Maintaining a balance between billable and non-billed hours is crucial for enhancing profit margins when invoicing clients in a service business.

The distinction between billable hours (time spent on client-facing tasks that can be charged) and non-billable hours (time spent on internal tasks that cannot be directly charged to clients) is fundamental for a growth business and ensuring financial stability.

This in-depth review explains the challenges associated with tracking billable and non-billable hours and formulating effective strategies to ensure that both types of hours are not only recognized, but also fairly compensated.

Table of Contents

- Billable vs. non-billable hours: the difference

- How does tracking billable hours boost cash flow and profits?

- How tracking non-billable hours can boost your profit margins

- 4 Key strategies to boost billable hours with accurate time tracking

- Case study: How Boomdata achieved a 15% increase in on-budget and on-schedule completion

- How to track billable and non-billable hours with Birdview: A brief guide

Billable vs. non-billable hours: the difference

The differentiation between billable and non-billable hours is fundamental for financial management, client billing, and internal efficiency.

Billable Hours

Billable hours represent the time spent on activities directly related to client projects that can be charged to the client. These are the hours that directly contribute to the revenue of the business. For service businesses that require detailed billing, organizing tasks and categorizing them into billable and non-billable becomes crucial. Utilizing custom invoice templates, like those available for invoices in Word format, can enhance accuracy and presentation when billing clients for billable hours.

Non-Billable Hours

Non-billable hours include time used for tasks that help run the business or grow. When you work on things that keep the business going or help people learn more but can’t be charged to a client.

This could include time spent in team meetings, learning new skills, meeting new people who will help the business, writing plans for a possible new job, as well as day-to-day office work such as invoicing, scheduling, and maintaining order in the office, etc.

Setting profitable billing rates requires a delicate balance, grounded in a thorough understanding of the true costs of delivering services. This encompasses both the direct expenses linked to billable hours and the indirect costs associated with non-billable hours.

Tracking both billable and non-billable hours helps businesses accurately bill clients, manage resources efficiently, and understand operational costs. It provides insights into employee productivity, informs strategic planning, and supports fair employee compensation.

Additionally, it aids in identifying areas for improvement and growth opportunities, ultimately leading to better financial health and client relationships.

How does tracking billable hours boost cash flow and profits?

Tracking billable hours, or the time spent on activities directly chargeable to clients not only ensures accurate billing but also brings a host of benefits that can significantly enhance a firm’s operational efficiency, profitability, and client relationships.

Accurate client billing, visibility, client trust

Precise tracking of billable hours fosters transparency, providing clients with clear, itemized billing statements that outline the work performed. This clarity builds trust and reduces the likelihood of disputes.

By accurately logging billable hours, firms ensure they are fairly compensated for the work done. This guarantees that the effort put into client projects is appropriately reflected in the revenue generated.

Operational Efficiency and resource workload

Tracking billable hours provides data on how time is spent across different projects and tasks, allowing firms to allocate resources more efficiently and prioritize high-value work.

Service Offering Evaluation

By understanding which services consume the most billable hours and generate the most revenue, firms can make informed decisions about which areas to grow or scale back.

Client Portfolio Optimization

Analysis of billable hours by client can reveal which relationships are most profitable, guiding firms in targeting similar clients and optimizing their client portfolio.

Financial Health and Profitability

Effective tracking of billable hours enables firms to maximize revenue by ensuring that all client-related work is billed. This is crucial for maintaining healthy cash flow and profitability.

By ensuring that resources are efficiently allocated and fully utilized, professional firms can increase their profitability. Efficient resource planning reduces idle time and increases the proportion of billable hours to total hours worked, directly impacting the bottom line. Additionally, it can also improve client satisfaction by delivering projects more efficiently and effectively, leading to repeat business and referrals.

Resource Optimization

- Data-Driven Allocation: With accurate records of billable hours, resource managers have a clear understanding of how much time tasks or projects actually take. This data enables them to make informed decisions about how to allocate resources to upcoming projects.

- Maximizing Utilization: By analyzing the billable hours logged against each resource, managers can identify patterns of under or over-utilization. Resources (personnel, equipment, etc.) that are consistently logging fewer billable hours can be reallocated to areas with higher demand, thus maximizing their utilization and contributing more effectively to revenue-generating activities.

