If you’re a CFO in a professional services firm, tracking profitability across dozens of projects shouldn‘t mean chasing spreadsheets. Yet that’s the reality when financial data is fragmented. To make strategic decisions, you need real-time oversight – and that‘s where PSA software steps in.

The challenge? Often, financial data is fragmented. Project budgets live in spreadsheets or basic project tools, time and expense tracking might be in separate systems, and core accounting is in the ERP. Piecing together performance data across dozens or hundreds of concurrent projects – to understand overall profitability, resource costs, budget adherence, and revenue forecasts – is a significant manual effort. This lack of consolidated, real-time financial oversight makes it difficult to make informed strategic decisions, identify financial risks early, and confidently report on the firm’s financial performance.

You need a system that connects project execution directly to financial outcomes. A tool that provides unified visibility and powerful analytics across your entire project portfolio. This is the critical value of Professional Services Automation (PSA) software from a CFO’s perspective.

This article will explore the key financial challenges CFOs face in project-based businesses, highlight the essential Project Financial KPIs needed for oversight, and show you how Birdview PSA provides the comprehensive financial visibility and control required to manage project portfolios for maximum profitability and growth.

The CFO’s financial challenge in project-based businesses

Managing finances in a professional services firm is distinct from managing a product-based business. Your inventory isn’t physical goods; it’s billable time and intellectual capital. This creates specific financial complexities:

- Fragmented Financial Data: Financial information related to projects is often scattered across project management tools, time tracking systems, expense platforms, and the core accounting/ERP system.

- Lack of Real-Time Project Profitability: It’s difficult to see the profitability of individual projects or the overall portfolio in real-time. Relying on retrospective data means you identify unprofitable projects too late to course-correct.

- Inaccurate Cost Tracking: Accurately capturing all project-related costs, especially labor costs based on time entries and varied billing rates, is challenging when systems are disconnected.

- Billing & Revenue Recognition Complexities: Managing varied billing models (hourly, fixed fee, milestone-based) and ensuring accurate, timely invoicing and revenue recognition adds layers of complexity.

- Poor Cash Flow Forecasting: Without a clear view of project progress, billing milestones, and payment timelines across the portfolio, accurately forecasting cash flow is difficult.

- Inefficient Resource Cost Management: Understanding the cost of resources (internal staff, contractors) relative to the value they are producing is challenging without integrated data.

- Limited Portfolio Financial Oversight: Gaining a consolidated financial view of the entire project portfolio – understanding overall budget adherence, profitability trends, and revenue forecasts – requires significant manual aggregation.

These challenges underscore the need for a system designed to bridge the gap between project execution and financial outcomes across the entire portfolio.

📚 You may also like:

Improve Cash Flow with PSA: Speed Up Quote-to-Cash Cycle

Billable vs. Non-Billable Hours: How to Increase Your Profits

Essential project financial KPIs for CFO oversight

For a CFO, specific Project Financial KPIs are critical for understanding the health and performance of the firm’s project portfolio. These go beyond basic financial statements and provide insights into the drivers of project-based revenue and costs. Birdview PSA is designed to track and report on these essential metrics:

- Project Profitability (Margin): Measures the profit generated by individual projects and the overall portfolio.

- Project Budget Variance: Compares planned project budgets to actual costs incurred.

