In the competitive world of professional services, financial clarity is paramount. It’s not enough to just deliver projects; you need to understand their financial performance, monitor costs, track revenue, and ensure profitability. For both executives guiding the strategic direction of the firm and project managers responsible for the financial health of their specific projects, access to accurate, timely financial reports is non-negotiable.

However, gaining these insights can be a challenge. Financial data might be scattered across separate accounting systems, project management tools, spreadsheets, and time tracking logs. Piecing together the numbers to understand project profitability, monitor budget burn rate, track resource costs, or forecast revenue requires significant manual effort. This lack of integrated, real-time reporting leads to delayed insights, reactive decision-making, and missed opportunities to improve financial performance.

What if your PSA software could automatically consolidate all project-related financial data and provide customizable, insightful financial reports tailored to the needs of both executives and project managers? This is the essential value of Birdview PSA’s financial reporting capabilities.

This article will explore the critical need for comprehensive financial reports in professional services, highlight the specific insights required by executives and project managers, and show you how Birdview PSA provides the integrated reporting tools to deliver essential financial visibility across individual projects and the entire portfolio.

In this article

Why comprehensive financial reports are critical for professional services

For firms that bill based on time, expertise, and project outcomes, financial reports are the vital signs of business health. They provide the quantitative data needed to assess performance, make informed decisions, and drive profitability.

Comprehensive financial reports are critical for several reasons:

- Tracking project profitability: Understanding the revenue and costs associated with each project is fundamental to identifying which services, clients, or project types are most profitable and where margins need improvement.

- Managing project budgets: Reports showing actual costs against planned budgets allow project managers to monitor spending and take corrective action to prevent overruns, while executives can see budget adherence across the portfolio.

- Informing pricing strategies: Data on actual project costs provides crucial insights for refining estimating processes and setting competitive yet profitable pricing for future proposals.

- Optimizing resource costs: Reports on resource utilization and associated costs help identify if labor costs are aligning with project value and inform decisions about resource allocation efficiency.

- Revenue forecasting: Accurate reports on current projects and pipeline opportunities contribute to reliable forecasting of future revenue.

- Cash flow management: Reports on invoicing status, accounts receivable, and Work in Progress (WIP) are essential for managing cash flow effectively.

- Strategic decision-making: Executives need consolidated financial insights across the portfolio to make informed decisions about investments, service offerings, market focus, and growth strategies.

- Accountability: Reports provide objective data for holding project teams accountable for financial performance.

Without integrated and insightful financial reports, managing a professional services firm effectively is like navigating without a compass.

Essential financial insights for executives and project managers

While both executives and project managers require access to financial data, their specific reporting needs often differ, reflecting their distinct roles and responsibilities.

For executives:

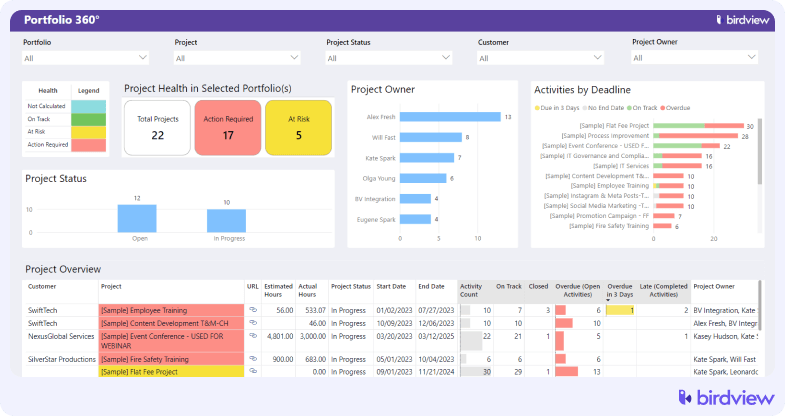

- Portfolio profitability: Rolled-up view of profitability across all projects or aggregated by business unit, service line, client type, or geographic region.

- Overall budget performance: Summary of budget variance across the entire portfolio, identifying major over or under budget projects.

- Resource utilization (firm-wide): High-level view of billable and overall utilization rates across the entire team or by role/department.

- Revenue forecasting: Consolidated forecast of future revenue based on the project pipeline and estimated completion dates.

- Cash flow metrics: Reports on Accounts Receivable (AR) aging, Days Sales Outstanding (DSO), and Work in Progress (WIP).

- Service line/client profitability: Analysis of profitability broken down by specific services offered or key clients.

