Let’s be honest – client billing in professional services can feel like a tangled mess. You’re juggling different rates for different team members, various billing models (hourly, fixed fee, project-based), and trying to ensure every billable hour and expense is accurately captured and invoiced. Maybe you’re already using Rate Cards – those complex spreadsheets filled with rates for every role, skill, or project type. You know the concept helps standardize things, but managing those spreadsheets? That’s the real challenge.

Manually calculating costs, applying those spreadsheet rates, cross-referencing them with time entries, and generating invoices for complex projects is time-consuming, prone to errors, and can lead to frustrating disputes with clients. You’re spending valuable hours on administrative tasks that could be spent delivering high-value services or growing your business. And when billing is complex and manual, it impacts your profitability and makes it hard to forecast revenue accurately.

What if there was a way to automate those complex calculations from your Rate Cards, manage varied rates effortlessly without the spreadsheet struggle, and generate accurate invoices with just a few clicks? This is where leveraging Rate Cards within a dedicated PSA software like Birdview PSA becomes a game-changer for professional services firms.

This article will dive into the complexities of client billing, explain what Rate Cards are and why moving beyond spreadsheets is essential, and show you how Birdview PSA simplifies the entire process, ensuring accurate invoices, improved profitability, and happier clients.

The pain of managing rate cards manually (and why you need a better way)

You’re already using Rate Cards – great! You know the value of standardizing your pricing. But if you’re managing those Rate Cards manually with spreadsheets, you’re likely facing significant hidden costs and frustrations:

- Time Drain on Administrative Staff: Hours spent manually calculating billable amounts, applying spreadsheet rates, cross-referencing with time tracking data (often from another system!), and generating invoices take away from other critical tasks. It’s a never-ending cycle of copying, pasting, and formula checking.

- Increased Risk of Errors: Manual data entry and complex spreadsheet formulas are highly prone to mistakes. A single error in a lookup or calculation can lead to incorrect invoices, underbilling (losing revenue without even knowing it), or overbilling (damaging client trust when errors are found).

- Delayed Invoicing and Cash Flow Issues: The time it takes to manually process invoices means you get paid later. This impacts your firm’s cash flow and financial stability, creating unnecessary stress.

- Client Disputes: Inaccurate or unclear invoices (often a result of manual errors) can lead to questions and disputes with clients, requiring even more time and effort to resolve and potentially damaging valuable relationships.

- Difficulty Tracking Profitability: Trying to manually apply costs and spreadsheet rates to project progress makes it hard to accurately track project profitability in real-time. You might not know a project is unprofitable until it’s already completed.

- Lack of Standardization: Even with a spreadsheet, different people in the firm might interpret or apply the Rate Card differently, leading to inconsistency in billing practices across project managers or clients.

- Version Control Nightmares: Keeping track of the latest version of the Rate Card spreadsheet and ensuring everyone is using it can be a headache, leading to misapplied rates.

If you’re experiencing any of these pain points, it’s time to explore a better way to manage your client billing – a way that leverages your Rate Cards but automates the heavy lifting.

What are rate cards and why moving beyond spreadsheets is essential

A Rate Card is essentially a predefined list of rates charged for different services, roles, or types of work. In professional services, they are a structured way to manage billing, ensuring consistency and accuracy when applying rates to billable activities.

Think of a Rate Card as your pricing rulebook for projects. It clearly defines how much you charge for different levels of expertise or types of work, no matter which team member performs the task or which project it’s for (depending on how you set it up).

While Rate Cards are essential for professional services firms because they standardize billing and provide clarity, managing them manually with spreadsheets introduces the very inefficiencies you’re trying to avoid. Moving beyond spreadsheets allows you to fully unlock the benefits of your Rate Cards:

- Automate Calculations: Integrate your Rate Cards into a system that automatically applies rates to time entries and expenses, eliminating manual effort and errors.

- Improve Accuracy: By applying predefined rates automatically, the system minimizes mistakes in invoicing.

- Enhance Transparency: Provide clarity to clients on how costs are calculated with automated, consistent invoices, building trust and reducing disputes.

- Enable Real-Time Financial Tracking: When integrated with project management software, Rate Cards allow for real-time tracking of project costs and projected revenue based on actual work performed.

- Support Varied Billing Models: Can be used seamlessly to support hourly billing, unit-based billing, or even as a component of fixed-fee projects.

How rate cards work in professional services (and how PSA automates it)

The beauty of Rate Cards lies in their flexibility to accommodate the diverse billing needs of professional services firms. They can be structured and applied in various ways, and PSA software like Birdview PSA automates this process.

- Role-Based Rate Cards: Charge different rates based on the team member’s role or seniority (e.g., Senior Consultant rate vs. Junior Consultant rate).

- Skill-Based Rate Cards: Charge different rates based on specific skills required for a task (e.g., Data Analysis rate vs. Content Creation rate).