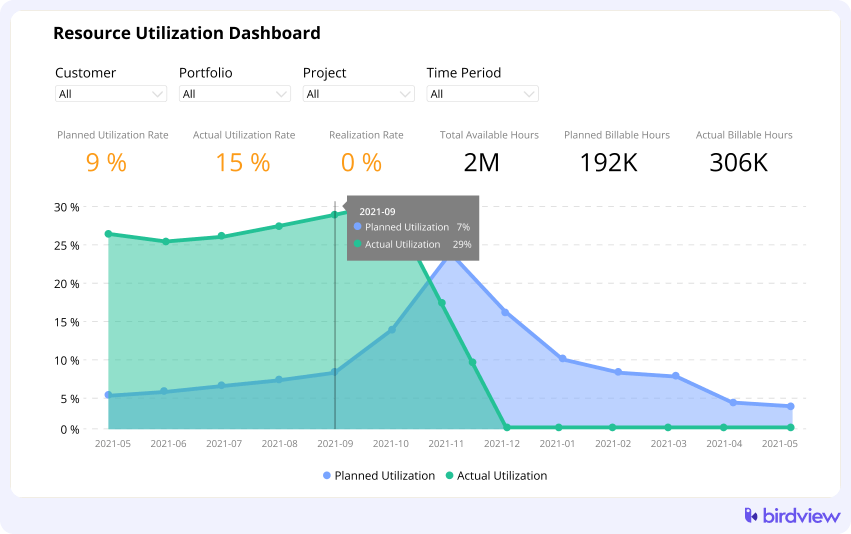

- Resource Utilization (Billable & Overall): Tracks how effectively your team’s time is used on revenue-generating work.

- Revenue Forecast Accuracy: Measures how closely predicted revenue aligns with actual revenue collected.

- Cost Performance Index (CPI): Assesses the efficiency of spending relative to the value of work completed.

- Schedule Performance Index (SPI): Assesses the efficiency of project timelines relative to planned progress (impacts costs).

- Work in Progress (WIP): The value of work completed but not yet invoiced.

- Days Sales Outstanding (DSO): The average number of days it takes to collect payment after invoicing.

- Resource Cost per Hour: The average cost of different roles or individuals, essential for accurate labor cost tracking.

- Actual Cost vs. Planned Cost: Tracking overall spending against the budget.

Tracking these KPIs manually across a large portfolio is a significant burden. You need a system that automates collection, calculation, and reporting.

How PSA software provides financial oversight across portfolios

Professional Services Automation (PSA) software is specifically built to connect project execution with financial results, providing CFOs with the oversight needed in a project-based business. It consolidates data that is typically scattered, offering a unified financial view across the entire project portfolio.

Here‘s how PSA software, and specifically Birdview PSA, empowers CFOs with financial oversight:

1. Consolidated Project & Financial Data:

- How PSA helps: PSA software brings together project plans, time tracking, expense logging, and billing data into one platform.

- Birdview PSA Advantage: Birdview PSA acts as a single source of truth, pulling project execution data (tasks, time, resources) and linking it directly to financial inputs (rates, costs, expenses, billing). This eliminates data fragmentation and ensures financial metrics are based on real project activity.