- Trend analysis: Historical data to identify trends in profitability, costs, utilization, and revenue over time.

For project managers:

- Individual project profitability: Detailed view of revenue and costs for their specific project(s).

- Budget burn rate: Real-time tracking of how quickly the project budget is being consumed relative to progress.

- Budget variance (project level): Comparison of actual costs against the planned budget for their specific project, often broken down by cost component (labor, expenses).

- Resource costs (project level): Tracking the labor costs associated with the resources assigned to their project.

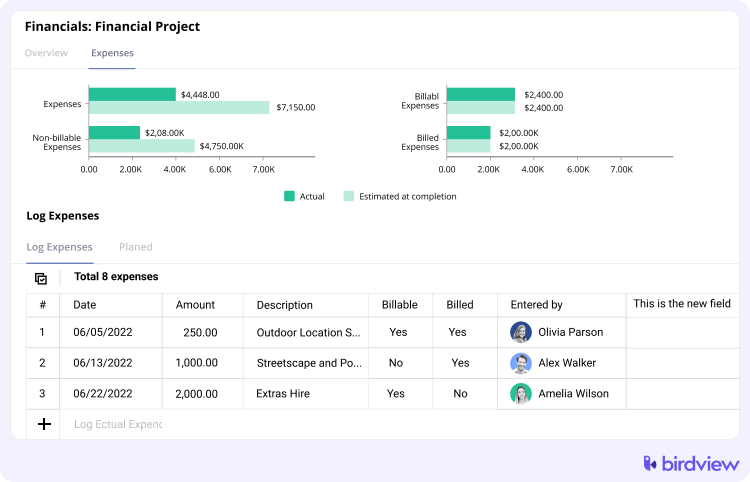

- Expense tracking: Detailed view of project-related expenses incurred.

- Time entry compliance: Monitoring team members’ time tracking for their project to ensure accuracy for billing and cost tracking.

- Billing status: Visibility into the invoicing status for their project (e.g., invoiced value, outstanding amount).

Providing both levels of insight requires a PSA software platform that can consolidate detailed project data and roll it up into portfolio-level reports.

The challenge: fragmented data hinders reporting

The primary challenge in generating comprehensive financial reports for professional services is the fragmentation of data.

- Disconnected systems: Project plans live in one tool, time tracking in another, expenses in a spreadsheet, and core financials in an accounting system; pulling this data together manually is time-consuming and increases the risk of errors.

- Lack of real-time updates: Manual reporting processes mean financial data is often outdated by the time it is compiled, providing a retrospective view rather than real-time insights.

- Inconsistent data: Data entered manually across different systems or by different people is often inconsistent, making it difficult to aggregate accurately for reports.

- Manual aggregation: Compiling portfolio-level reports for executives requires significant manual effort to pull data from individual project reports.

- Limited customization: Generic reports from basic tools may not provide the specific breakdowns or metrics needed by your firm’s executives or project managers.

- Difficulty linking metrics: Connecting project progress, resource allocation, and financial outcomes in a single report is challenging without an integrated system.

These challenges make it difficult to generate the essential financial reports needed for effective oversight and decision-making.

How Birdview PSA’s financial reports provide essential insights

Birdview PSA is designed to be a single source of truth for project execution and financials, automatically consolidating data from project planning, resource allocation, time tracking, expense management, and billing. This integrated approach enables Birdview PSA to generate comprehensive and insightful financial reports tailored for both executives and project managers.

Here‘s how Birdview PSA’s financial reports provide essential insights:

1. Automated data consolidation:

- How Birdview PSA helps: Automatically pulls data from project plans, assigned resources, time entries, expense submissions, rate cards, and billing activities.

- Provides Insight: Ensures reports are based on accurate, real-time, and consistent data from across the platform.

