, now‘s the time to evaluate your current approach.

Streamlining your billing can make a huge difference in how you manage projects, track payments, and stay on top of your finances.

💡 Ready to take the first step? Birdview PSA is here to help.This all-in-one platform simplifies billing and helps you stay on top of your financial processes.

Don‘t wait–transform your billing process today!