- Avoiding Overallocation: Conversely, tracking billable hours helps in identifying resources that are consistently overburdened, risking burnout or quality compromise.

- Forecasting and Planning: Resource managers can predict with greater accuracy the number and type of resources needed for future projects, based on the detailed historical data of how long similar tasks have taken.

The diligent tracking of billable hours is more than an administrative necessity; it’s a strategic tool that brings multifaceted benefits to professional services firms.

It ensures clients are billed correctly, helps earn more money, makes the business run smoother, and helps make big decisions.

How tracking Non-Billable hours can boost your profit margins

It might appear that tracking non-billable hours would have no impact on your company’s profitability, but that’s not the case.

Non-billable hours encompass all the activities essential for running the business but not chargeable to clients, such as administrative tasks, employee training, business development, and more.

While these hours don’t generate revenue directly, they are integral to the firm’s operations and contribute to the overhead.

Firms must thoroughly analyze not only billable hours but non-billable as well, to gain a complete picture of the true costs of service delivery. This includes the direct costs of billable work and the proportional share of overheads and indirect costs associated with non-billable activities.

With a clear understanding of the true costs, firms can develop pricing strategies that ensure all costs are covered. This might involve setting different billing rates for different services, clients, or project complexities, based on the insights gained from tracking non-billable hours.

Beyond just covering costs, profitable billing rates also need to include a margin for profit. This margin should reflect the value provided to the client, the firm’s expertise, and market positioning.

4 Key Strategies to Boost Billable Hours with Accurate Time Tracking

A key requirement when selecting software is the presence of time-tracking tools that distinguish between billable and non-billable hours. These tools must give up-to-date information and analysis, showing where and how time is used on different tasks and projects.

The data derived from tracking hours aids in making informed decisions about pricing, project management, and even resource allocation, ensuring that the firm remains competitive while profitable.

Understanding the true costs involved in providing professional services is pivotal for setting billing rates. By diligently tracking both billable and non-billable hours, firms can gain valuable insights into the direct and indirect costs of service delivery.

This full picture helps create pricing plans that cover all expenses and make extra money, fitting what the company offers and what customers want.

1. Leveraging time tracking for objective performance assessment and employee growth

By keeping accurate records of billable hours, managers gain a clear, quantifiable insight into each employee’s direct contributions to revenue-generating activities. This data-driven approach removes subjectivity from performance evaluations, ensuring that assessments are based on tangible work output.

Including non-billable hours in the assessment provides a comprehensive view of an employee’s engagement in activities that, while not directly revenue-generating, are essential for the business’s operational excellence and long-term sustainability, such as training, team collaboration, and process improvement initiatives.

Analyzing the distribution of an employee’s billable and non-billable hours can highlight areas for professional growth. For instance, an employee spending excessive time on non-billable tasks may benefit from time management training or could be redirected towards more billable work to align with their skill set. Insights from time tracking can inform the development of personalized training programs, focusing on enhancing skills that increase billable efficiency.

Involving employees in the process of tracking and evaluating their own time fosters engagement. It encourages them to take ownership of their professional development and contributions to the company.

2. Strengthen customer relationships and establish trust by monitoring billable and non-billable work hours

In the professional services sector, where services rendered are often intangible and outcomes can be complex, establishing trust and managing client relationships effectively is paramount.

The meticulous tracking of both billable and non-billable hours plays a crucial role in this dynamic, serving as a foundation for transparency, accountability, and mutual respect.

Transparency in Billing

Transparently tracking and communicating billable hours ensures that clients understand the scope of work performed and the associated costs.

Providing itemized invoices that reflect the tracked billable hours offers clients a detailed view of the services rendered, reinforcing the value provided.

Justifying Non-Billable Hours

While non-billable hours are not directly charged to the client, communicating the activities undertaken during this time can illustrate the firm’s commitment to excellence and the indirect value clients receive. You can include unbilled time on your invoice without payment.

Establishing clear agreements on what constitutes billable versus non-billable time sets a foundation for accountability, aligning client and firm expectations from the outset.

Strengthening Client Relationships – Collaborative Approach

Engaging clients in discussions about project planning and time allocation promotes a partnership approach, where clients feel involved and vested in the process.