2. Real-time project profitability reports:

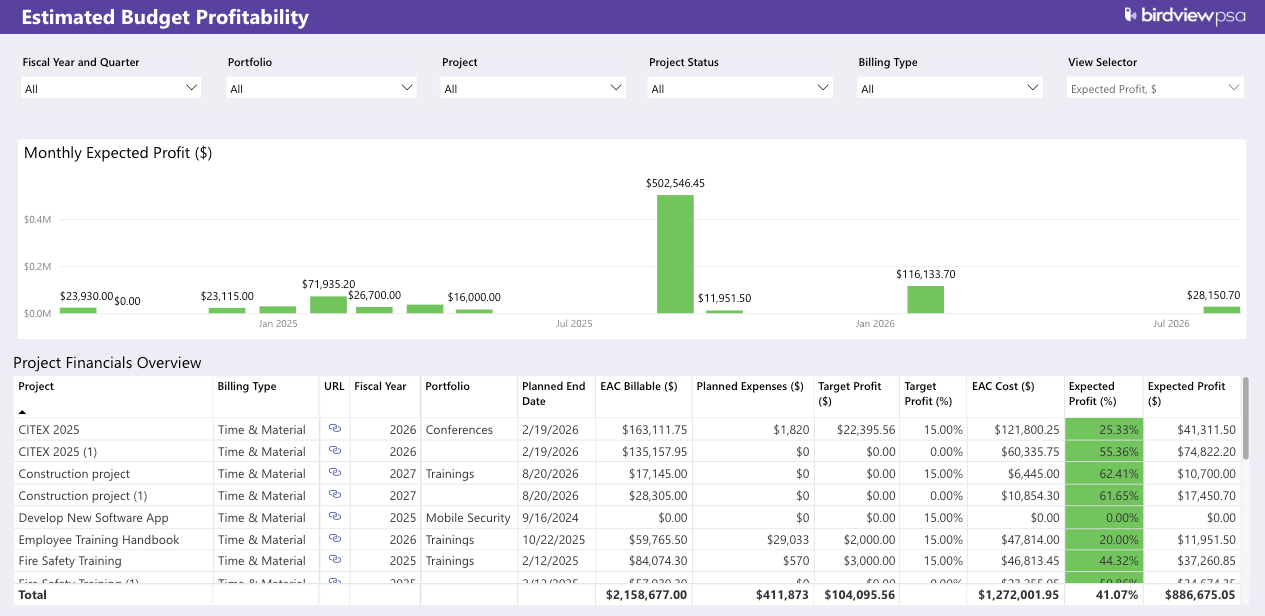

- How Birdview PSA helps: Provides detailed reports on individual project profitability, showing revenue versus labor costs and expenses.

- Provides Insight: Project managers can monitor the financial health of their projects in real-time, understanding margins and cost drivers. Executives can drill down into specific projects.

Example: A project manager can run a report in Birdview PSA to see the current profit margin for their active project, broken down by labor hours and expense categories.

3. Comprehensive budget tracking reports:

- How Birdview PSA helps: Offers reports on project budget variance, showing actual costs against the planned budget, often broken down by different cost components (labor, expenses). Includes burn rate tracking.

- Provides Insight: Project managers can monitor spending and identify potential budget overruns early. Executives can review budget adherence across the portfolio.

Useful Tip: Use Birdview PSA’s budget burn rate reports to see if project spending is pacing ahead or behind schedule.

4. Integrated resource cost reports:

- How Birdview PSA helps: Links time entries and internal cost rates to report on labor costs by project, task, resource, or role.

- Provides Insight: Both executives and project managers can understand how labor costs impact project profitability and identify opportunities for optimizing resource utilization.

Example: An executive can run a report showing total labor costs for a specific department or service line, while a project manager can see the labor cost breakdown for resources on their project.

5. Portfolio-level financial reports:

- How Birdview PSA helps: Aggregates financial data across all projects to provide consolidated reports on portfolio profitability, budget performance, and revenue forecasts.

- Provides Insight: Provides executives with the high-level financial oversight needed for strategic decision-making across the entire firm’s project work.

6. Customizable dashboards:

- How Birdview PSA helps: Allows users to create personalized dashboards displaying the key financial metrics most relevant to their role (e.g., project manager dashboard vs. executive dashboard).

- Provides Insight: Provides instant, at-a-glance visibility into essential financial KPIs without having to run detailed reports.

Useful Tip: An executive might configure a dashboard in Birdview PSA showing portfolio profitability trends, firm-wide utilization, and AR aging, while a project manager focuses on their project’s budget variance and burn rate.

7. Revenue forecasting and WIP reports:

- How Birdview PSA helps: Offers reports on forecasted revenue based on pipeline and active projects, as well as reports on Work in Progress (WIP) to track the value of unbilled work.

- Provides Insight: Essential for financial planning, cash flow management, and accurate revenue recognition.

8. Drill-down capabilities:

- How Birdview PSA helps: Allows users to drill down from high-level portfolio reports to detailed data on specific projects, tasks, or resources.

- Provides Insight: Enables executives to investigate the drivers of performance and project managers to analyze details for problem-solving.

Best Practices for Using Financial Reports in Birdview PSA

Getting access to these reports is the first step; effectively using them is key to driving financial performance.

