In the world of professional services, your project budget is more than just a forecast–it‘s your strategic guide to delivering value profitably. A well-planned budget shapes what‘s possible, helps allocate time and resources wisely, and keeps profitability in sight.

Yet, building those budgets is rarely straightforward. Changing scopes, evolving resource needs, and surprise costs can derail even the most well-intentioned plans.

“According to PMI‘s Pulse of the Profession report, 29% of project failures are caused by inaccurate cost estimates–highlighting just how crucial reliable financial planning is for project success.”

That‘s not just a statistic–it‘s a clear signal that stronger financial planning is essential. Because when budgets go off course, the impacts are real: missed deadlines, overspending, client dissatisfaction, and long-term damage to your firm‘s financial health.

In this article

Budget planning: a strategic priority for service firms

You understand the goal: plan budgets effectively to ensure projects stay within financial limits and contribute positively to your bottom line. But manual estimating, disconnected cost tracking, and difficulty managing budgets across multiple projects make this a significant challenge. This can lead to budget overruns, difficult conversations with clients, and reduced profitability.

What if you had a system that integrates project planning with financial tracking, making budget creation more accurate, monitoring simpler, and providing the insights needed to manage budgets proactively across your entire portfolio? This is the critical value of Professional Services Automation (PSA) software for improving budget planning.

This article will explore the core challenges of budget planning in professional services, highlight the essential components of a strong project budget, and show you how PSA software, specifically Birdview PSA, provides the integrated tools to improve budget accuracy, track costs effectively, and manage project financials for maximum success.

8 top budget planning challenges in Professional Services

Creating and managing project budgets in professional services comes with its own unique set of obstacles:

- Inaccurate Cost Estimating: Predicting how much time and which resources are needed for complex, often custom work is difficult. Underestimating leads to budget overruns, while overestimating might lose you the contract. This is especially tricky with new service offerings or unfamiliar client industries.

- Varied Billing Models: Professional services firms often use different billing structures–hourly, fixed-fee, milestone-based, or retainers. A budgeting system designed for just one of these may not handle the nuances of the others well, making consolidated financial oversight harder to achieve.

- Scope Creep: Project requirements that expand beyond the original agreement–without budget adjustments–are a common cause of cost overruns. It‘s crucial to manage internal and client-driven scope changes carefully to maintain budget integrity.

- Disconnected Systems: Project planning, time tracking, expenses, and financial reporting often live in separate tools, which makes it hard to get a unified view. Transferring data manually is time-consuming and introduces risk of error.

- Lack of Real-Time Cost Tracking: When you can’t track actual labor costs and project expenses as they occur, it’s hard to see whether you’re staying within budget–until it’s too late to fix the problem.

- Managing Resource Costs: Understanding how different resources (employees with varying rates, freelancers, vendors) affect your project budget is difficult without integrated data that ties resource assignments directly to cost.

- Portfolio Budget Oversight: Rolling up budget performance across all active projects requires heavy manual work and often results in outdated insights. Without visibility into which projects are under- or over-performing, it’s hard to make informed strategic decisions.

- Client Expectation Misalignment: Budgets are often based on initial proposals. If those don‘t match actual project costs, it can lead to tough conversations–or firms eating costs to preserve relationships.

These challenges highlight the need for a streamlined, integrated, and dynamic approach to project budgeting.

What goes into a strong project budget? Essential components

A strong project budget isn‘t just a ballpark figure–it‘s a detailed financial map of your entire project. In professional services, where margins are tight and client expectations are high, your ability to plan, track, and manage costs at a granular level can make or break your profitability. Let‘s break down the key components that go into building a successful, service-based project budget:

Labor Costs: For most service firms, labor is the biggest driver of project costs. You need to estimate how many hours each team member or role will spend on specific tasks and multiply that by their internal cost rate (or billable rate, if you’re modeling revenue).

Project Expenses: These are non-labor, direct costs that are tied specifically to delivering the project. This might include:

- Travel and accommodation

- Software or tool licenses purchased for a specific client project

- Hardware or materials

- Subcontractor or freelancer fees

Overhead Allocation: While not directly billable, overhead needs to be accounted for. This includes a portion of rent, utilities, admin salaries, insurance, or general business operations that support project delivery. Many firms apply a fixed percentage (e.g., 10–20%) to cover this.

Contingency Reserve: No matter how well you plan, unexpected events can impact timelines or scope. A contingency reserve provides a buffer–typically 5–15% of total costs–that protects your profitability from unplanned changes, risk realizations, or client-driven revisions.

Profit Margin (Optional): For firms tracking revenue vs. cost, especially in fixed-fee projects, adding a target profit margin into your budget model is important. This helps ensure you‘re not just breaking even.

A clear and comprehensive budget makes downstream tracking easier. When every component–from labor to risk–is defined upfront, it becomes much easier to detect issues early, manage expectations, and avoid financial surprises mid-project.

You may also like:

How PSA software improves budget planning

Professional Services Automation (PSA) software

is designed to integrate project planning with financial tracking, providing the tools to create more accurate budgets and manage them effectively throughout the project lifecycle. It consolidates the data needed for key budget components and automates calculations that are tedious and error-prone when done manually.