3. Utilize Tracking Non-Billable Hours for Identifying Less Profitable Clients

By meticulously tracking billable hours, firms can directly correlate revenue with client work. However, integrating non-billable hours–spent on client communication, project preparation, and other indirect tasks–into this assessment paints a fuller picture of the total effort expended on each client.

Time-tracking data allows for an objective evaluation of client relationships, moving beyond subjective perceptions to a data-driven understanding of profitability.

Analyzing Profitability

Compare the revenue generated from each client against the total billable and non-billable hours dedicated to them. Clients for whom the cost (in terms of time spent) significantly outweighs the revenue might be considered less profitable.

Define clear benchmarks for acceptable profit margins per client. This helps in categorizing clients based on their alignment with these financial goals.

With data in hand, firms can engage in meaningful conversations with less profitable clients to discuss project scope, efficiency improvements, or potential adjustments to billing rates.

Service Realignment

Evaluate whether certain services can be streamlined or modified to reduce non-billable hours while maintaining client satisfaction.

Sometimes, it may be necessary to consider discontinuing services for chronically unprofitable clients and reallocating resources to more profitable or strategically aligned engagements.

Why is it so important to identify less profitable clients?

Resource Optimization: Redirecting resources from less profitable to more profitable clients or opportunities can enhance overall firm profitability and efficiency.

Improved Client Portfolio: Regularly assessing client profitability helps in curating a client portfolio that aligns with the firm’s strategic goals and profitability targets.

Enhanced Service Delivery: Focusing on profitable clients allows firms to deliver higher quality services, fostering stronger relationships and potentially attracting similar profitable engagements.

Keeping track of billable and non-billable hours is more than just an administrative task; it’s a smart move that helps a business make more money and manage clients better. By carefully watching the time spent, businesses can spot which clients aren’t bringing in much profit.

4. Leverage insights from non-billable activities for strategic business decisions

Non-billable hours, often sidelined in favor of direct revenue tasks, are rich with strategic insights. This section highlights how analyzing time spent on marketing, research and development (R&D), and client acquisition can shape strategic business decisions.

Marketing Insights. Evaluating the time invested in marketing reveals which strategies enhance brand visibility and engage the target audience effectively, guiding future campaign optimizations.

R&D’s Role in Innovation. Tracking R&D efforts helps assess how new technologies or service improvements can fuel business growth, informing innovation strategies.

Client Acquisition Analysis. Analyzing time spent on acquiring new clients identifies the most fruitful strategies, refining the approach for better conversion rates.

ROI Focus. Evaluating the ROI of non-billable activities ensures resources are channeled into high-impact areas, maximizing business growth.

The strategic tracking and analysis of non-billable activities provide businesses with a deeper understanding of where their efforts are most impactful.

Leveraging this data enables organizations to make informed decisions that drive growth, optimize resource allocation, and ensure that every effort–billable or not–contributes to the overarching goal of sustainable business success.

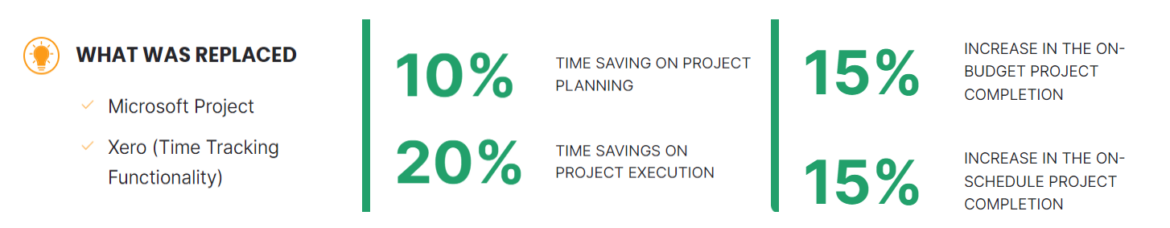

Case study: How Boomdata achieved a 15% increase in on-budget and on-schedule completion