- Define your key financial KPIs: Based on your firm’s goals and billing models, identify the most critical financial metrics you need to track for both executives and project managers.

- Customize dashboards for roles: Configure personalized dashboards in Birdview PSA for different user roles, displaying the KPIs most relevant to their daily responsibilities and decision-making needs.

- Schedule regular report reviews: Incorporate reviewing key Birdview PSA financial reports into your regular operational cadence (e.g., weekly project manager review of budget/profitability, monthly executive review of portfolio performance).

- Use reports for data-driven conversations: Leverage the objective data from Birdview PSA reports to inform discussions about project performance, resource allocation, pricing, and strategic decisions.

- Analyze trends over time: Use historical data in Birdview PSA reports to identify trends in profitability, costs, and utilization, informing process improvements and future planning.

- Integrate financial insights into project reviews: Ensure that financial performance is a standard component of project review meetings, using Birdview PSA reports to guide the discussion.

- Train users on report interpretation: Provide training for both executives and project managers on how to access and interpret the various financial reports available in Birdview PSA.

- Correlate financial metrics with project outcomes: Analyze how financial KPIs correlate with other project outcomes (e.g., schedule adherence, client satisfaction) using Birdview PSA data.

Empowering financial oversight with Birdview PSA

Gaining comprehensive, real-time financial visibility is essential for the success of professional services firms. Fragmented data and manual reporting processes hinder the ability of both executives and project managers to access the essential insights needed to drive profitability and make informed decisions.

Birdview PSA provides the integrated solution. By automatically consolidating financial data from across the project lifecycle and offering customizable dashboards and detailed financial reports, Birdview PSA delivers essential insights for executives overseeing the portfolio and project managers managing individual projects.

Empower your financial oversight. Gain the clarity and control needed to boost profitability and guide your firm’s strategic growth.

Frequently Asked Questions

1. Why are financial reports important for project management?

Financial reports are important for project managers to track the financial health of their specific projects, monitor budget burn rate and variance, understand project costs (labor and expenses), ensure time entry compliance, and gain visibility into billing status, enabling them to manage project financials effectively.

2. What key financial insights do executives need from project data?

Executives need key financial insights from project data such as portfolio profitability (rolled-up view), overall budget performance across the firm, firm-wide resource utilization, consolidated revenue forecasting, cash flow metrics (AR aging, WIP), and profitability analysis by service line or client.

3. How does PSA software consolidate financial data for reporting?

PSA software consolidates financial data by automatically pulling information from integrated modules like project planning, resource allocation, time tracking, expense management, rate cards, and billing activities into a single database, ensuring reports are based on accurate, real-time data.

4. What types of financial reports does Birdview PSA provide?

Birdview PSA provides a range of financial reports including individual project profitability reports, comprehensive budget tracking reports (with variance and burn rate), integrated resource cost reports, portfolio-level financial reports, revenue forecasting reports, WIP reports, and customizable financial dashboards.

5. Can financial reports in Birdview PSA be tailored for different roles?

Yes, financial reports and dashboards in Birdview PSA can typically be customized to display the key financial metrics most relevant to different roles, such as executives (focus on portfolio) or project managers (focus on individual projects).

6. How do financial reports help manage project budgets?

Financial reports help manage project budgets by showing actual costs incurred against the planned budget, often highlighting budget variance and burn rate, which allows project managers to monitor spending, identify potential overruns early, and take corrective action.

7. Does Birdview PSA provide real-time project profitability reports?

Yes, Birdview PSA automatically calculates and provides real-time project profitability reports by consolidating revenue data (from billing rules) and cost data (from time entries and expenses), allowing users to see project margin as the work progresses.

8. How can executives use portfolio-level financial reports?

Executives use portfolio-level financial reports to gain high-level oversight across all project work. They analyze overall profitability, budget performance, and revenue forecasts across the firm, identifying trends, comparing performance across business units, and informing strategic decisions.

9. How does integrating time tracking impact financial reporting?

Integrating time tracking is crucial for financial reporting as it provides the data for labor costs (when linked to internal rates) and billable hours (when linked to billing rates), which are essential components of project cost calculation, profitability analysis, and revenue tracking.

10. What are the benefits of using Birdview PSA’s financial reports?

Benefits include reports based on automated data consolidation, real-time visibility into project and portfolio financials, customizable dashboards for different roles, drill-down capabilities for detailed analysis, and comprehensive insights for improved decision-making, cost control, and profitability.