Here’s how PSA software, and specifically Birdview PSA, helps improve budget planning:

1. Integrated Estimating Tools

How PSA helps: PSA software connects project scope, task breakdowns, and resource assignments directly to estimating tools. This integration helps firms estimate labor costs and project expenses more accurately from the outset.

Birdview PSA Advantage: Birdview lets you build estimates based on task lists, estimated hours, and resource cost rates (internal or billable). Project templates allow for rapid estimate generation by preloading tasks and typical efforts. Built-in AI can assist with initial effort estimations based on project descriptions, saving time and increasing consistency across similar project types.

2. Dynamic Budget Creation

How PSA helps: Instead of creating budgets separately in spreadsheets, PSA systems build budgets dynamically by linking them to the project plan.

Birdview PSA Advantage: Budgets in Birdview are generated from the ground up–based on assigned tasks, hours, and internal rates. As the project evolves, the budget updates accordingly, staying aligned with changes in scope, resources, or estimates.

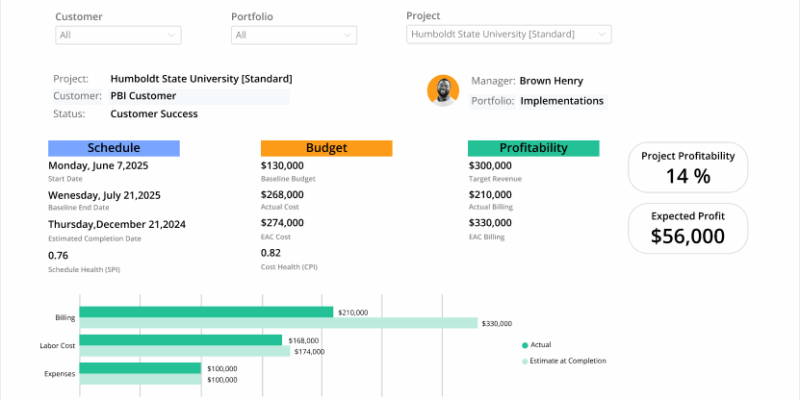

3. Real-Time Cost Tracking

How PSA helps: PSA software tracks actual costs as they are incurred–enabling continuous comparison between budgeted and actual spending.

Birdview PSA Advantage: Time entries and expense reports in Birdview automatically feed into your project‘s cost tracking. Managers get an up-to-date snapshot of where the budget stands and how actual costs are trending compared to the original estimates.

4. Budget Variance Monitoring

How PSA helps: Variance reporting shows when actual costs deviate from the planned budget–essential for proactive budget control.

Birdview PSA Advantage: Birdview calculates and visualizes budget variances at both the project and portfolio level. It offers alerts when costs approach or exceed thresholds, allowing early intervention before budgets spiral out of control.

5. Financial Reporting & Analytics

How PSA helps: Insightful financial reports and dashboards provide visibility across your entire portfolio and help identify trends and risks.

Birdview PSA Advantage: Birdview offers configurable reports on budget health, labor cost breakdowns, expense tracking, and profitability analysis. Visual dashboards summarize financial performance, allowing managers to drill into details or zoom out for portfolio-level oversight.

6. Time Tracking and Expense Integration

How PSA helps: PSA software removes the need for manual data entry by integrating time and expense logging with budget and cost calculations.

Birdview PSA Advantage: Every time log or expense entered by a team member is immediately reflected in the actual cost figures. This not only increases accuracy but also eliminates duplicate work.

7. Resource Cost Visibility

How PSA helps: Understanding the real cost of each team member or vendor is essential for building precise budgets.

Birdview PSA Advantage: Birdview allows you to assign internal cost rates to every resource–per person, per role, or per skillset. It then uses these rates to calculate labor costs and support margin analysis.

PSA software not only helps you build smarter budgets–it gives you the tools to manage, adjust, and improve them throughout the entire project lifecycle. With Birdview PSA, budget planning becomes a continuous, integrated part of project execution–not a disconnected task done at the start and ignored until the end.

🗣️ “The key benefit of using Birdview PSA in our company – now when we want to know how profitable a project was we run a report and when it is time to do billing it is all right there.” – Kevin McNally, Interactive Palette Founder

6 proven strategies to improve budget planning with Birdview PSA

Adopting PSA software like Birdview is a major step forward–but it‘s how you use it that really drives value. To truly improve budget planning, you need smart, repeatable strategies that help you plan with confidence, adapt in real time, and learn from every project.

1. Use Historical Project Data to Refine Estimates

Past projects are your most reliable source of truth. Dig into completed work to understand what tasks really cost, how long they took, and where you under- or over-estimated.

How Birdview helps: Birdview PSA stores detailed records of estimated vs. actual labor hours, expense totals, and resource allocation across all your completed projects. Use these insights to spot trends, refine your templates, and improve the accuracy of future budgets.

2. Involve the Team That‘s Doing the Work

No one understands how long a task takes better than the people who do it every day. Including them in the estimating process leads to more realistic plans–and fewer surprises later.