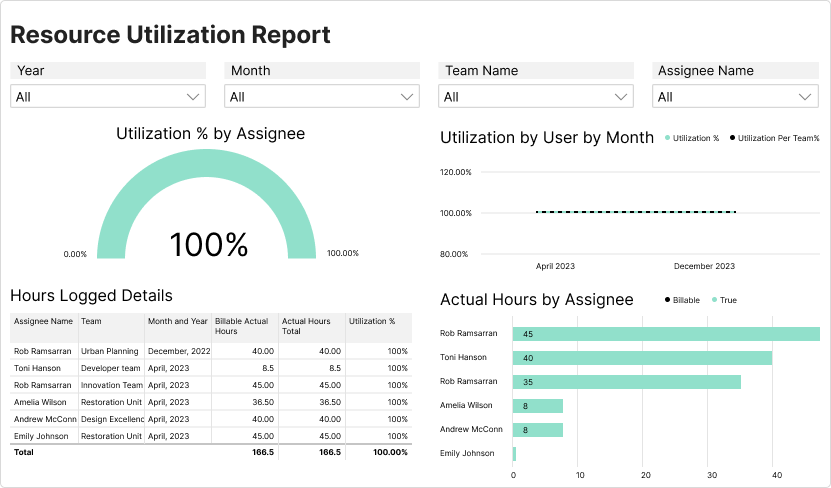

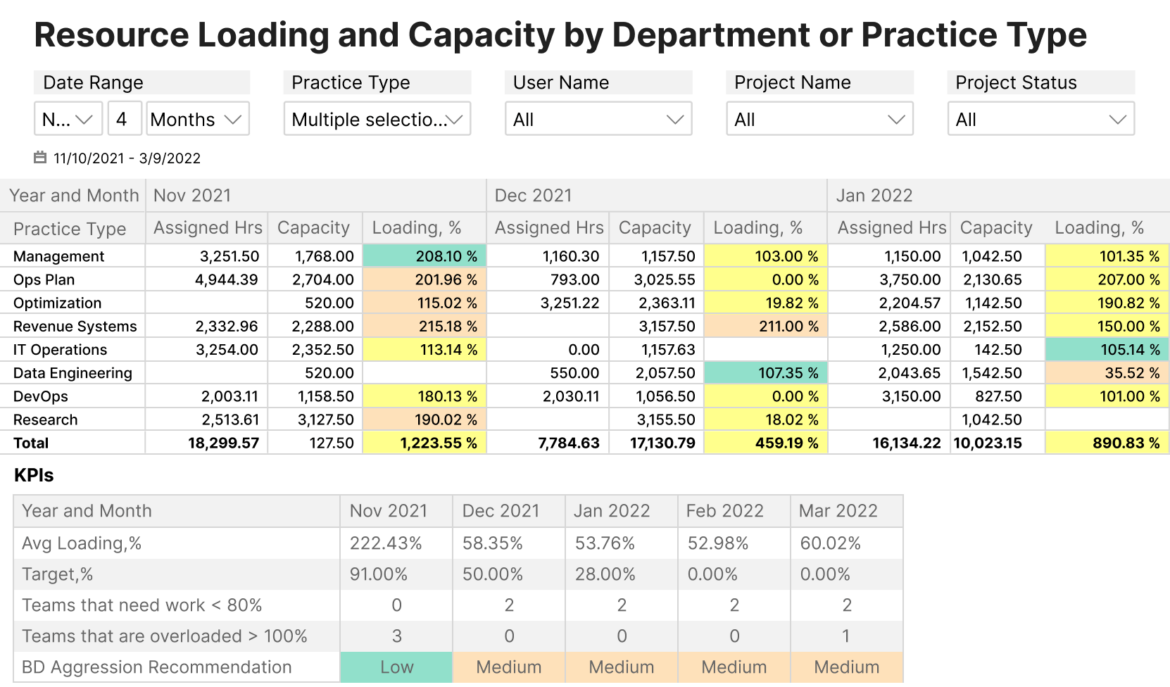

Boomdata, an IT company, significantly increased its project management results by enhancing its time tracking approach, streamlining operational processes, and consequently improving project delivery and client satisfaction. With a keen focus on accurately distinguishing between billable and non-billable hours and boosting project visibility, Boomdata has celebrated notable success, marked by a 15% increase in on-budget project completions and a 20% rise in meeting project deadlines, thereby reinforcing its status as a leader in efficient project management.