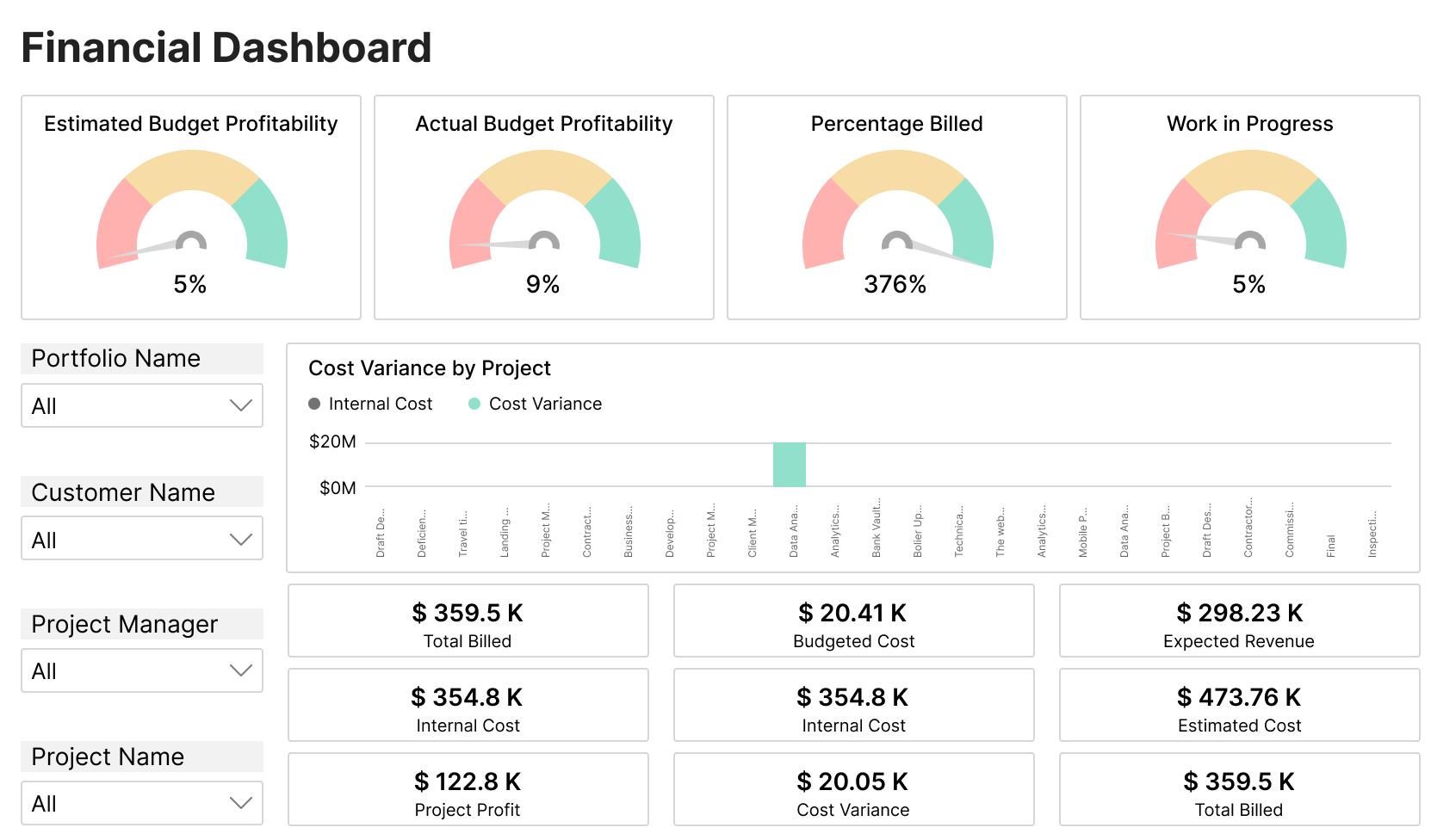

2. Real-Time Project & Portfolio Profitability:

- How PSA helps: PSA software automatically calculates project profitability by applying rates to billable time and tracking expenses.

- Birdview PSA Advantage: Birdview PSA provides real-time project profitability insights. CFOs can see the margin of individual projects and a rolled-up view of profitability across the entire portfolio, identifying which types of projects or business units are most profitable.💡 Useful Tip: Use a customizable dashboard in Birdview PSA to display average project margin by client type or service offering to identify profitable areas.

3. Accurate Cost Tracking & Budget Adherence:

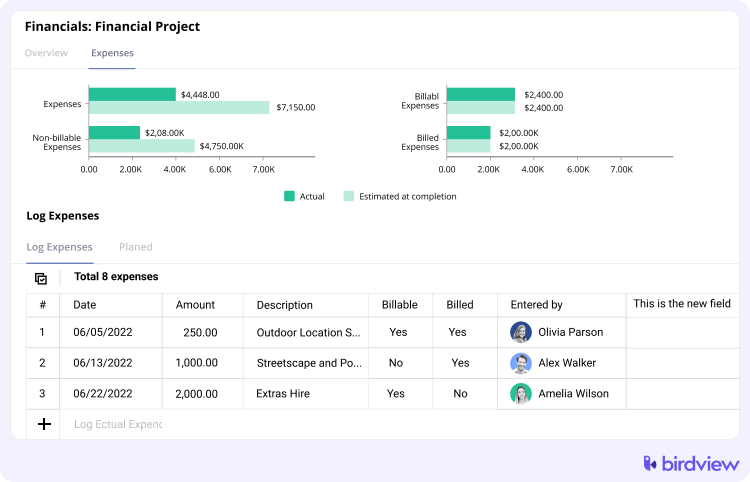

- How PSA helps: PSA software captures labor costs (from time entries and resource rates) and project expenses automatically.