- Client-Specific Rate Cards: Apply unique rates negotiated with a particular client for all their projects.

- Project-Specific Rate Cards: Set specific rates for a particular project based on its scope, complexity, or value.

- Blended Rate Cards: Apply an average rate across a team or project, regardless of individual roles or skills.

By setting up Rate Cards based on these structures within a PSA system, you create a powerful system for automating billing calculations that spreadsheets just can’t match.

📚 You may also like:

Simplifying complex billing: rate cards in Birdview PSA

Birdview PSA takes the power of Rate Cards and integrates it seamlessly into its comprehensive PSA software platform. This allows professional services firms to simplify even the most complex billing scenarios, directly linking billable activities to predefined rates for accurate invoicing and real-time financial tracking – without the need for manual spreadsheets.

Here‘s how Birdview PSA simplifies complex client billing using Rate Cards:

1. Flexible Rate Card Configuration (Beyond Spreadsheets): Birdview PSA allows you to set up and store your Rate Cards directly within the system, beyond the limitations of a spreadsheet. Configure rates based on various dimensions – by Job Role, Skill, Client, or Project. This flexibility ensures you can mirror your exact billing agreements within the system, and everyone is working from the same, current pricing data.

- Example: You can set a rate of $250/hour for a “Senior Consultant” role globally, but also specify a different rate of $200/hour for that same “Senior Consultant” when working on a specific client’s project, all managed directly in Birdview.

2. Automated Rate Application: Once Rate Cards are set up and linked to projects or resources in Birdview PSA, the system automatically applies the correct rate to all billable time entries and expenses as they are logged. This eliminates manual lookup in spreadsheets and calculation, drastically reducing errors and saving time.

- Useful Tip: Ensure your team is accurately logging time against the correct projects and tasks in Birdview PSA, as this data directly feeds into the automated billing calculations.

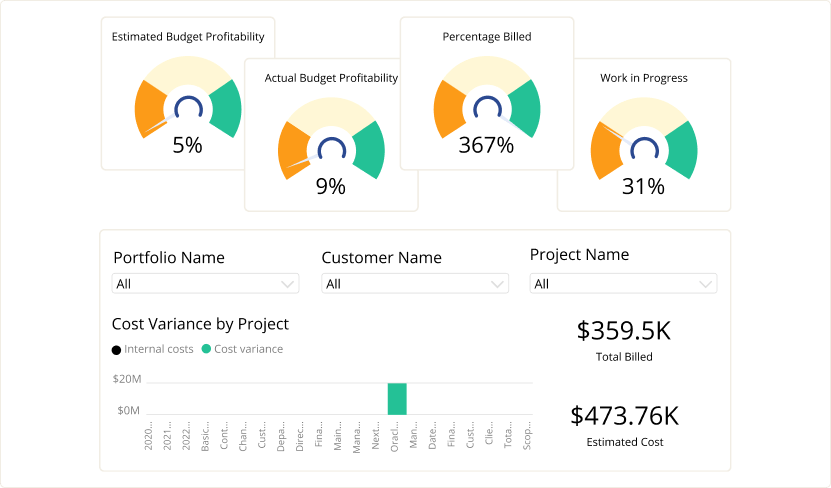

3. Real-Time Cost and Revenue Tracking: As your team logs billable hours and expenses in Birdview PSA, the system instantly applies the relevant Rate Card to calculate the associated revenue and cost. This provides real-time visibility into your project’s financial health and projected profitability directly within your project dashboard – something difficult to achieve with manual spreadsheets.

- Useful Tip: Use Birdview PSA’s dashboards to monitor key financial metrics like budget burn rate, actual cost vs. planned budget, and projected profitability in real-time.

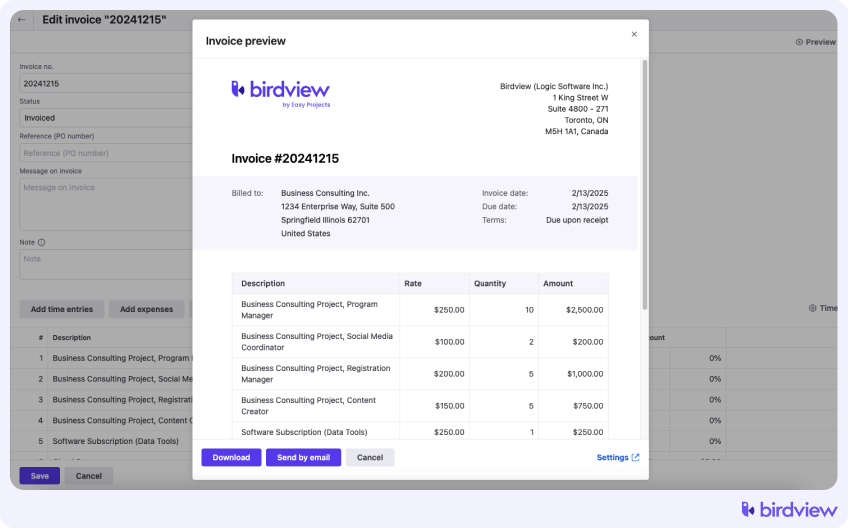

4. Accurate Invoice Generation: Birdview PSA allows you to generate accurate, detailed invoices directly from your project data, including tracked time, expenses, and applied rates from Rate Cards. You can customize invoice templates and ensure all billable activities are accounted for.