Challenges

Boomdata’s quest for improvement was spurred by several key challenges:

Inadequate Time Tracking: Existing tools were insufficient for detailed tracking at the task and sub-task levels, complicating the accurate categorization of billable versus non-billable hours.

Limited Project Visibility: A lack of real-time tracking capabilities hampered effective project management and client communications.

Fragmented Systems and the Need for a Unified Approach: The disconnection between project planning and time reporting tools led to inefficiencies and hindered project oversight. There was a clear need for an integrated system that could offer both detailed time tracking and project management in one platform.

Results after Birdview Implementation

The strategic enhancements in time tracking led to significant, quantifiable improvements for Boomdata:

- By accurately tracking billable and non-billable hours, Boomdata improved its financial performance, ensuring more accurate billing and better resource allocation.

- The clarity provided by detailed time entries resulted in a 15% improvement in completing projects on-budget and a 20% improvement in meeting project schedules, showcasing the effectiveness of their new approach.

- Transparent and accurate time tracking improved client satisfaction by providing clear insights into project progress and resource utilization.

Read more case studies on how companies succeed after implementing project management solutions with accurate time tracking.

How to Track Billable and Non-Billable Hours with Birdview: A Brief Guide

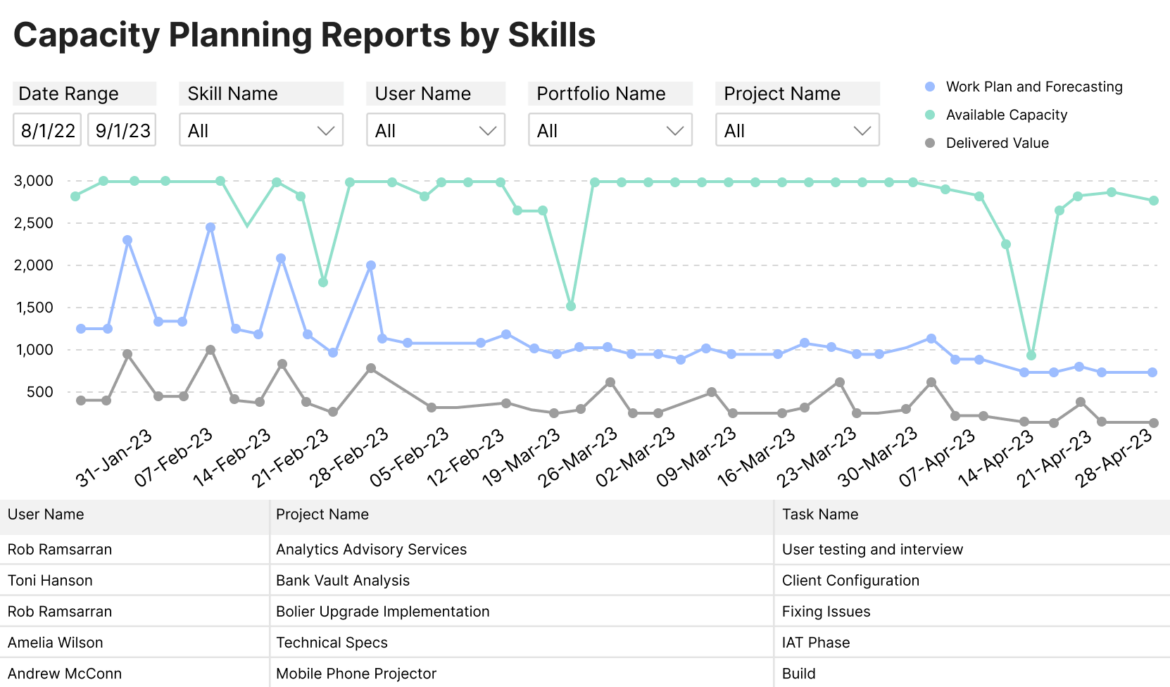

Birdview is a modern project management software that merges effective project oversight and easy-to-use time tracking with comprehensive reporting features, offering everything necessary for monitoring and billing.

To effectively track billable and non-billable hours with Birdview and bill clients accurately, you’ll need to follow a structured approach that ensures all billable work is captured and non-billable activities are also tracked for internal efficiency analysis.