- Birdview PSA Advantage: Birdview PSA automates project cost tracking by linking time entries and expenses directly to projects. CFOs can monitor budget variance for individual projects and the overall portfolio, ensuring adherence to financial plans.💡 Example: If a project team exceeds estimated hours on a specific task, Birdview PSA reflects the increased labor cost immediately, highlighting potential budget overruns.

4. Streamlined Billing & Cash Flow Management:

- How PSA helps: PSA software automates billing based on recorded time and expenses, simplifying the invoicing process.

- Birdview PSA Advantage: Birdview PSA streamlines the Quote-to-Cash cycle. It automates invoicing based on various billing models (hourly, fixed fee, milestones) and helps track payment status. Integration with accounting systems ensures smooth data flow for managing accounts receivable.

5. Resource Cost & Utilization Analysis:

- How PSA helps: PSA software tracks resource time and costs, linking them to projects.

- Birdview PSA Advantage: Birdview PSA provides detailed reports on resource utilization and cost. CFOs can see how effectively the team’s time is used on billable work and understand the labor costs associated with different roles or projects, informing decisions about staffing efficiency.

💡 Example: Analyze a report in Birdview PSA showing billable utilization by team or role to identify if valuable resources are spending too much time on non-billable activities.

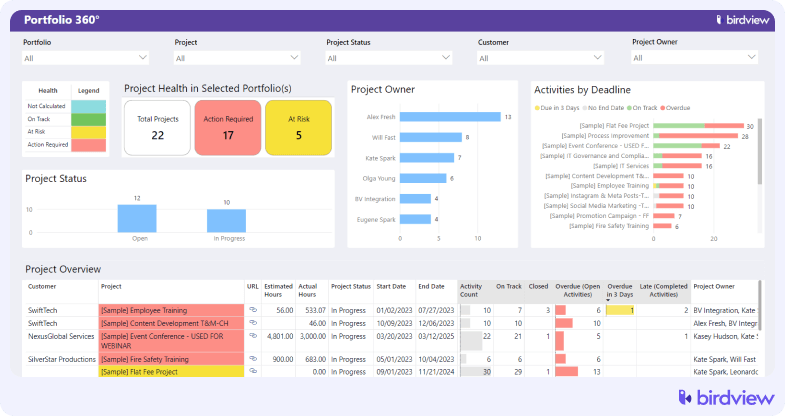

6. Portfolio-Level Reporting & Analytics:

- How PSA helps: PSA software aggregates financial data across all projects, providing a consolidated view of the entire portfolio.

- Birdview PSA Advantage: Birdview PSA offers powerful reporting and dashboards specifically for project portfolios. CFOs can analyze trends in profitability, budget adherence, and revenue forecasts across the entire firm’s project work. This enables strategic planning and resource allocation decisions at a higher level.💡 Useful Tip: Use Birdview PSA’s portfolio dashboards to compare the performance of different business units or project types over time.

7. Enhanced Financial Forecasting:

- How PSA helps: PSA software leverages historical project data and current pipeline information to provide more accurate financial forecasts.

- Birdview PSA Advantage: Birdview PSA supports financial forecasting for revenue, costs, and resource needs. CFOs can model different scenarios to understand the potential financial impact of taking on new projects or changes in demand.

Why Birdview PSA is built for CFO financial oversight

Birdview PSA is designed to meet the specific financial oversight needs of CFOs in project-based professional services firms. It moves beyond the limitations of disconnected systems and spreadsheets, providing a unified, real-time platform for financial control.

- Single Source of Truth: Consolidates project, resource, and financial data for accuracy and reliability.

- Real-Time Visibility: Provides instant access to project and portfolio financial performance.

- Automated Processes: Streamlines time tracking, expense capture, billing, and reporting.

- Powerful Analytics: Offers detailed reports and dashboards for data-driven decision-making.