- Useful Tip: Configure your invoicing process in Birdview PSA to align with your billing milestones or payment schedules for better cash flow management.

5. Support for Varied Billing Models: Whether you bill hourly, fixed fee, or a combination, Birdview PSA’s Rate Card functionality can support your model. For fixed-fee projects, Rate Cards can help calculate the underlying labor cost, providing insights into profitability.

- Useful Tip: For hybrid billing models, use Birdview PSA to track billable hours (using Rate Cards) for work exceeding the fixed scope and automatically add it to the invoice generated by the system.

6. Historical Rate Tracking & Audit Trail: Birdview PSA maintains a history of Rate Cards applied to projects and all changes made. This provides a valuable audit trail and insights for future pricing strategies, all stored centrally within the system, unlike scattered spreadsheet versions.

7. Integration with Time Tracking and Expenses: Birdview PSA‘s integrated time tracking and expense management features work seamlessly with Rate Cards, ensuring that all billable activities are captured and rated correctly as they are logged.

- Useful Tip: Encourage your team to log time and expenses daily within Birdview PSA to maintain the highest level of accuracy for billing.

8. Beyond PSA: Financial Integrations: Birdview PSA integrates with popular accounting platforms like QuickBooks. This allows seamless transfer of invoice data, further automating your financial processes and reducing manual work, unlike trying to export and import data from spreadsheets.

Beyond billing: the benefits of integrated rate cards

Implementing Rate Cards within a comprehensive PSA software like Birdview PSA offers benefits that extend beyond just simplifying invoicing – they transform your financial operations:

- Improved Profitability Analysis: With accurate cost and revenue data tied to Rate Cards within a single system, you can gain clear insights into the profitability of different projects, services, or clients, informing strategic decisions.

- Enhanced Financial Forecasting: Reliable data from Rate Cards and time tracking within Birdview PSA enables more accurate financial forecasting and budgeting for future projects.

- Greater Consistency: Ensure consistent billing practices across your firm, regardless of who is managing the project, by enforcing rates within the system.

- Increased Client Trust: Clear, accurate, and consistent invoices generated by the system reduce disputes and build trust with clients.

- Streamlined Workflow: Automate calculations and invoice generation, freeing up valuable administrative time spent wrestling with spreadsheets.

- Reduced Administrative Burden: Eliminate the need to maintain and cross-reference complex Rate Card spreadsheets.

📚 You may also like:

Implementing rate cards in Birdview PSA (leaving spreadsheets behind)

Ready to start simplifying your client billing with Rate Cards in Birdview PSA and leave those manual spreadsheets behind? Here are the basic steps:

- Define Your Rate Structures: Determine how you want to structure your Rate Cards (by role, skill, client, project, etc.). This is similar to what you do for your spreadsheets now, but you’ll configure them directly in Birdview PSA.

- Configure Rate Cards in Birdview PSA: Set up your Rate Cards within Birdview PSA’s system, defining the rates for each category. You can import existing rates if needed.

- Link Rate Cards to Projects and Resources: Assign the relevant Rate Cards to your projects, clients, or specific team members within Birdview PSA.

- Ensure Accurate Time and Expense Tracking: Remind your team to log all billable time and expenses accurately within Birdview PSA. The system will automatically apply the correct rate.

- Generate and Review Invoices: Use Birdview PSA to generate invoices based on the recorded data and applied Rate Cards. Review them for accuracy before sending.

- Analyze Financial Reports: Regularly review financial BI reports in Birdview PSA to monitor project profitability and identify areas for optimization, leveraging the accurate data fed by your Rate Cards.

📚 You may also like:

Complex client billing doesn’t have to be a source of stress and inefficiency for professional services firms, especially when you’re already using Rate Cards. Rate Cards provide a structured, automated way to manage varied rates and ensure accurate invoicing, allowing you to move beyond the limitations of manual spreadsheets.

When integrated into a comprehensive PSA software like Birdview PSA, Rate Cards unlock significant benefits – simplifying calculations, improving accuracy, enhancing transparency, and enabling real-time financial management and tracking.

Stop wrestling with spreadsheets and manual calculations. Empower your team and your business with the clarity and efficiency of Rate Cards in Birdview PSA, ensuring accurate invoices, improved profitability, and happier clients.

Ready to simplify your complex client billing and boost profitability?

Discover how Birdview PSA can transform your billing process with powerful Rate Cards.