Setting Up Birdview for Time Tracking

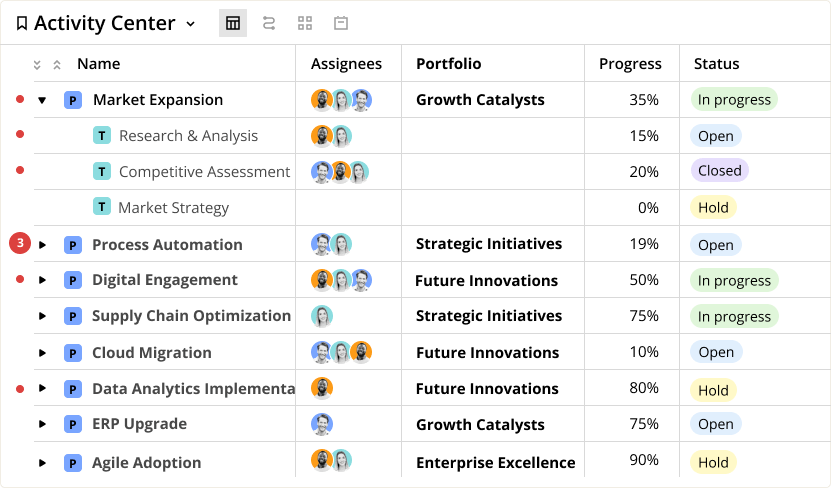

Setup projects and tasks: Begin by creating projects and tasks within Birdview. Clearly define which tasks are billable and non-billable by categorizing them accordingly. This clarity will help in the accurate logging of hours.

Use custom fields: Utilize Birdview’s custom fields to add more details to tasks, such as client names, project codes, or any other identifiers that will help in the billing process.

Track time: Ensure that Birdview‘s time tracking feature is activated and accessible to all team members. Familiarize your team with how to log their hours against specific tasks.

Logging Hours

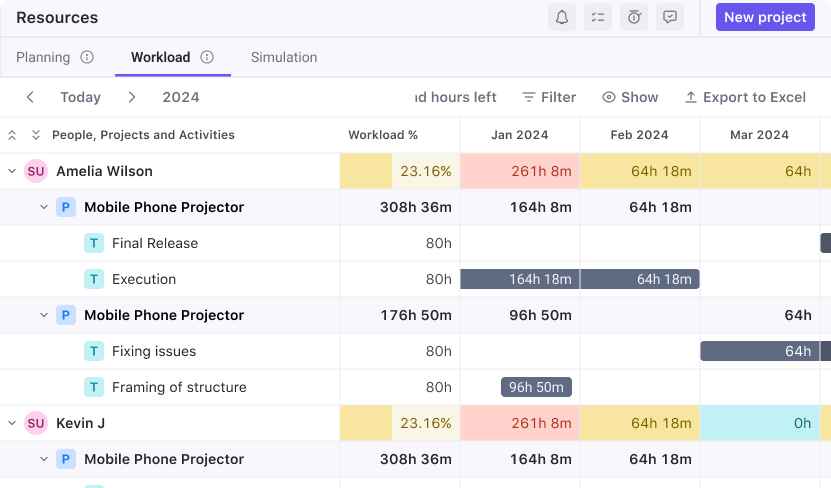

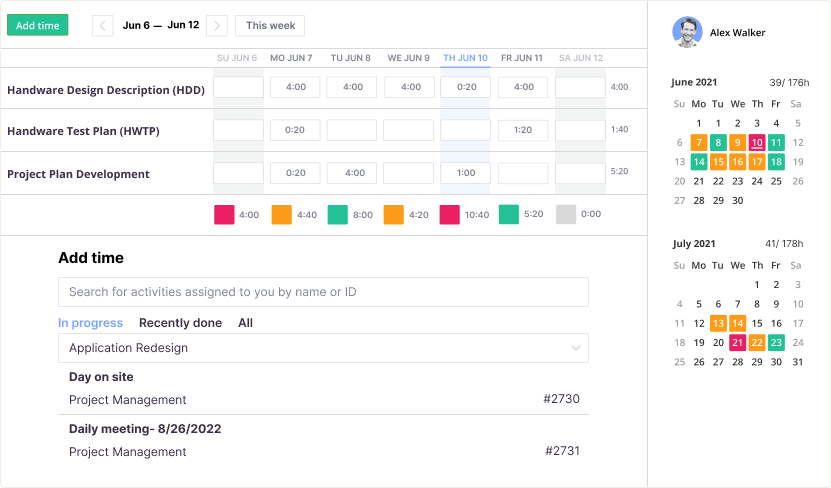

Team members are advised to record their hours daily to ensure precision. They need to indicate if the hours spent are billable or non-billable for the specific task or project they are engaged in.