- Scalability: Supports financial oversight for growing firms with increasing project volume.

- Integration: Connects with core accounting/ERP systems for seamless financial operations.

For CFOs in professional services, gaining accurate, real-time financial oversight across the entire project portfolio is paramount. The complexities of managing scattered data and manual processes create significant challenges to profitability and strategic decision-making.

Professional Services Automation (PSA) software, like Birdview PSA, offers the comprehensive solution needed. By integrating project execution with financial outcomes, Birdview PSA provides the unified visibility, automated processes, and powerful analytics to track essential Project Financial KPIs, control costs, accelerate cash flow, and manage project portfolios for maximum profitability and growth.

Empower your financial oversight. Gain the clarity and control you need to drive sustainable financial success for your firm.

Ready to gain comprehensive financial oversight across your project portfolios?

Discover how Birdview PSA can transform your financial management.

or

📚 You may also like:

Professional Services Revenue Recognition: Examples & Methods

Best professional services billing solutions – Top picks for 2025

Streamline Client Invoicing with Rate Cards

❓ Frequently Asked Questions

What is Project Financial Oversight?

Project Financial Oversight involves continuously monitoring, analyzing, and controlling the financial performance of individual projects and the entire project portfolio. This includes tracking budgets, costs, revenue, and profitability to ensure financial health and alignment with strategic goals.

How does PSA software help CFOs with financial oversight?

PSA (Professional Services Automation) software helps CFOs by consolidating project, resource, and financial data into one platform. It provides real-time visibility into project and portfolio profitability, automates cost tracking and billing, streamlines cash flow management, and offers powerful reporting and analytics for informed decision-making.

What are the most important Project Financial KPIs for CFOs?

Key Project Financial KPIs for CFOs include Project Profitability (Margin), Project Budget Variance, Resource Utilization (Billable & Overall), Revenue Forecast Accuracy, Cost Performance Index (CPI), Schedule Performance Index (SPI), Work in Progress (WIP), Days Sales Outstanding (DSO), Resource Cost per Hour, and Actual Cost vs. Planned Cost.

Can PSA software track costs and revenue for individual projects?

Yes, PSA software automatically tracks labor costs (from time entries and resource rates) and project expenses, linking them directly to individual projects. It also calculates revenue (from billing/invoicing) for each project, providing real-time profitability insights.

How can PSA software help CFOs forecast revenue and cash flow?

PSA software helps CFOs forecast revenue and cash flow by leveraging historical project data, current project progress, and pipeline information. It uses this data to predict future revenue based on estimated billing and track expected cash inflows against planned outflows.

What is the difference between project budget and project cost?

The project budget is the planned or estimated financial limit for a project. The project cost is the actual amount of money spent on the project. CFOs use budget variance (Budget – Actual Cost) to measure adherence to the financial plan.

How does PSA software help manage project portfolio financials?

PSA software helps manage project portfolio financials by aggregating data from all individual projects. It provides a consolidated view of overall portfolio profitability, budget adherence, and key financial trends, enabling CFOs to analyze performance at a higher level and make strategic decisions.

Does PSA software integrate with accounting or ERP systems?

Yes, most modern PSA software is designed to integrate seamlessly with core accounting or ERP systems. This ensures consistent data flow between project-level financials and the firm’s overall financial statements, reducing manual data entry and improving accuracy.

How can tracking resource utilization benefit a CFO?

Tracking resource utilization benefits a CFO by showing how effectively the team’s time is used, especially on billable work. This insight helps assess the cost-effectiveness of labor, identify opportunities to increase billable hours, and inform decisions about staffing levels and resource allocation for optimal profitability.

What types of reports in Birdview PSA are most useful for a CFO?

In Birdview PSA, useful reports for a CFO include Project Profitability Reports, Project Budget Variance Reports, Resource Utilization Reports (Billable & Overall), Revenue Forecasting Reports, Cash Flow Reports, WIP Reports, and Portfolio Performance Dashboards. These provide both detailed and consolidated financial insights.

Try Birdview PSA in action

or