How Birdview helps: Use Birdview‘s task breakdown and assignment features to involve your team in estimating hours and costs. Let them review and refine their own tasks before the project kicks off.

Action Step: Host brief estimating sessions with your delivery team during planning and record their input directly in Birdview. This adds accuracy and fosters accountability.

3. Build Contingency Into Every Budget

Even the best-planned projects face risks. A well-sized contingency reserve helps you absorb those surprises without derailing the entire budget.

How Birdview helps: Birdview allows you to track identified risks, assign potential financial impact, and include those values in your budget as a contingency line item.

3. Plan for Scope Changes and Their Impact

Scope creep is one of the biggest threats to your budget. But it doesn‘t have to be unmanageable–if you plan for it.

How Birdview helps: Create a formal process for scope change approvals. In Birdview, you can document change requests, track their financial impact, and only implement them after budget adjustment and stakeholder approval.

Action Step: Enable change request workflows and ensure that any approved scope adjustments also update your resource plan and budget.

4. Monitor Budgets Continuously–Not Just Monthly

Waiting until month-end to review your budget is risky. Real-time visibility helps you catch issues before they turn into major financial setbacks.

How Birdview helps: Set up dashboards that show real-time budget usage, track actual vs. estimated costs, and send alerts when spending crosses thresholds.

5. Adjust Budgets as Projects Evolve

Your project isn‘t static–and your budget shouldn‘t be either. Revisit and adjust it as new information, approvals, or risks emerge.

How Birdview helps: Birdview lets you update labor hours, rates, expenses, and contingencies at any point. These adjustments automatically roll up into your financial reports.

Action Step: Establish a cadence (e.g., bi-weekly) for reviewing budget alignment with current progress, and adjust projections if needed.

6. Analyze Budget Performance After Every Project

Don‘t let budget insights go to waste. Post-project reviews reveal where you nailed the estimate–and where things went off course.

How Birdview helps: Birdview‘s post-project reports show detailed budget variance: planned vs. actual labor, expenses, and total costs. This gives you actionable data to improve future planning.

Accurate and effective budget planning is fundamental to the financial success of professional services projects. The challenges of manual estimating, disconnected data, and real-time cost tracking can lead to significant budget overruns and reduced profitability.

Professional Services Automation (PSA) software, like Birdview PSA, provides the integrated solution needed to improve budget planning. By linking project planning with financial tracking, automating cost capture, and providing real-time visibility, Birdview PSA empowers you to create more accurate budgets, manage spending effectively, and improve profitability across your project portfolio.

Invest in your projects’ financial health. Gain the clarity and control needed to manage budgets for maximum success.

Ready to improve budget planning and financial oversight?

Discover how Birdview PSA can transform your project financial management.

Frequently Asked Questions about budget planning in PSA

What are the main challenges of budget planning in professional services?

The main challenges include inaccurate cost estimating, managing varied billing models, controlling scope creep, tracking costs across disconnected systems, managing resource costs, gaining portfolio-level budget oversight, and aligning with client expectations.

How can PSA software improve budget planning accuracy?

PSA software improves budget planning accuracy by integrating estimating tools with project planning, dynamically calculating labor costs based on estimated hours and resource rates, and allowing real-time cost tracking against the planned budget.

What essential components should be included in a project budget for professional services?

A strong project budget should include estimated Labor Costs, Project Expenses, Overhead Costs, a Contingency Reserve, and the desired Profit Margin.

How does real-time cost tracking in PSA software help with budget management?

Real-time cost tracking automatically captures actual labor costs and expenses as they occur. This allows for immediate comparison against the planned budget, enabling proactive identification and management of budget variances before they lead to overruns.

Can PSA software help track budgets for different billing models (e.g., hourly, fixed fee)?

Yes, PSA software is designed to support various billing models. It allows you to structure budgets (e.g., internal cost for fixed fee, estimated billable for hourly) and track actual costs against the plan regardless of the billing structure.

How does PSA software provide financial oversight across project portfolios?

PSA software provides financial oversight across portfolios by aggregating budget and cost data from all projects. It offers portfolio-level dashboards and reports that show rolled-up budget performance, trends, and key financial metrics across the entire firm’s project work.

What strategies can improve budget planning when using PSA software?

Strategies include using data from past projects in the PSA, involving the team in estimating, factoring in contingency, planning for scope changes (and their budget impact), monitoring budgets regularly with real-time tools, and reviewing and adjusting budgets as needed.

How does Birdview PSA help track labor costs in the budget?

Birdview PSA tracks labor costs by linking estimated hours and recorded time entries to defined internal cost rates for resources. It automatically calculates labor costs for both the estimated budget and actual spending throughout the project.

What is budget variance and why is it important to monitor?

Budget variance is the difference between the planned budget and actual costs. Monitoring it is important because a negative variance indicates you are over budget, requiring investigation and corrective action to stay within financial limits and protect profitability.

Does Birdview PSA help with forecasting project expenses?

Yes, Birdview PSA helps with forecasting project expenses by allowing you to estimate expected costs for categories like travel, software, or vendor services as part of the initial budget planning. Real-time tracking helps refine these forecasts as the project progresses.