In Birdview, employees can pick their preferred way to track time: entering it once, submitting it weekly, or using the integrated timer with stopwatch features. Time tracking is available in the Activity Center, under My Assignments section, on Timesheets, and in the mobile app.

Reviewing and Approving Hours

Conduct regular reviews of logged hours to ensure accuracy. This can be done by project managers or designated team members.

Implement an approval process where logged hours are reviewed and approved by supervisors or project managers before being forwarded for billing.

Reporting and Invoicing

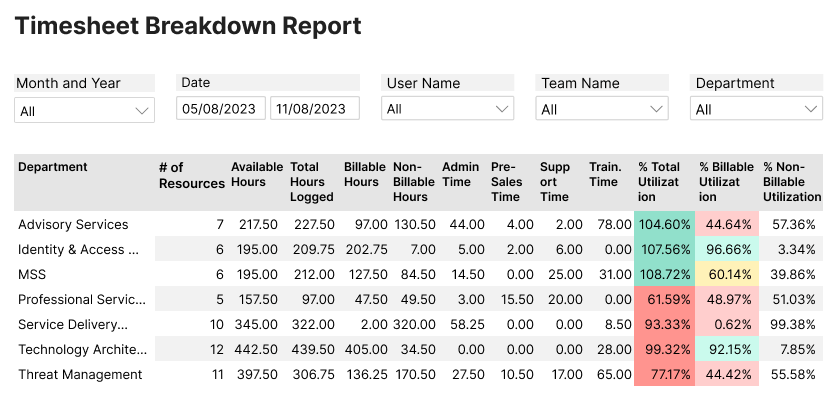

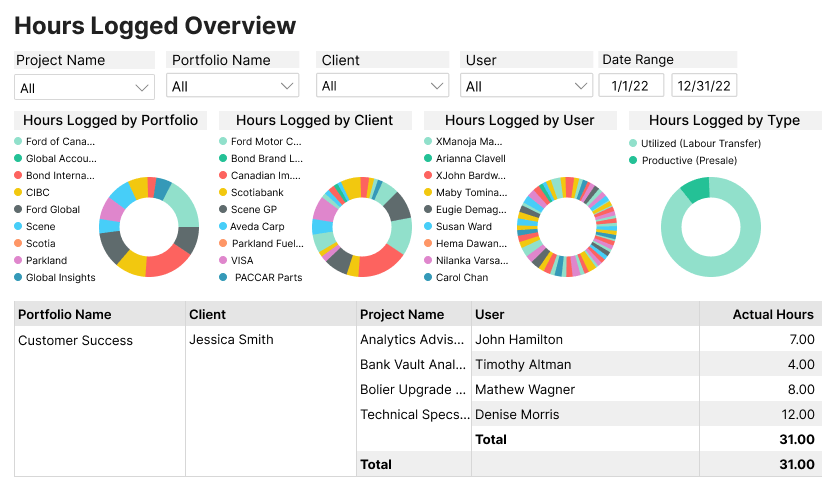

Birdview can be utilized to produce in-depth reports focusing on billable hours. Such reports ought to encompass thorough task descriptions, the number of hours recorded, and the associated billing amounts. Subsequently, these validated time reports can be transformed into invoices. Birdview can synchronize with accounting software, facilitating the generation and dispatch of invoices to clients.

Non-Billable Hours Analysis

Even though non-billable hours aren’t invoiced to clients, tracking them is crucial for internal efficiency analysis and resource allocation. Regularly review non-billable hours to identify any inefficiencies or areas where productivity can be improved. This can help in optimizing workflows and reducing non-billable overhead.

By meticulously setting up Birdview for time tracking, ensuring accurate logging of hours, and efficiently managing the billing process, businesses can streamline their billing cycles, improve productivity, and maintain transparent and trustworthy relationships with their clients.